As global markets experience a boost from easing core U.S. inflation and robust bank earnings, investors are keenly observing shifts in market dynamics. With value stocks outpacing growth shares and financials showing strong gains, the current landscape offers intriguing opportunities for discerning investors. Though the term 'penny stock' might sound like a relic of past trading days, it still points to relevant opportunities in smaller or newer companies that can lead to significant returns when built on solid financials. We'll spotlight several penny stocks that stand out for their financial strength, making them promising candidates for those seeking under-the-radar companies poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.01 | HK$641.14M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £147.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £778.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.2M | ★★★★★☆ |

Click here to see the full list of 5,712 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aelis Farma (ENXTPA:AELIS)

Simply Wall St Financial Health Rating: ★★★★★★

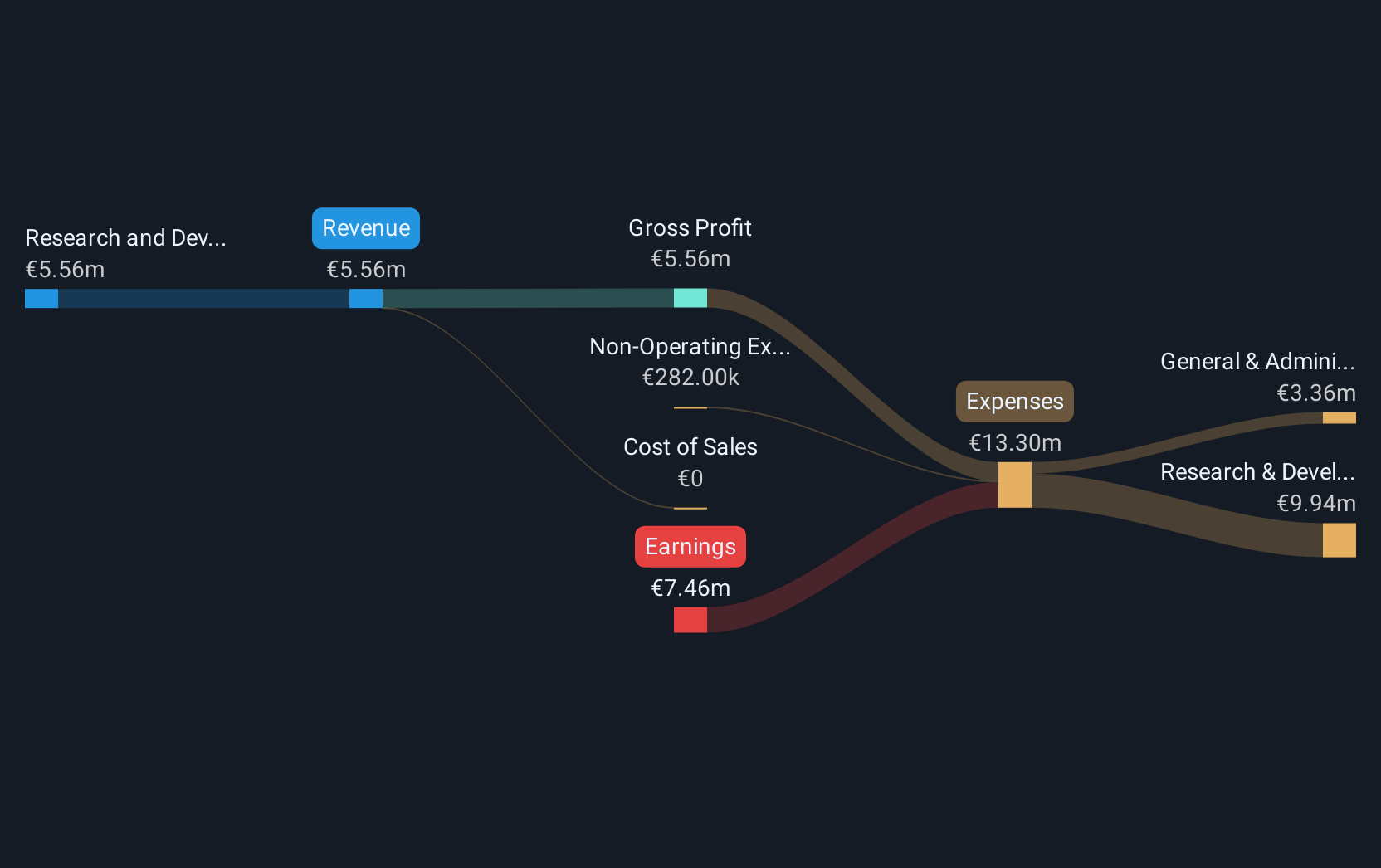

Overview: Aelis Farma SA is a clinical-stage biotechnology company dedicated to discovering and developing drug candidates for central nervous system disorders, with a market cap of €31.32 million.

Operations: The company's revenue is derived entirely from the research and development of pharmaceutical products, amounting to €10.78 million.

Market Cap: €31.32M

Aelis Farma, a clinical-stage biotechnology firm with a market cap of €31.32 million, remains pre-revenue and unprofitable, yet it shows promise through its innovative drug development for central nervous system disorders. Recent positive results from its Phase 1/2 study of AEF0217 in young adults with Down syndrome highlight potential efficacy and safety, supporting further research. Despite high volatility and limited cash runway (11 months), the company has raised additional capital to support operations. Its experienced management team and favorable debt position offer some stability amidst ongoing financial challenges typical for companies in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Aelis Farma.

- Learn about Aelis Farma's future growth trajectory here.

Lokotech Group (OB:LOKO)

Simply Wall St Financial Health Rating: ★★★★★☆

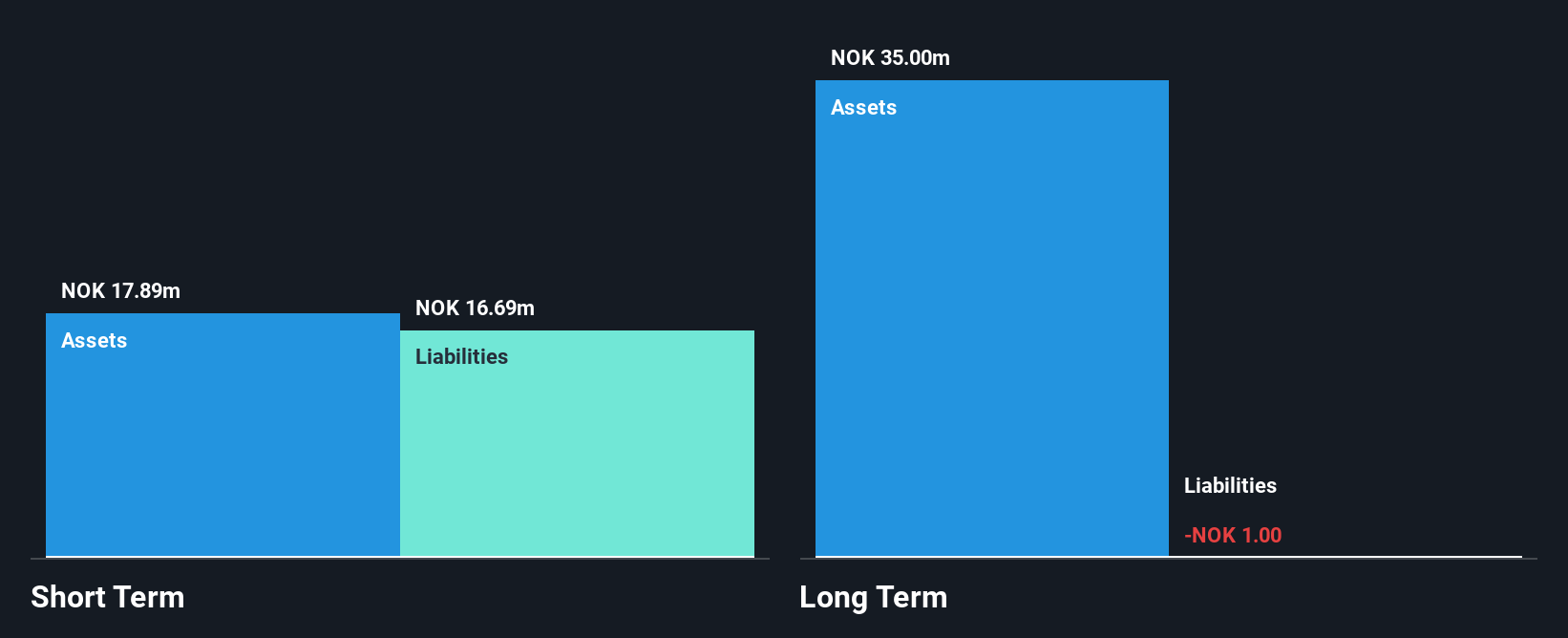

Overview: Lokotech Group AS is a management and holding company that provides software and hardware solutions for the crypto industry, with a market cap of NOK385.44 million.

Operations: Lokotech Group AS has not reported any specific revenue segments.

Market Cap: NOK385.44M

Lokotech Group AS, with a market cap of NOK385.44 million, is pre-revenue and unprofitable, focusing on innovative hardware solutions for the crypto industry. The recent launch of its DoubleBarrel and SingleBarrel Scrypt ASIC miners aims to enhance efficiency in volatile markets. A framework agreement with a U.S. client could yield US$2-5 million in gross revenue upon execution, potentially accelerating economies of scale. The company benefits from being debt-free and having short-term assets exceeding liabilities but faces high share price volatility and negative return on equity as it navigates growth challenges typical for emerging tech firms.

- Unlock comprehensive insights into our analysis of Lokotech Group stock in this financial health report.

- Gain insights into Lokotech Group's outlook and expected performance with our report on the company's earnings estimates.

China Jicheng Holdings (SEHK:1027)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Jicheng Holdings Limited, with a market cap of HK$367.17 million, manufactures and sells POE umbrellas, nylon umbrellas, and umbrella parts in the People’s Republic of China.

Operations: The company generates CN¥323.64 million in revenue from its operations focused on the manufacturing and sale of umbrellas.

Market Cap: HK$367.17M

China Jicheng Holdings, with a market cap of HK$367.17 million, faces challenges typical for penny stocks. Despite generating CN¥323.64 million in revenue from its umbrella business, the company remains unprofitable with declining earnings over the past five years. Its weekly volatility is higher than 75% of Hong Kong stocks, reflecting a volatile share price in recent months. The firm has less than one year of cash runway and a negative return on equity at -42.68%. However, it maintains satisfactory debt levels and covers short-term liabilities with assets totaling CN¥317 million. Recent auditor changes may impact investor confidence moving forward.

- Get an in-depth perspective on China Jicheng Holdings' performance by reading our balance sheet health report here.

- Gain insights into China Jicheng Holdings' historical outcomes by reviewing our past performance report.

Where To Now?

- Gain an insight into the universe of 5,712 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1027

China Jicheng Holdings

Manufactures and sells POE umbrellas, nylon umbrellas, and umbrella parts in the People’s Republic of China.

Adequate balance sheet slight.