As Arribatec Solutions ASA's (OB:ARR)) market cap dropped by kr202m, insiders who sold kr183m worth of stock were able to offset their losses

Over the past year, insiders sold kr183m worth of Arribatec Solutions ASA (OB:ARR) stock at an average price of kr1.57 per share allowing them to get the most out of their money. The company’s market cap plunged by kr202m after price dropped by 39% last week but insiders were able to limit their loss to an extent.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Arribatec Solutions

The Last 12 Months Of Insider Transactions At Arribatec Solutions

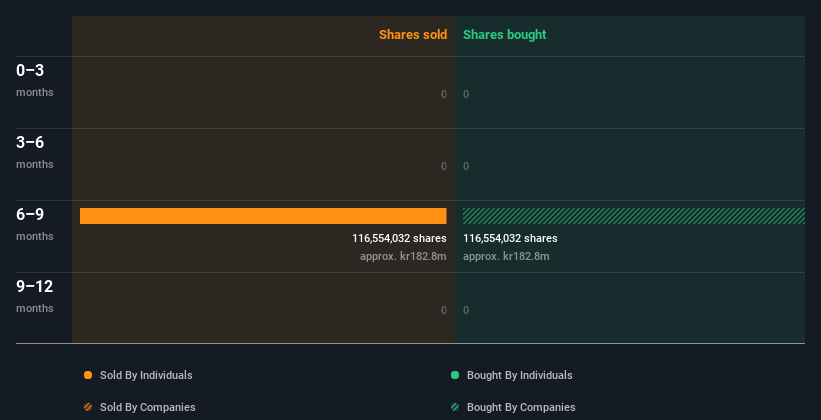

Over the last year, we can see that the biggest insider sale was by the Director, Oystein Spetalen, for kr183m worth of shares, at about kr1.57 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is kr0.55. So it may not tell us anything about how insiders feel about the current share price. Oystein Spetalen was the only individual insider to sell shares in the last twelve months.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Arribatec Solutions better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Arribatec Solutions insiders own about kr89m worth of shares. That equates to 28% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The Arribatec Solutions Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Arribatec Solutions shares in the last quarter. Our analysis of Arribatec Solutions insider transactions leaves us cautious. The modest level of insider ownership is, at least, some comfort. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 4 warning signs for Arribatec Solutions you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ARR

Arribatec Group

A software and consulting company, provides digital business solutions in Norway, Europe, the Americas, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)