- United Kingdom

- /

- Consumer Durables

- /

- LSE:GLE

3 Undervalued European Small Caps With Notable Insider Buying

Reviewed by Simply Wall St

As European markets navigate a complex landscape of mixed economic indicators and geopolitical uncertainties, the pan-European STOXX Europe 600 Index has managed to edge higher, buoyed by encouraging company results and gains in certain sectors. In this environment, identifying small-cap stocks with potential for growth can be particularly appealing, especially those that demonstrate strong fundamentals and have garnered notable insider interest.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.5x | 5.0x | 24.38% | ★★★★★★ |

| 4imprint Group | 16.5x | 1.4x | 34.61% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 27.56% | ★★★★★☆ |

| Gamma Communications | 22.4x | 2.3x | 35.66% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.8x | 1.9x | 22.54% | ★★★★☆☆ |

| Franchise Brands | 39.1x | 2.0x | 25.20% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.32% | ★★★★☆☆ |

| IAR Systems Group | 13.2x | 3.3x | -0.10% | ★★★☆☆☆ |

| FastPartner | 18.9x | 5.3x | -109.68% | ★★★☆☆☆ |

| Logistri Fastighets | 17.1x | 8.2x | 17.33% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

MJ Gleeson (LSE:GLE)

Simply Wall St Value Rating: ★★★☆☆☆

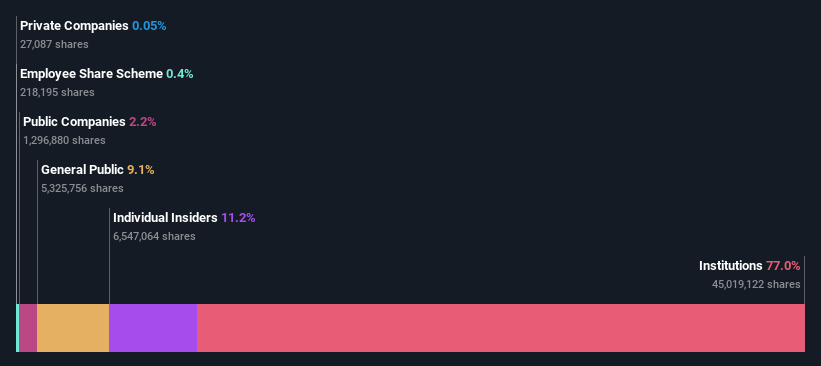

Overview: MJ Gleeson is a UK-based company specializing in low-cost house building through its Gleeson Homes division and strategic land sales via Gleeson Land, with a market capitalization of £0.34 billion.

Operations: Gleeson derives its revenue primarily from Gleeson Homes (£343.33 million) and Gleeson Land (£8.40 million). The gross profit margin has shown a declining trend, reaching 22.32% in the most recent period. Operating expenses are significant, with general and administrative expenses being a major component, affecting overall profitability.

