- New Zealand

- /

- Food and Staples Retail

- /

- NZSE:MFB

Here's What To Make Of My Food Bag Group's (NZSE:MFB) Decelerating Rates Of Return

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at My Food Bag Group (NZSE:MFB), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for My Food Bag Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = NZ$10m ÷ (NZ$104m - NZ$16m) (Based on the trailing twelve months to March 2024).

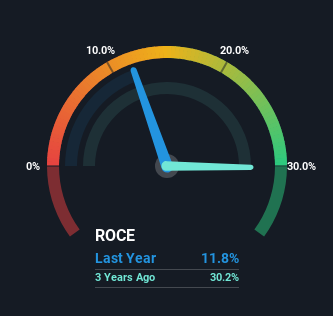

Therefore, My Food Bag Group has an ROCE of 12%. That's a relatively normal return on capital, and it's around the 11% generated by the Consumer Retailing industry.

See our latest analysis for My Food Bag Group

In the above chart we have measured My Food Bag Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering My Food Bag Group for free.

The Trend Of ROCE

There hasn't been much to report for My Food Bag Group's returns and its level of capital employed because both metrics have been steady for the past five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if My Food Bag Group doesn't end up being a multi-bagger in a few years time. That probably explains why My Food Bag Group has been paying out 76% of its earnings as dividends to shareholders. If the company is in fact lacking growth opportunities, that's one of the viable alternatives for the money.

What We Can Learn From My Food Bag Group's ROCE

We can conclude that in regards to My Food Bag Group's returns on capital employed and the trends, there isn't much change to report on. It seems that investors have little hope of these trends getting any better and that may have partly contributed to the stock collapsing 88% in the last three years. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

My Food Bag Group does have some risks, we noticed 3 warning signs (and 1 which is significant) we think you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:MFB

My Food Bag Group

Engages in creating and delivering meal kits, pre-prepared ready-to-heat meals, and grocery items in New Zealand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion