- New Zealand

- /

- Biotech

- /

- NZSE:PEB

Global Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Global markets have recently faced a turbulent period, with U.S. stocks experiencing declines amid geopolitical tensions and consumer spending concerns, while European indices displayed cautious optimism. Despite these market challenges, certain investment opportunities continue to attract attention, particularly in the realm of penny stocks. Although the term "penny stocks" might seem outdated, these typically smaller or newer companies offer unique growth potential when backed by strong financials and solid fundamentals. In this article, we spotlight several penny stocks that could stand out as hidden gems with promising prospects for investors seeking affordable entry points into the market.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| NEXG Berhad (KLSE:DSONIC) | MYR0.255 | MYR709.45M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.85 | SEK288.69M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.85 | £438.82M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.83 | MYR275.51M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.65 | £294.87M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.79 | HK$44.89B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.03 | £301.35M | ★★★★☆☆ |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.995 | MYR1.55B | ★★★★★☆ |

Click here to see the full list of 5,745 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pacific Edge (NZSE:PEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pacific Edge Limited is a cancer diagnostics company that focuses on researching, developing, and commercializing tools for early cancer detection and management across New Zealand, the United States, and other international markets, with a market cap of NZ$51.15 million.

Operations: The company's revenue primarily comes from its Commercial segment, which generated NZ$22.57 million, complemented by NZ$3.78 million from Research activities.

Market Cap: NZ$51.15M

Pacific Edge Limited, with a market cap of NZ$51.15 million, focuses on cancer diagnostics and has generated revenue primarily from its Commercial segment (NZ$22.57 million) and Research activities (NZ$3.78 million). Despite being unprofitable with a negative return on equity (-70.8%), the company maintains more cash than debt and covers both short-term (NZ$8.4M) and long-term liabilities (NZ$1.8M) with short-term assets (NZ$44.3M). However, it faces high share price volatility and increased losses over five years at 14.7% annually, posing risks typical of penny stocks in the biotech sector.

- Take a closer look at Pacific Edge's potential here in our financial health report.

- Evaluate Pacific Edge's prospects by accessing our earnings growth report.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market capitalization of HK$25.28 billion.

Operations: Revenue Segments: No specific revenue segments have been reported.

Market Cap: HK$25.28B

Dongguan Rural Commercial Bank, with a market cap of HK$25.28 billion, exhibits characteristics typical of penny stocks. Despite high-quality past earnings and an experienced management team, the bank has faced challenges with negative earnings growth over the past year (-18.4%). The net profit margins have also declined from 54.6% to 49.8%. However, it maintains a strong financial position with an appropriate loans-to-deposits ratio (70%) and low non-performing loans (1.2%). Trading significantly below its estimated fair value suggests potential undervaluation but is tempered by low return on equity (7.9%) and stable weekly volatility (9%).

- Navigate through the intricacies of Dongguan Rural Commercial Bank with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Dongguan Rural Commercial Bank's future.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market cap of CN¥5.46 billion.

Operations: Yechiu Metal Recycling (China) Ltd. has not reported specific revenue segments.

