- Singapore

- /

- Hotel and Resort REITs

- /

- SGX:Q5T

Smartpay Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced volatility, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic indicators. Despite these fluctuations, certain investment opportunities continue to attract attention, particularly in sectors that offer potential for growth at lower price points. Penny stocks, often representing smaller or newer companies, provide a unique blend of affordability and growth potential when backed by strong financials. In this article, we explore several promising penny stocks that stand out for their balance sheet strength and potential to deliver impressive returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Smartpay Holdings (NZSE:SPY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smartpay Holdings Limited is a merchant service provider operating in New Zealand and Australia with a market capitalization of NZ$122.18 million.

Operations: The company generates revenue of NZ$100.40 million by offering technology solutions through diverse product lines.

Market Cap: NZ$122.18M

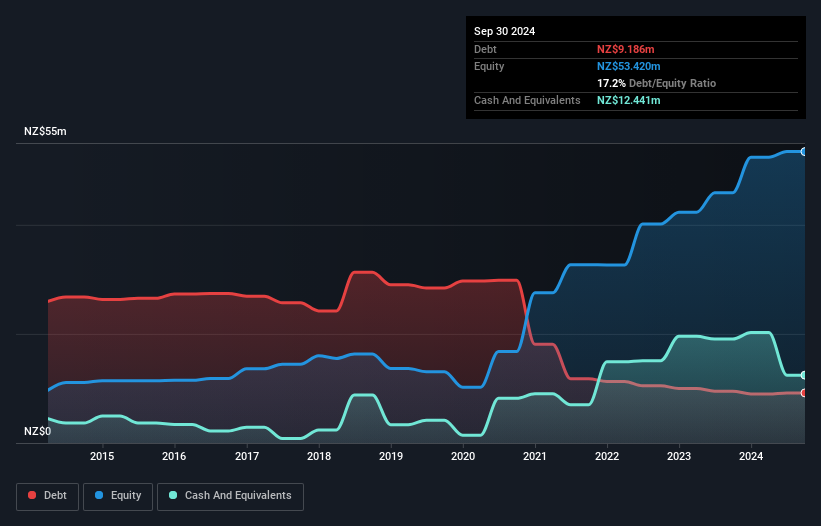

Smartpay Holdings Limited, with a market capitalization of NZ$122.18 million, has shown stable weekly volatility at 5% over the past year. The company generates revenue of NZ$100.40 million and reported half-year sales of NZ$50.8 million, up from the previous year's NZ$46.91 million, though net income declined to NZ$0.907 million from NZ$2.64 million. Despite negative earnings growth in the past year, Smartpay's debt is well covered by operating cash flow (222.3%), and it has reduced its debt-to-equity ratio significantly over five years to 17.2%. However, short-term assets do not cover short-term liabilities (NZ$28.6M vs NZ$36.7M).

- Click here and access our complete financial health analysis report to understand the dynamics of Smartpay Holdings.

- Understand Smartpay Holdings' earnings outlook by examining our growth report.

Far East Hospitality Trust (SGX:Q5T)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Far East Hospitality Trust is a Singapore-focused hotel and serviced residence hospitality trust listed on the SGX, with a market cap of SGD1.22 billion.

Operations: The trust's revenue is primarily derived from its Hotels and Serviced Residences segment, which generated SGD91.36 million, complemented by SGD17.34 million from Retail Units, Offices and Others.

Market Cap: SGD1.22B

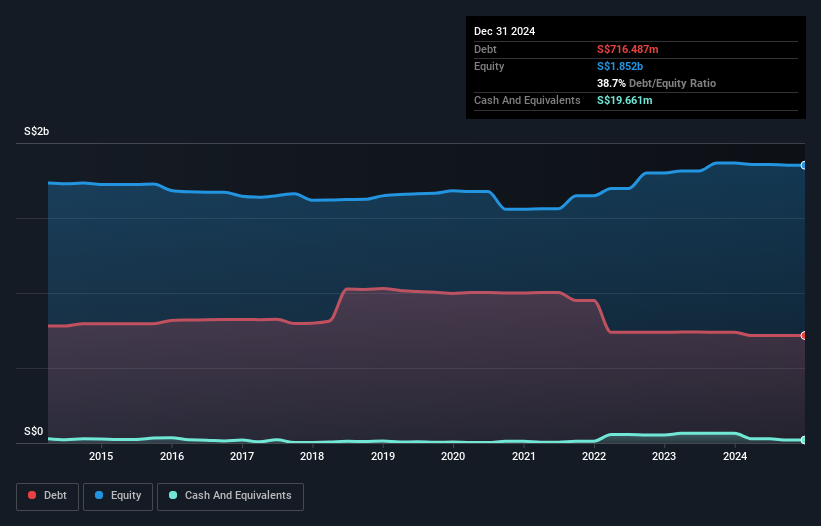

Far East Hospitality Trust, with a market cap of SGD1.22 billion, primarily generates revenue from its Hotels and Serviced Residences segment. Recent earnings show sales of SGD108.71 million, though net income dropped to SGD46.7 million from the previous year due to large one-off losses impacting results. The trust's debt-to-equity ratio has improved over five years but operating cash flow coverage remains low at 13.1%. While interest payments are well covered by EBIT (3.5x), short-term assets do not cover long-term liabilities (SGD67.9M vs SGD724.7M). Analysts suggest the stock trades below fair value estimates by 42.3%.

- Click to explore a detailed breakdown of our findings in Far East Hospitality Trust's financial health report.

- Assess Far East Hospitality Trust's future earnings estimates with our detailed growth reports.

Jiangsu Huasheng Tianlong PhotoelectricLtd (SZSE:300029)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Huasheng Tianlong Photoelectric Co., Ltd. operates in the photoelectric industry and has a market cap of CN¥974.46 million.

Operations: The company's revenue is derived entirely from its industrial segment, totaling CN¥274.75 million.

Market Cap: CN¥974.46M

Jiangsu Huasheng Tianlong Photoelectric Co., Ltd. operates with a market cap of CN¥974.46 million and generates CN¥274.75 million in revenue from its industrial segment, yet remains unprofitable. The company is debt-free, which may appeal to risk-averse investors, though it faces challenges with less than a year of cash runway based on current free cash flow trends. Its short-term assets exceed both short and long-term liabilities, indicating some financial stability despite ongoing losses. The board's average tenure is 1.5 years, suggesting recent changes in leadership that could influence future strategic direction.

- Navigate through the intricacies of Jiangsu Huasheng Tianlong PhotoelectricLtd with our comprehensive balance sheet health report here.

- Examine Jiangsu Huasheng Tianlong PhotoelectricLtd's past performance report to understand how it has performed in prior years.

Key Takeaways

- Navigate through the entire inventory of 5,698 Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Q5T

Far East Hospitality Trust

Far East H-Trust is a Singapore-Focused Hotel and Serviced Residence Hospitality Trust listed on the Main Board of The Singapore Exchange Securities Trading Limited (“SGX-ST”).

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives