- Norway

- /

- Semiconductors

- /

- OB:RECSI

REC Silicon ASA (OB:RECSI) Analysts Just Trimmed Their Revenue Forecasts By 22%

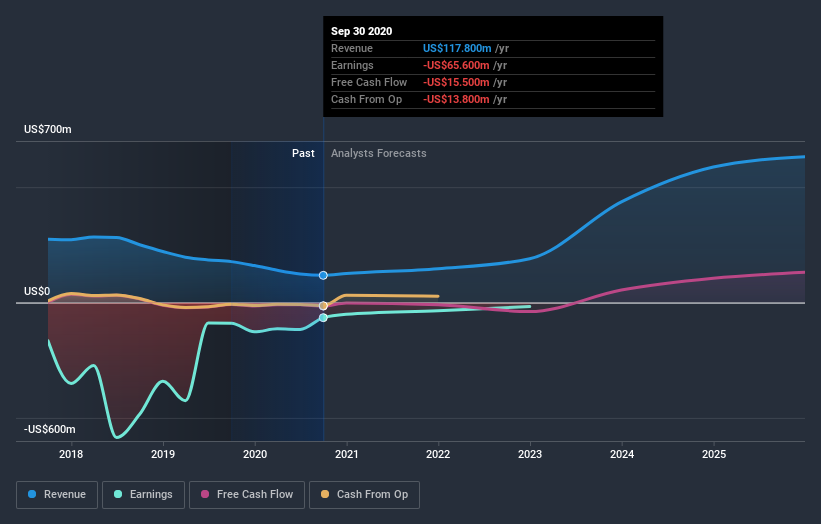

Today is shaping up negative for REC Silicon ASA (OB:RECSI) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the latest downgrade, REC Silicon's dual analysts currently expect revenues in 2021 to be US$116m, approximately in line with the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$147m in 2021. It looks like forecasts have become a fair bit less optimistic on REC Silicon, given the pretty serious reduction to revenue estimates.

See our latest analysis for REC Silicon

There was no particular change to the consensus price target of kr16.83, with REC Silicon's latest outlook seemingly not enough to result in a change of valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on REC Silicon, with the most bullish analyst valuing it at kr25.00 and the most bearish at kr8.16 per share. We would probably assign less value to the forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing that stands out from these estimates is that shrinking revenues are expected to moderate from the historical decline of 18% per annum over the past five years.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for REC Silicon this year. They're also anticipating slower revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on REC Silicon after today.

There might be good reason for analyst bearishness towards REC Silicon, like dilutive stock issuance over the past year. Learn more, and discover the 3 other flags we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading REC Silicon or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade REC Silicon, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:RECSI

REC Silicon

Produces and sells silicon materials for the solar and electronics industries worldwide.

Moderate and good value.