- Hong Kong

- /

- Semiconductors

- /

- SEHK:650

Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and strong bank earnings in the U.S., major indices have rebounded, highlighting a positive start to 2025. In this context, penny stocks—though often seen as a relic term—still offer intriguing opportunities for investors seeking growth at lower price points. These smaller or newer companies can present significant potential when backed by solid financials, offering a chance to uncover hidden value in quality investments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$615.75M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £147.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

Click here to see the full list of 5,720 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Fortress Minerals (Catalist:OAJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortress Minerals Limited is an investment holding company involved in the exploration, mining, production, and sale of iron ore concentrates with a market cap of SGD128.21 million.

Operations: The company generates revenue from the iron ore segment, amounting to $50.79 million.

Market Cap: SGD128.21M

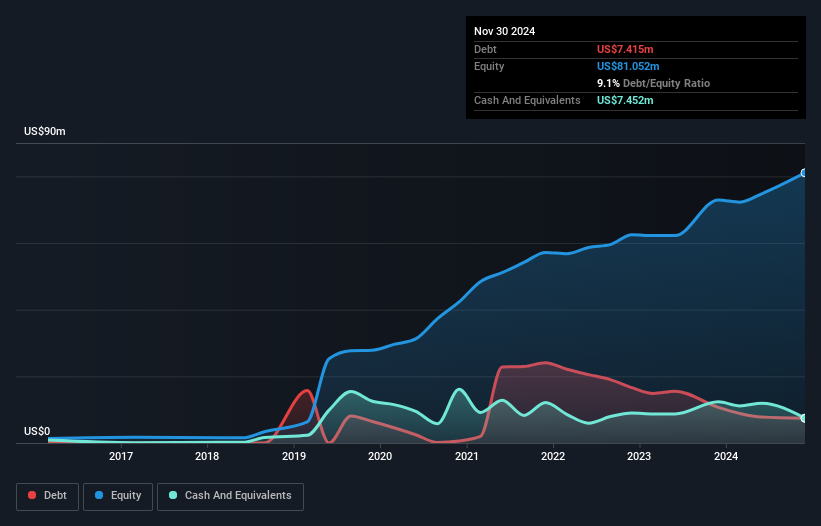

Fortress Minerals Limited, with a market cap of SGD128.21 million, operates in the iron ore segment, generating US$50.79 million in revenue. Despite a decline in net income to US$0.70 million for Q3 2024 from US$2.33 million a year ago, the company maintains strong debt management with a reduced debt-to-equity ratio of 9.1% and interest coverage at 27.9 times EBIT. Its price-to-earnings ratio is slightly below the SG market average, suggesting potential value for investors mindful of volatility risks and recent earnings contraction trends amidst industry challenges.

- Take a closer look at Fortress Minerals' potential here in our financial health report.

- Gain insights into Fortress Minerals' future direction by reviewing our growth report.

Shing Chi Holdings (SEHK:1741)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shing Chi Holdings Limited is an investment holding company that operates as a construction contractor in Hong Kong and the People's Republic of China, with a market cap of HK$74.40 million.

Operations: The company's revenue is primarily derived from Other Construction Works (HK$67.30 million), Foundation and Site Formation Works (HK$42.31 million), General Building Works and Associated Services (HK$24.95 million), and Construction Related Consultancy Services (HK$9.40 million).

Market Cap: HK$74.4M

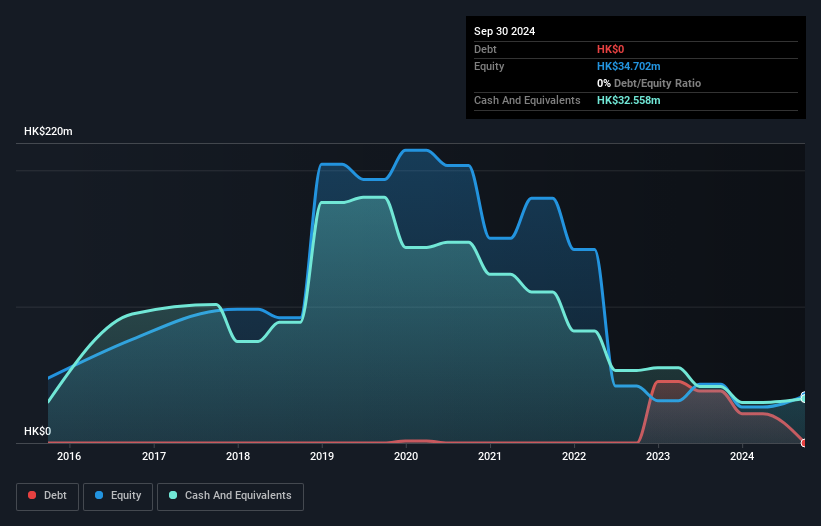

Shing Chi Holdings Limited, with a market cap of HK$74.40 million, reported a significant net loss increase to HK$10.07 million for the fiscal year ending September 30, 2024, driven by reduced revenue and gross profit margins amid competitive market conditions. The company remains debt-free and its short-term assets surpass both short- and long-term liabilities, indicating some financial stability despite ongoing unprofitability. The management team and board are experienced with average tenures of 6.9 years and 6.3 years respectively, but the stock's high volatility raises caution for investors considering potential value opportunities in this sector.

- Get an in-depth perspective on Shing Chi Holdings' performance by reading our balance sheet health report here.

- Understand Shing Chi Holdings' track record by examining our performance history report.

Productive Technologies (SEHK:650)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Productive Technologies Company Limited is an investment holding company involved in manufacturing equipment for the semiconductor and solar power industries in China, with a market cap of approximately HK$1.52 billion.

Operations: The company's revenue is primarily derived from the Pan-semiconductor segment, which generated HK$200.60 million, followed by the Oil and Gas and Others segment with HK$168.77 million.

Market Cap: HK$1.52B

Productive Technologies Company Limited, with a market cap of HK$1.52 billion, faces challenges as it remains unprofitable and reported a net loss of HK$160.7 million for the half year ending September 30, 2024. Despite these setbacks, the company maintains financial stability with short-term assets exceeding both its short- and long-term liabilities. The management team is relatively experienced with an average tenure of 2.7 years, though the board is less seasoned at 2.4 years on average. While debt levels have increased over five years, cash reserves surpass total debt, offering some buffer against ongoing financial pressures.

- Dive into the specifics of Productive Technologies here with our thorough balance sheet health report.

- Examine Productive Technologies' past performance report to understand how it has performed in prior years.

Make It Happen

- Unlock more gems! Our Penny Stocks screener has unearthed 5,717 more companies for you to explore.Click here to unveil our expertly curated list of 5,720 Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:650

Productive Technologies

An investment holding company, engages in the manufacturing of equipment applied in semiconductor and solar power businesses in the People’s Republic of China.

Excellent balance sheet minimal.