- New Zealand

- /

- Food

- /

- NZSE:ATM

The a2 Milk Company Limited's (NZSE:ATM) 28% Share Price Surge Not Quite Adding Up

The The a2 Milk Company Limited (NZSE:ATM) share price has done very well over the last month, posting an excellent gain of 28%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

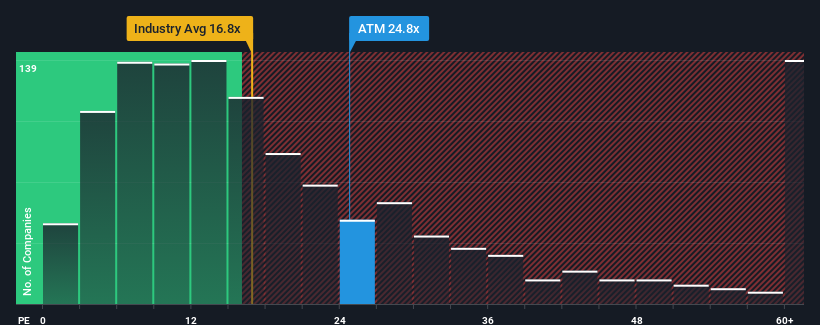

Following the firm bounce in price, a2 Milk's price-to-earnings (or "P/E") ratio of 25.7x might make it look like a strong sell right now compared to the market in New Zealand, where around half of the companies have P/E ratios below 14x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, a2 Milk has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for a2 Milk

Is There Enough Growth For a2 Milk?

In order to justify its P/E ratio, a2 Milk would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 29% last year. Still, incredibly EPS has fallen 59% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 18% each year, which is noticeably more attractive.

With this information, we find it concerning that a2 Milk is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Shares in a2 Milk have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of a2 Milk's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for a2 Milk with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:ATM

a2 Milk

Sells A2 protein type branded milk and related products in Australia, New Zealand, China, rest of Asia, and the United States.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives