Did The Underlying Business Drive IDEX Biometrics' (OB:IDEX) Lovely 324% Share Price Gain?

For many, the main point of investing in the stock market is to achieve spectacular returns. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, IDEX Biometrics ASA (OB:IDEX) has generated a beautiful 324% return in just a single year. Also pleasing for shareholders was the 57% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Unfortunately the longer term returns are not so good, with the stock falling 44% in the last three years.

Check out our latest analysis for IDEX Biometrics

IDEX Biometrics recorded just US$1,095,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that IDEX Biometrics will significantly advance the business plan before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some IDEX Biometrics investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

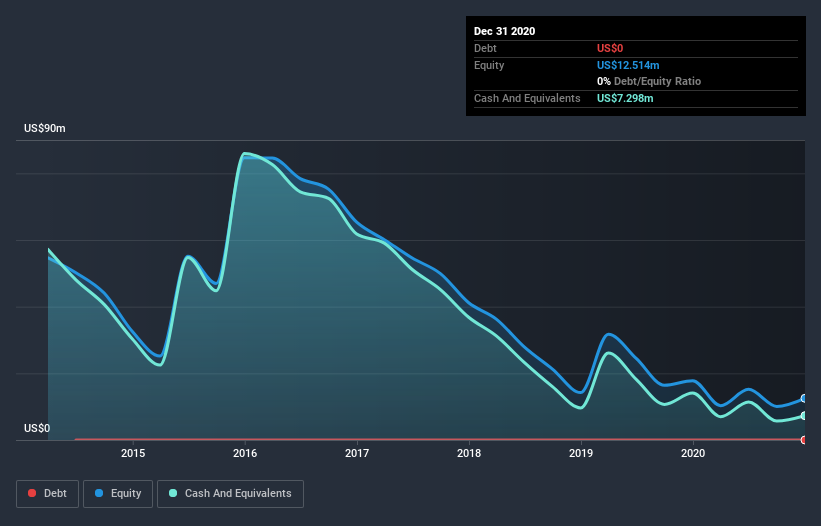

IDEX Biometrics had cash in excess of all liabilities of just US$2.8m when it last reported (December 2020). So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. Given how low on cash it got, investors must really like its potential for the share price to be up 56% in the last year. You can see in the image below, how IDEX Biometrics' cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's good to see that IDEX Biometrics has rewarded shareholders with a total shareholder return of 324% in the last twelve months. That certainly beats the loss of about 10% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand IDEX Biometrics better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with IDEX Biometrics (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you’re looking to trade IDEX Biometrics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:IDEX

IDEX Biometrics

Designs, develops, and sells fingerprint authentication solutions in Norway, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific regions.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)