- Norway

- /

- Semiconductors

- /

- OB:NOD

Nordic Semiconductor (OB:NOD) Valuation Check Following New Direct-to-Satellite IoT Platform Launch

Reviewed by Simply Wall St

Nordic Semiconductor (OB:NOD) just took a meaningful step deeper into satellite IoT, launching its nRF9151 SMA Development Kit and new modem firmware that adds NB-IoT NTN support for direct-to-satellite connectivity.

See our latest analysis for Nordic Semiconductor.

The timing of this launch comes after a choppy spell for the stock, with a 90 day share price return of minus 13.14 percent, but a strong year to date share price return of 27.73 percent and a 1 year total shareholder return of 31.9 percent, suggesting longer term momentum is still building as investors reassess Nordic Semiconductor's role in higher value IoT and satellite connectivity.

If this satellite IoT move has caught your attention, it could be worth exploring other innovative chip and connectivity names through high growth tech and AI stocks to see what else is emerging as a potential long term compounder.

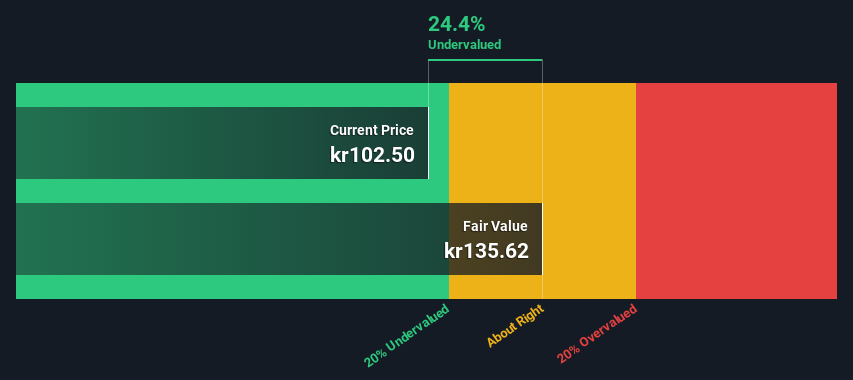

Yet with earnings bouncing back, revenue growing, and the shares still trading below consensus targets, investors now face a key question: is Nordic Semiconductor still an underappreciated satellite IoT play, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 9.7% Undervalued

Against a last close of NOK131.5, the most followed narrative puts Nordic Semiconductor’s fair value modestly higher, framing upside through sustained growth and margin expansion.

Strong innovation, broadening market reach, and a strategic solutions shift position Nordic Semiconductor for sustained growth, margin resilience, and long term competitive differentiation.

Want to see the engine behind that valuation gap? The narrative leans on powerful revenue compounding, sharply improving margins, and a bold future earnings step change. Curious how those moving parts add up to today’s fair value call and tomorrow’s potential rerating path? Dive in to unpack the full playbook.

Result: Fair Value of NOK145.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, much stronger than expected demand, faster adoption of new platforms, or smoother integration of recent acquisitions could quickly narrow that perceived valuation gap.

Find out about the key risks to this Nordic Semiconductor narrative.

Another View: SWS DCF Model Flags Overvaluation Risk

While the narrative fair value suggests Nordic Semiconductor is modestly undervalued, our DCF model tells a very different story. On that view, the shares trade around NOK131.5 versus a fair value estimate near NOK64.8, implying meaningful downside if cash flow expectations disappoint.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nordic Semiconductor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nordic Semiconductor Narrative

If you see the story differently or want to stress test the numbers yourself, you can shape a custom narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nordic Semiconductor.

Ready for more investment ideas?

Turn today’s insight into real opportunities by hunting for fresh, data backed stock ideas on the Simply Wall Street Screener before the next wave of gains escapes you.

- Capture early stage growth potential by scanning these 3610 penny stocks with strong financials that already show robust fundamentals instead of chasing crowded large caps.

- Position your portfolio at the heart of digital transformation by targeting these 26 AI penny stocks that marry cutting edge technology with accelerating revenue momentum.

- Lock in quality at a discount by focusing on these 903 undervalued stocks based on cash flows where strong cash flows support attractive upside and reduce downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)