Market Cap: CN¥5.46B

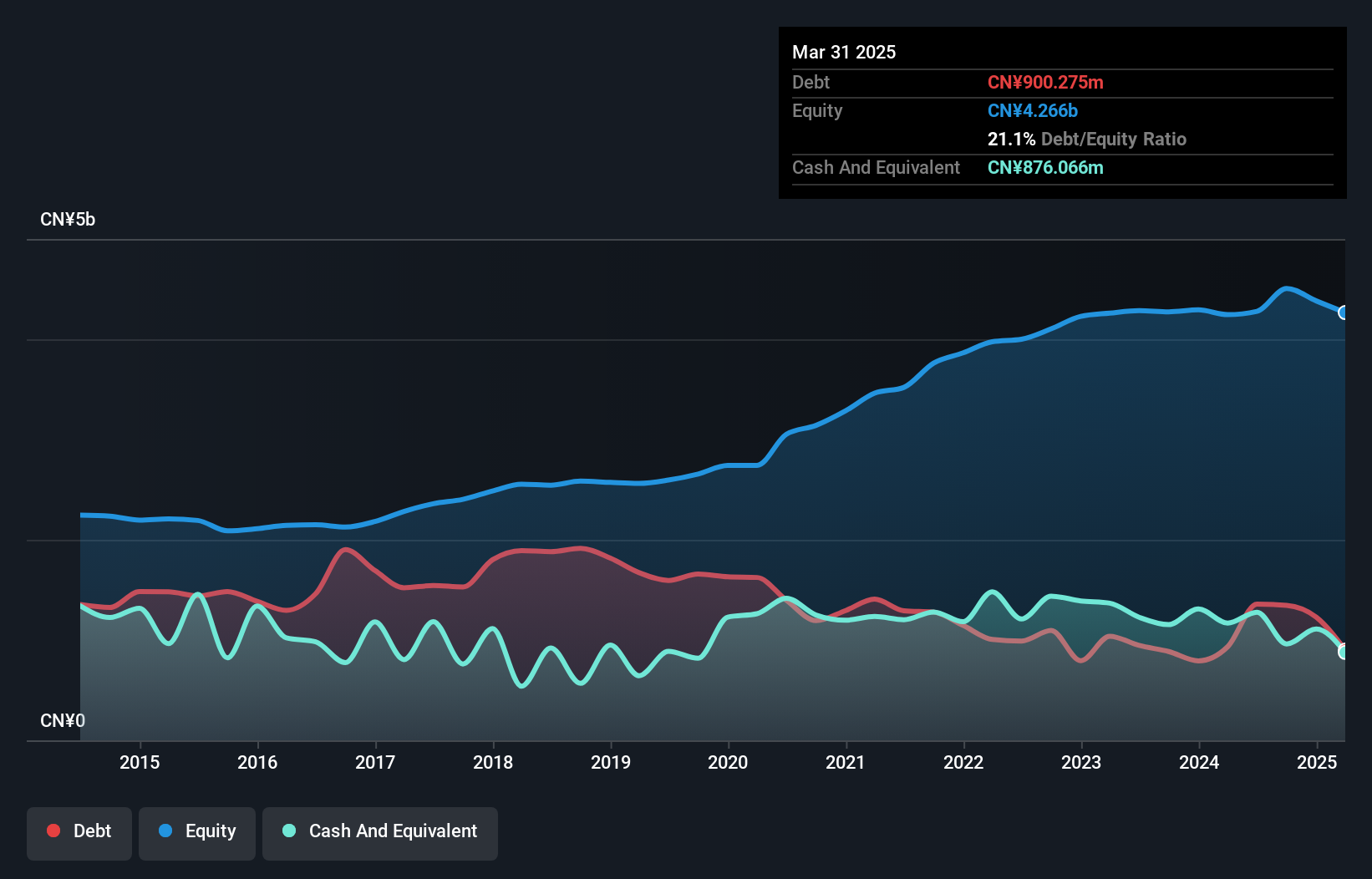

Yechiu Metal Recycling (China) Ltd., with a market cap of CN¥5.46 billion, faces challenges typical in the aluminum alloy recycling industry. The company's net profit margins have decreased to 1.3% from 3.1% last year, and it reports negative operating cash flow, indicating that debt is not well covered by cash flow. Despite this, Yechiu's short-term assets of CN¥3.7 billion exceed both its short- and long-term liabilities, reflecting a solid liquidity position. Earnings are forecasted to grow significantly at 62.99% per year, yet past earnings have declined by 8.5% annually over five years, highlighting volatility in performance.

- Jump into the full analysis health report here for a deeper understanding of Yechiu Metal Recycling (China).

- Gain insights into Yechiu Metal Recycling (China)'s future direction by reviewing our growth report.

Key Takeaways

- Investigate our full lineup of 5,745 Global Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:PEB

Pacific Edge

A cancer diagnostics company, researches, develops, and commercializes diagnostic and prognostic tools for the early detection and management of cancers in New Zealand, the United States, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives