Exploring OVH Groupe And 2 Other High Growth Tech Stocks In Europe

Reviewed by Simply Wall St

The European market has recently seen a boost in sentiment, with the pan-European STOXX Europe 600 Index rising by 2.10% following a de-escalation in the U.S.-China trade war, and key indices like Germany’s DAX and France’s CAC 40 also posting gains. In this context of improving market conditions, exploring high growth tech stocks such as OVH Groupe can offer insights into companies that may benefit from increased investor confidence and economic activity driven by technological advancements.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Elicera Therapeutics | 75.80% | 107.14% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 57.11% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

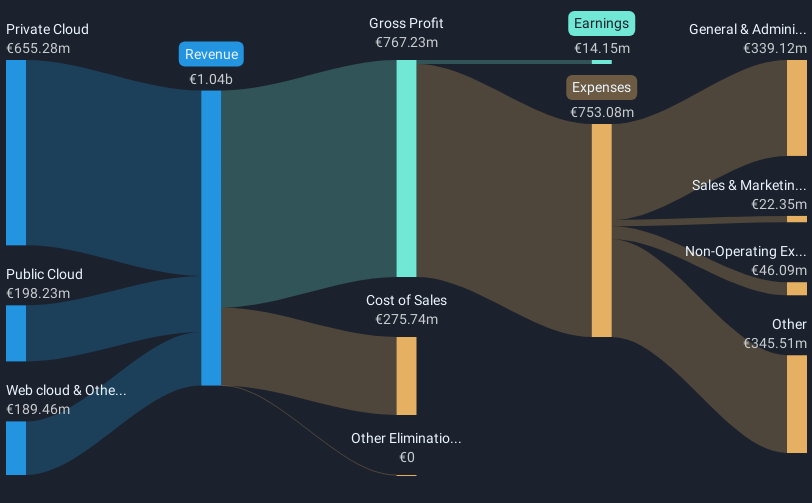

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.99 billion.

Operations: The company's revenue streams include public cloud services (€198.23 million), private cloud solutions (€655.28 million), and web cloud services (€189.46 million).

OVH Groupe has demonstrated a robust turnaround, transitioning from a net loss to reporting a net income of €7.21 million in the recent half-year results, up from last year's €17.24 million loss. This shift is underscored by a significant 84.3% forecasted annual earnings growth, outpacing the French market's average of 12%. Additionally, their commitment to innovation is evident as they presented at the OCP EMEA Summit 2025, highlighting their focus on environmental sustainability through their Global Environmental Director's insights. Despite challenges like high share price volatility and interest payments not being well covered by earnings, OVH's strategic direction and financial recovery position it as an emerging contender in Europe’s tech landscape.

- Click here to discover the nuances of OVH Groupe with our detailed analytical health report.

Review our historical performance report to gain insights into OVH Groupe's's past performance.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★★☆

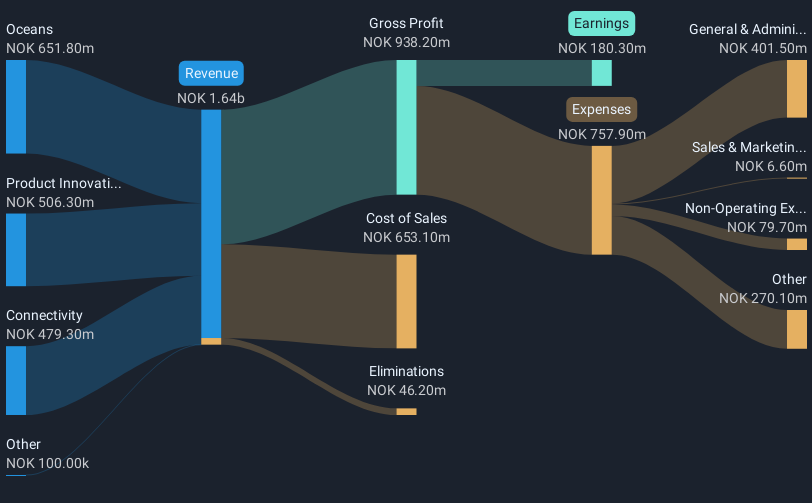

Overview: Norbit ASA offers technology solutions across various industries, with a market capitalization of NOK12.42 billion.

Operations: Norbit ASA generates revenue by delivering technology solutions tailored for diverse sectors. The company has a market capitalization of NOK12.42 billion.

Norbit ASA, a Norwegian tech firm, recently reported a robust first-quarter with sales jumping to NOK 521.7 million from NOK 404.4 million year-over-year and net income soaring to NOK 89.7 million from NOK 30.2 million. This growth reflects an impressive annual earnings increase of 85.1%, significantly outpacing the electronic industry's average of 8.1%. The company also announced a dividend of NOK 3 per share and secured a substantial contract worth approximately NOK 125 million in the defense sector, underscoring its strategic expansion and financial health. With revenue forecasted to grow at an annual rate of 16.4%, faster than Norway's market average (2.5%), and earnings expected to climb by 23.41% annually, Norbit is well-positioned for sustained growth driven by both innovative offerings and strategic market expansions.

- Delve into the full analysis health report here for a deeper understanding of Norbit.

Gain insights into Norbit's historical performance by reviewing our past performance report.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

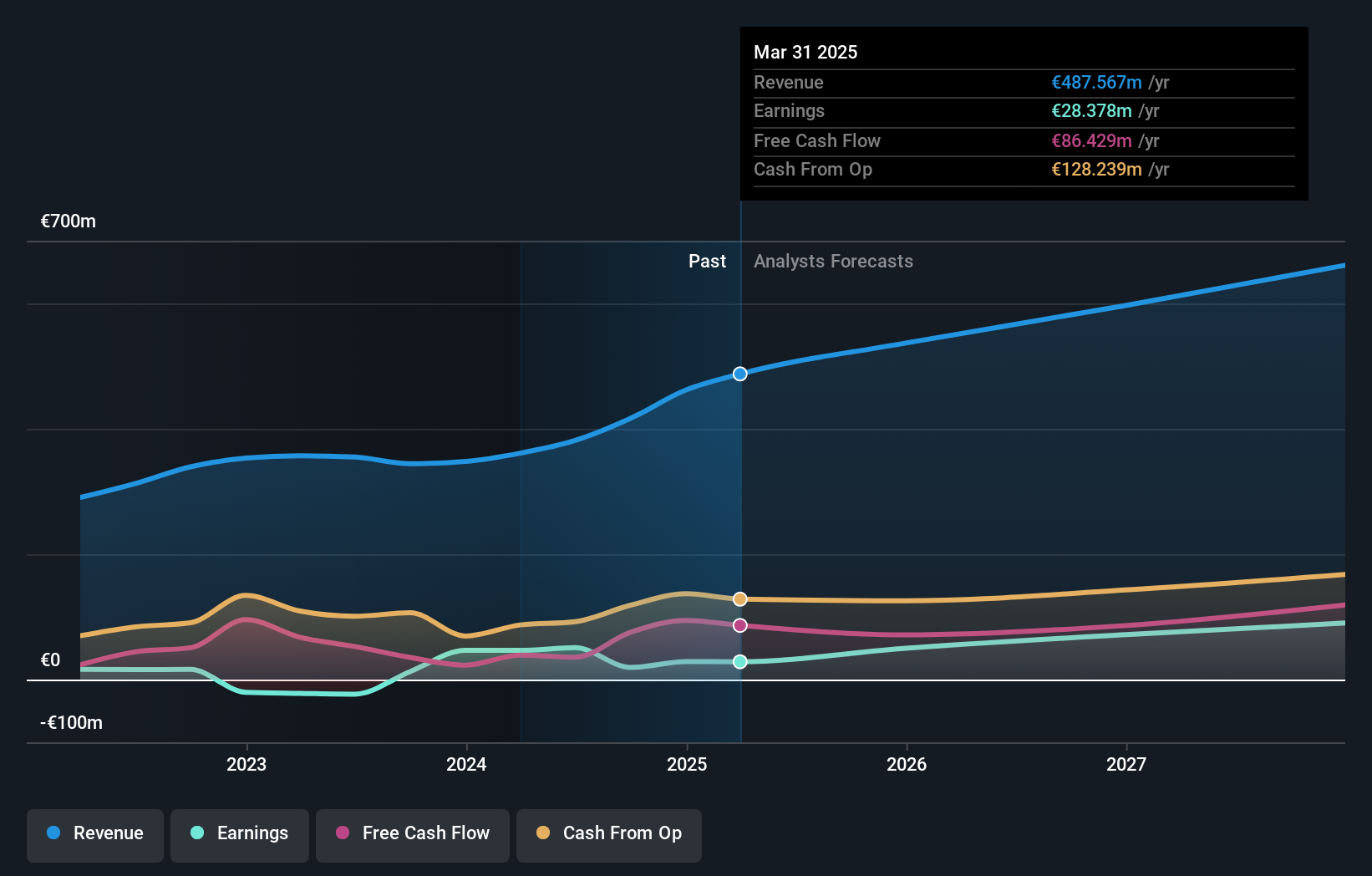

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market capitalization of €761.86 million.

Operations: Verve Group SE generates revenue primarily through its Demand Side Platforms (DSP) and Supply Side Platforms (SSP), with SSP contributing €390.27 million and DSP adding €100.55 million.

Verve Group SE, amidst a dynamic advertising landscape, has demonstrated robust growth with its innovative ID-less solutions tailored for privacy-centric marketing. In 2024, the company's revenues surged to €461.94 million from €347.94 million the previous year, marking a significant increase. This growth trajectory is complemented by an earnings forecast promising a 28.7% annual increase and an ambitious revenue CAGR of 25-30% for 2025. Recent presentations at high-profile investment forums underscore their strategic focus on leveraging technological advancements to capture market share in the U.S., their largest market, ensuring sustained financial health and expansion into new segments.

- Unlock comprehensive insights into our analysis of Verve Group stock in this health report.

Assess Verve Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Navigate through the entire inventory of 227 European High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Norbit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORBT

Norbit

Provides technology solutions to customers in a range of industries.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)