The CEO of Cooks Global Foods Limited (NZSE:CGF) is Graeme Jackson, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Cooks Global Foods

Comparing Cooks Global Foods Limited's CEO Compensation With the industry

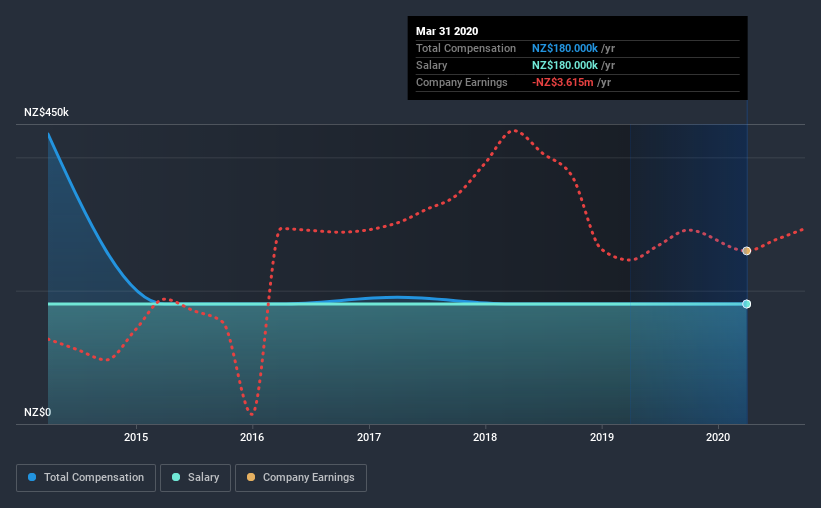

At the time of writing, our data shows that Cooks Global Foods Limited has a market capitalization of NZ$26m, and reported total annual CEO compensation of NZ$180k for the year to March 2020. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth NZ$180k.

On comparing similar-sized companies in the industry with market capitalizations below NZ$278m, we found that the median total CEO compensation was NZ$179k. From this we gather that Graeme Jackson is paid around the median for CEOs in the industry. Moreover, Graeme Jackson also holds NZ$2.5m worth of Cooks Global Foods stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | NZ$180k | NZ$180k | 100% |

| Other | - | - | - |

| Total Compensation | NZ$180k | NZ$180k | 100% |

On an industry level, around 56% of total compensation represents salary and 44% is other remuneration. At the company level, Cooks Global Foods pays Graeme Jackson solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Cooks Global Foods Limited's Growth

Cooks Global Foods Limited has reduced its earnings per share by 12% a year over the last three years. Its revenue is up 15% over the last year.

Overall this is not a very positive result for shareholders. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cooks Global Foods Limited Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Cooks Global Foods Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Cooks Global Foods pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we touched on above, Cooks Global Foods Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Cooks Global Foods that you should be aware of before investing.

Switching gears from Cooks Global Foods, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Cooks Global Foods, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Cooks Coffee, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:CCC

Cooks Coffee

Operates a network of cafes in the New Zealand and internationally.

Slight with acceptable track record.

Market Insights

Community Narratives