PE: 16.5x

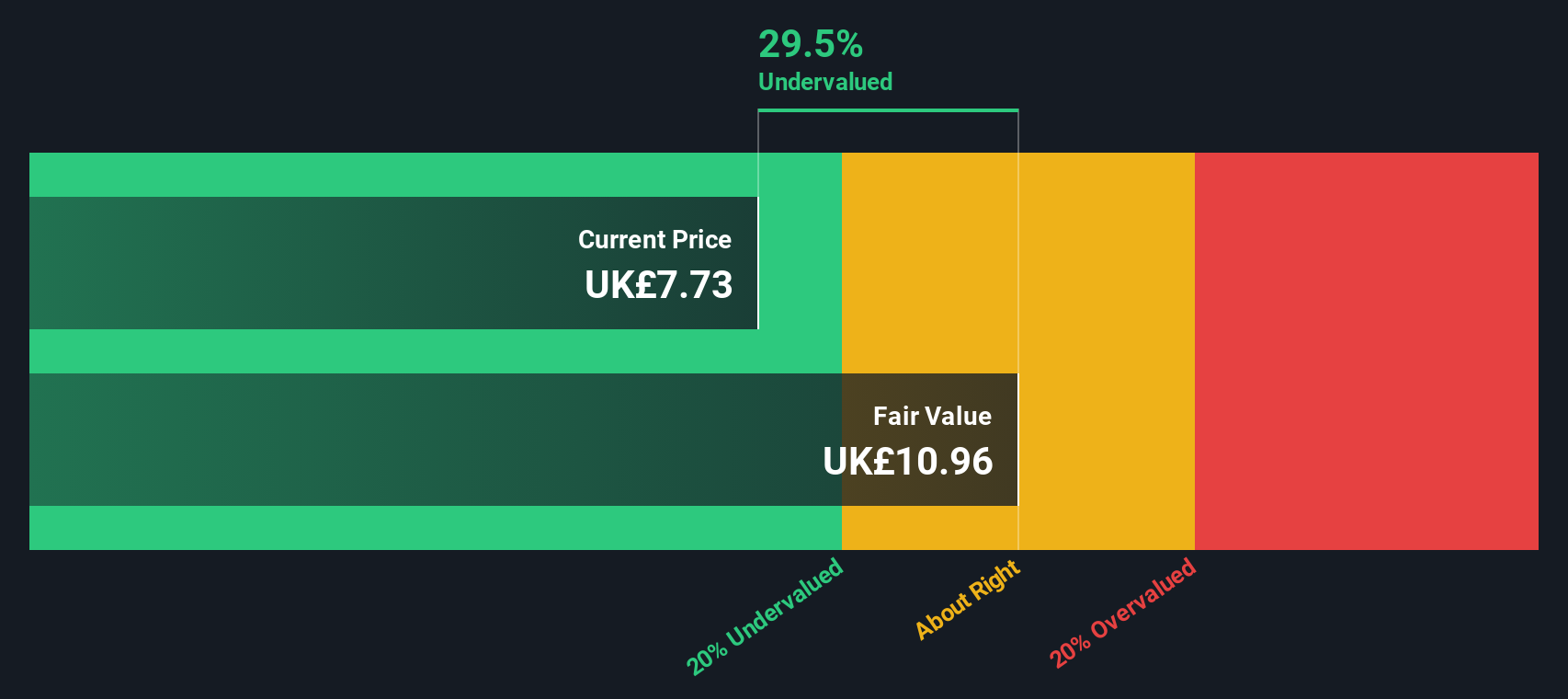

MJ Gleeson, a company with a market capitalization that places it among smaller European stocks, shows potential for growth with earnings projected to rise by 20.29% annually. Despite relying entirely on external borrowing for funding, which poses higher risks, insider confidence is evident through recent share purchases in February 2025. For the half year ending December 31, 2024, sales increased to £157.85 million from £151.46 million the previous year; however, net income decreased to £2.8 million from £5.59 million due to various operational challenges affecting profitability. The interim dividend remains steady at 4 pence per share as of March 2025, aligning with their policy of covering dividends three to five times over earnings—suggesting cautious optimism despite current financial hurdles.

J D Wetherspoon (LSE:JDW)

Simply Wall St Value Rating: ★★★★★★

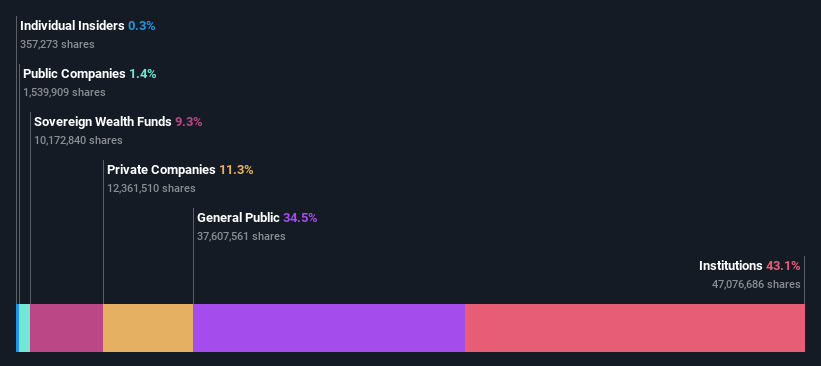

Overview: J D Wetherspoon operates a chain of pubs across the UK and Ireland, with a market cap of approximately £1.08 billion.

Operations: The company generates revenue primarily from its pub operations, with the latest reported revenue at £2.04 billion. Cost of goods sold is a significant expense, impacting gross profit margins, which have shown variability, recently recorded at 11.70%. Operating expenses and non-operating expenses further influence net income margins, which have been observed at 2.40% in the most recent period.

PE: 14.4x

J D Wetherspoon, a European small-cap stock, presents an intriguing investment case. Despite relying solely on external borrowing for funding, which carries higher risk without customer deposits, the company demonstrates insider confidence with share purchases made in the past six months. Earnings are projected to grow 13% annually, though current interest payments aren't well covered by earnings. These factors suggest potential growth opportunities amidst financial challenges.

- Get an in-depth perspective on J D Wetherspoon's performance by reading our valuation report here.

Assess J D Wetherspoon's past performance with our detailed historical performance reports.

Elmera Group (OB:ELMRA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Elmera Group operates in the energy sector, focusing on various segments including Nordic, Business, Consumer, and New Growth Initiatives with a market capitalization of NOK 2.56 billion.

Operations: Elmera Group generates revenue primarily from its Consumer and Business segments, with the Consumer segment contributing NOK 5.46 billion and the Business segment adding NOK 4.84 billion. The company's gross profit margin has shown variability, reaching a high of 44.07% in December 2020 before declining to 6.24% by June 2023, then recovering slightly to 14.53% by December 2024.

PE: 10.0x

Elmera Group, a European small company, has recently demonstrated insider confidence with Executive VP & CFO Henning Nordgulen purchasing 10,000 shares for NOK 325,000 in February 2025. Despite the company's reliance on higher-risk external borrowing and one-off items affecting earnings quality, its financial position remains stable. For Q4 2024, Elmera reported net income of NOK 206 million versus NOK 88 million last year. The board proposed a dividend increase to NOK 3 per share while reaffirming growth guidance for all segments in 2025.

- Navigate through the intricacies of Elmera Group with our comprehensive valuation report here.

Explore historical data to track Elmera Group's performance over time in our Past section.

Taking Advantage

- Unlock more gems! Our Undervalued European Small Caps With Insider Buying screener has unearthed 49 more companies for you to explore.Click here to unveil our expertly curated list of 52 Undervalued European Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MJ Gleeson, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLE

MJ Gleeson

Engages in house building, and land promotion and sale businesses in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives