- New Zealand

- /

- Food

- /

- NZSE:NZK

New Zealand King Salmon Investments Limited (NZSE:NZK) Soars 33% But It's A Story Of Risk Vs Reward

The New Zealand King Salmon Investments Limited (NZSE:NZK) share price has done very well over the last month, posting an excellent gain of 33%. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

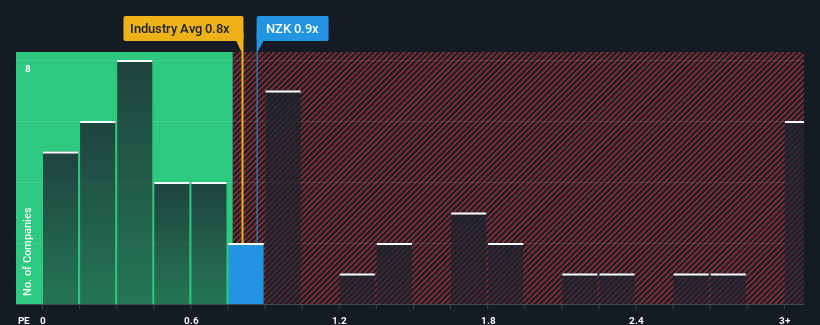

Although its price has surged higher, it's still not a stretch to say that New Zealand King Salmon Investments' price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Food industry in New Zealand, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for New Zealand King Salmon Investments

How New Zealand King Salmon Investments Has Been Performing

New Zealand King Salmon Investments could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on New Zealand King Salmon Investments.How Is New Zealand King Salmon Investments' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like New Zealand King Salmon Investments' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 15% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be materially higher than the 2.3% growth forecast for the broader industry.

With this information, we find it interesting that New Zealand King Salmon Investments is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From New Zealand King Salmon Investments' P/S?

New Zealand King Salmon Investments' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at New Zealand King Salmon Investments' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware New Zealand King Salmon Investments is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on New Zealand King Salmon Investments, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if New Zealand King Salmon Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:NZK

New Zealand King Salmon Investments

Engages in the farming, processing, and sale of salmon products in New Zealand, North America, Australia, Japan, Europe, China, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives