- New Zealand

- /

- Food

- /

- NZSE:FCG

Fonterra (NZSE:FCG) Valuation in Focus After Earnings Dip and Fresh Dividend Announcement

Reviewed by Kshitija Bhandaru

Fonterra Co-operative Group (NZSE:FCG) just released its annual results, highlighting a modest drop in net income and earnings per share compared to last year. The company also announced fresh regular and special cash dividends.

See our latest analysis for Fonterra Co-operative Group.

Fonterra Co-operative Group’s latest earnings and fresh dividends arrive after an impressive run for shareholders. The stock price hit $5.95 and delivered a stellar 81.7% total shareholder return over the past year. The strong multi-year gains suggest momentum remains clearly on the side of long-term investors, even as recent events prompt some near-term shifts in sentiment.

If news about Fonterra’s new dividend has you looking for other opportunities, this could be a smart moment to discover fast growing stocks with high insider ownership.

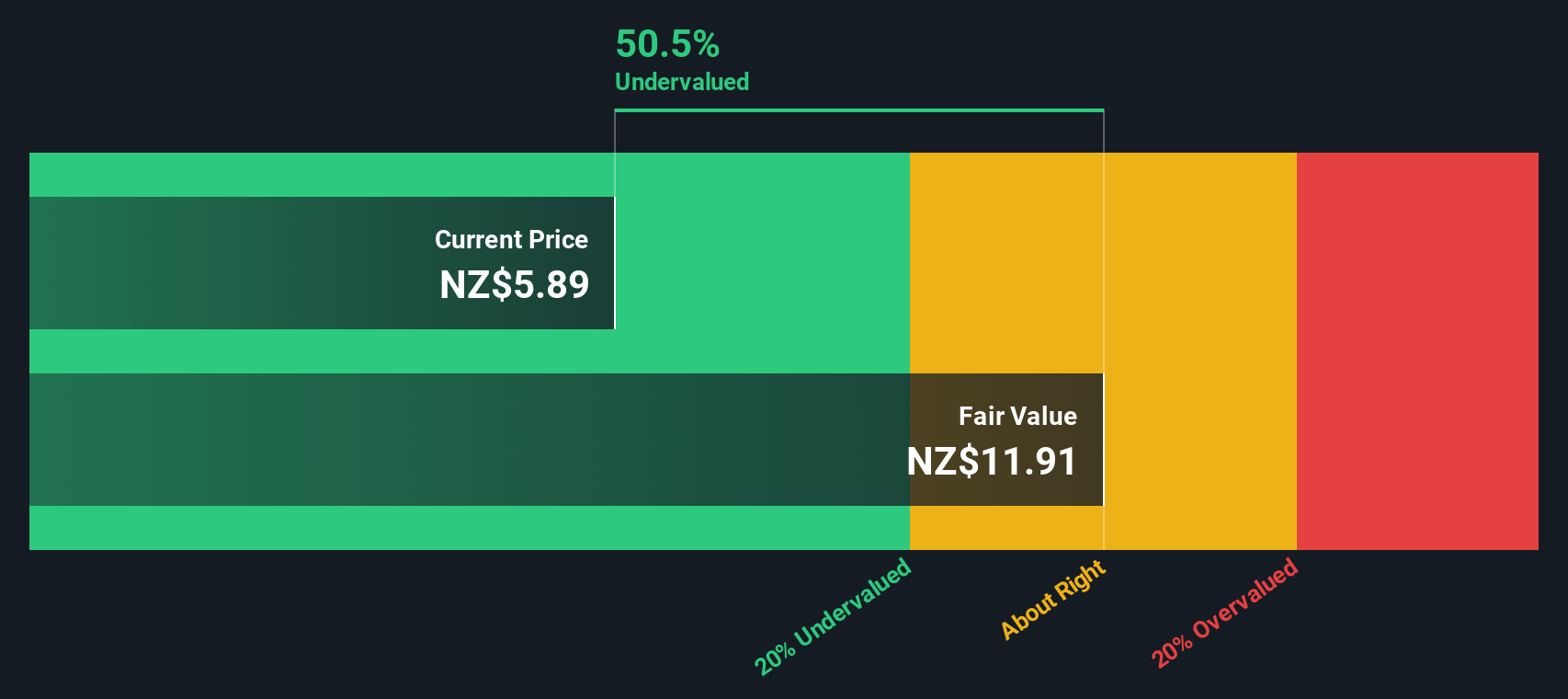

With shares near record highs and performance metrics showing only modest declines, investors may be asking if Fonterra remains undervalued or if the market has already priced in all of its future growth potential.

Price-to-Earnings of 9.5x: Is it justified?

Fonterra Co-operative Group trades at a price-to-earnings ratio of 9.5x, well below both its peer average and the wider industry benchmark given its last close of NZ$5.95. This points to a stock that appears undervalued relative to comparable companies.

The price-to-earnings (P/E) ratio gauges how much investors are willing to pay now for a dollar of earnings. For Fonterra, a lower P/E means the market may not be fully crediting its profit profile or sees limited growth on the horizon. In the food sector, peer multiples are closely watched as they capture assessment of stability, earnings quality, and long-term demand.

Compared to its peer group, where the average P/E stands at 28.6x, Fonterra’s multiple of 9.5x represents a significant discount. The Oceanic Food industry average of 14.6x further highlights how conservatively the market is pricing Fonterra’s current results and future potential.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.5x (UNDERVALUED)

However, global commodity price volatility and changes in dairy demand could challenge Fonterra’s current valuation and future growth outlook.

Find out about the key risks to this Fonterra Co-operative Group narrative.

Another Perspective: Discounted Cash Flow Says Undervalued

While price-to-earnings suggests Fonterra is undervalued compared to the market and peers, our DCF model presents an even starker picture. The SWS DCF model estimates Fonterra’s fair value at NZ$11.91, nearly double its recent price. Could the market be missing something, or is there hidden risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fonterra Co-operative Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fonterra Co-operative Group Narrative

Keep in mind, if you see the story differently or want to draw your own conclusions, you can easily build your own analysis in just a few minutes. Do it your way

A great starting point for your Fonterra Co-operative Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize fresh opportunities early, setting themselves up for advantage. Let Simply Wall Street’s unique screeners help you spot your next breakthrough winner. Do not let these pass you by.

- Tap into the future of medicine by targeting innovative companies driving healthcare transformation with these 32 healthcare AI stocks.

- Boost your search for reliable income streams by zeroing in on high-yield options using these 19 dividend stocks with yields > 3%.

- Unleash your potential in cutting-edge technology by starting your journey with these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:FCG

Fonterra Co-operative Group

Fonterra Co-operative Group Limited, together with its subsidiaries, collects, manufactures, and sells milk and milk-derived products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives