- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

High Growth Tech Stocks To Watch For Potential Portfolio Boost

Reviewed by Simply Wall St

As global markets experience fluctuations, with U.S. stocks rebounding due to easing core inflation and strong bank earnings, investors are keenly observing the performance of various indices such as the S&P 500 and Nasdaq Composite. In this dynamic environment, identifying high-growth tech stocks that align with current economic trends can potentially enhance portfolio performance by capitalizing on innovation and market momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 61.26% | 20.47% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

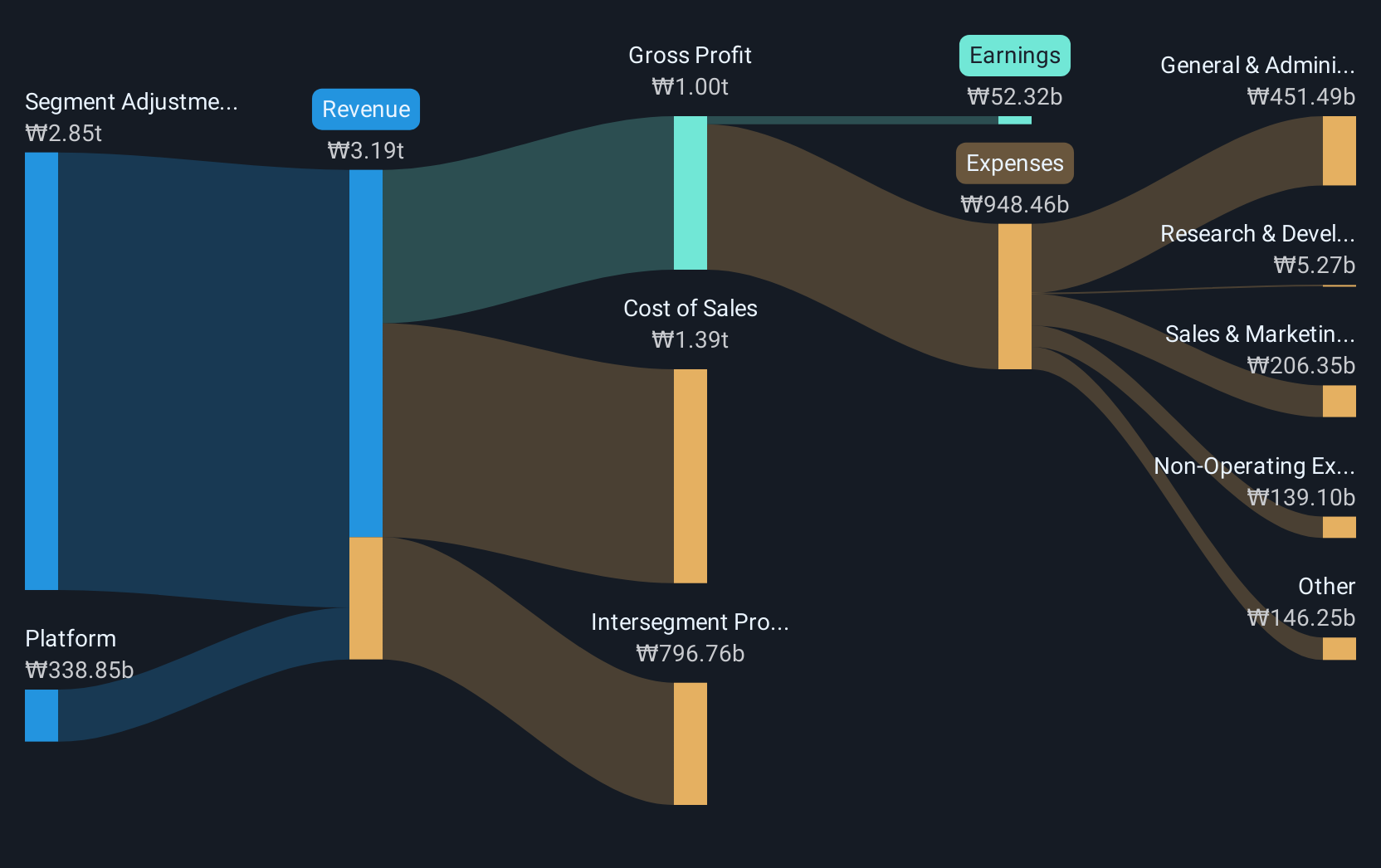

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩9.04 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from its Label and Solution segments, contributing ₩1.29 trillion and ₩1.21 trillion respectively, while the Platform segment adds ₩337.18 billion to its revenue streams.

Amidst a challenging year, HYBE's strategic leadership reshuffles signify a robust intent to bolster its market stance. Notably, the appointment of Shin Seon-jeong as CEO of Big Hit Music underscores a commitment to leveraging deep industry experience for sustainable growth. Despite recent earnings showing a dip—with third-quarter sales at KRW 527.85 billion and net income plunging to KRW 6.37 billion—HYBE's revenue growth outlook remains positive at an annual rate of 16.8%. This figure comfortably surpasses South Korea's average market growth rate of 9.4%, reflecting potential resilience and adaptability in its business model amidst evolving entertainment landscapes.

- Click here and access our complete health analysis report to understand the dynamics of HYBE.

Assess HYBE's past performance with our detailed historical performance reports.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

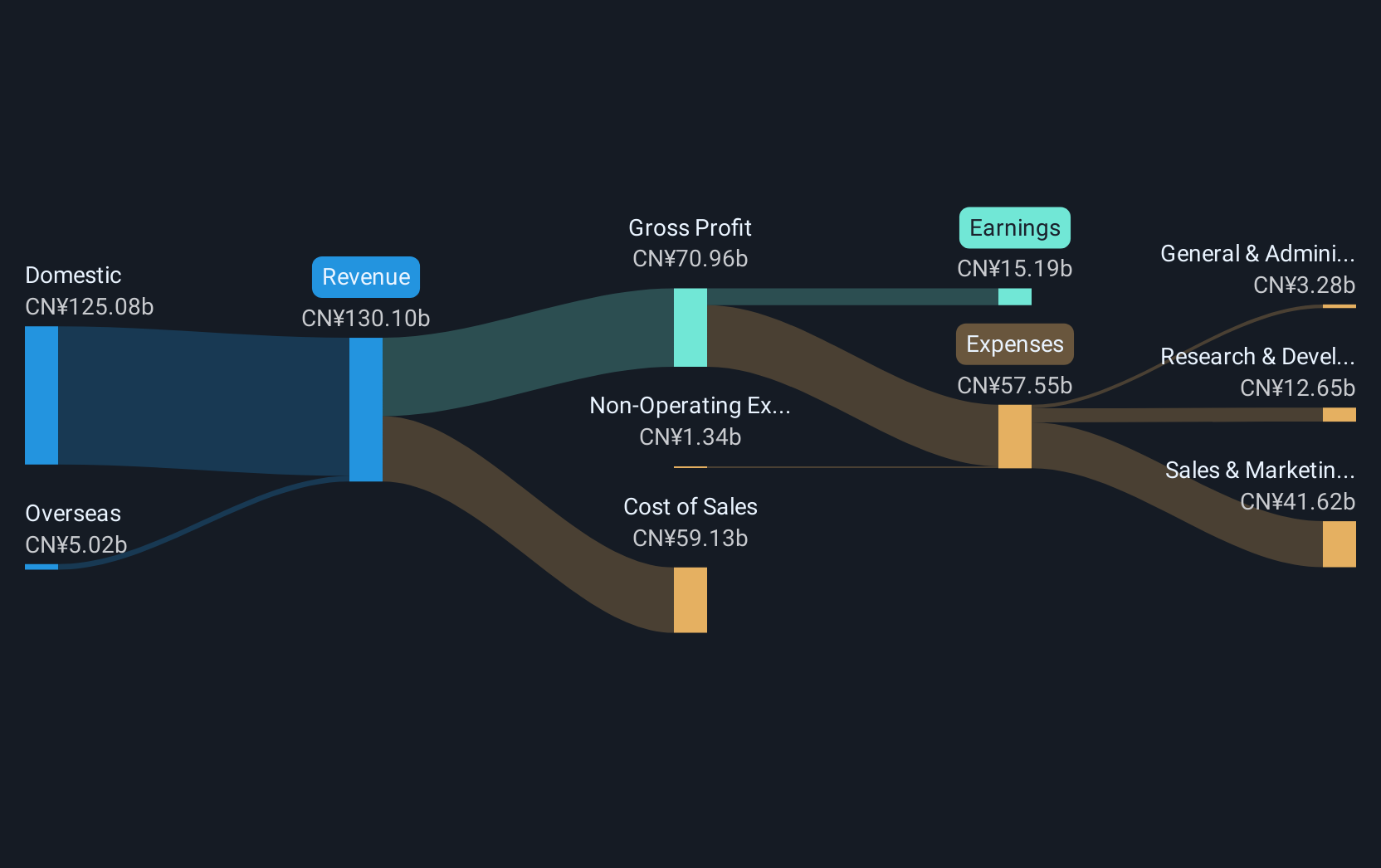

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China with a market capitalization of approximately HK$171.50 billion.

Operations: Kuaishou Technology generates revenue primarily from its domestic operations, which account for CN¥119.83 billion, significantly overshadowing its overseas segment at CN¥4.25 billion. The company focuses on live streaming and online marketing services in the Chinese market.

Kuaishou Technology, with a notable 1106.6% surge in earnings over the past year, significantly outpaces its industry's growth rate of 6.5%. This performance is anchored by robust R&D investments, which have facilitated pioneering developments like the Kling AI multi-image reference feature—enhancing video consistency and creativity for its users globally. The firm's strategic share repurchases, totaling HKD 2.44 billion for 1.33% of outstanding shares since July 2024, underscore a commitment to shareholder value amidst expanding market presence evidenced by recent inclusion in the Hang Seng Index. These maneuvers position Kuaishou not just as a tech innovator but as a shrewd player tuned to market dynamics and user engagement trends.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

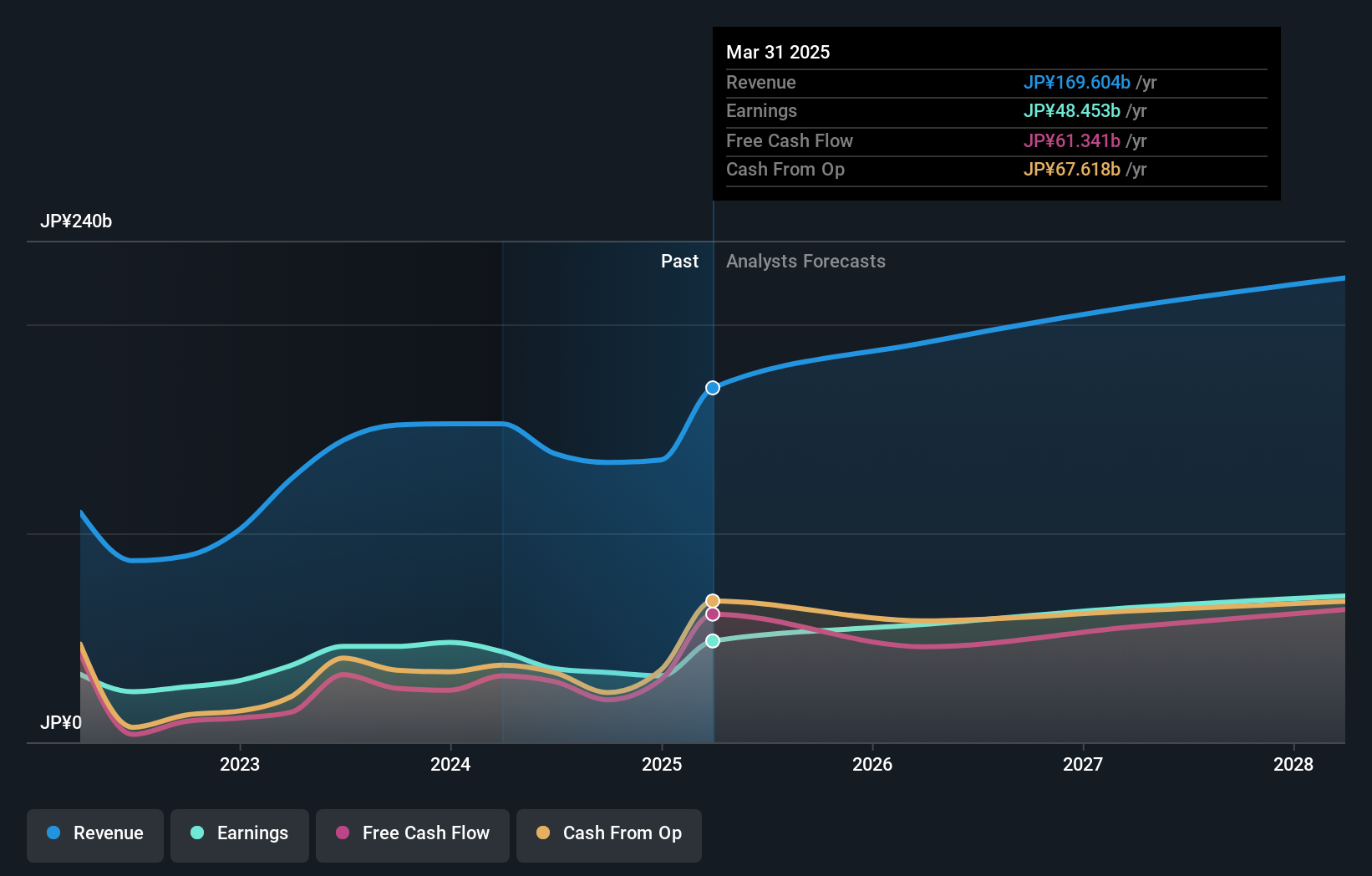

Overview: Capcom Co., Ltd. is involved in the planning, development, manufacturing, selling, and distribution of home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of ¥1.38 trillion.

Operations: The company generates revenue primarily through the development and sale of video games across various platforms, including home consoles, online, mobile, and arcade systems. It operates both domestically in Japan and internationally. The business model focuses on leveraging popular game franchises to drive sales across these segments.

Capcom, amid a challenging environment with a 27.3% dip in earnings last year, still forecasts an earnings growth of 15.6% annually, outpacing the Japanese market's 8%. This resilience is partly due to its strategic R&D allocation which has enabled Capcom to stay competitive and innovative in the gaming sector. With revenue growth also expected to exceed the market average at 10.2% per year, Capcom's ability to generate high-quality earnings and maintain a robust return on equity forecasted at 20% positions it for potential future growth despite recent setbacks.

- Dive into the specifics of Capcom here with our thorough health report.

Understand Capcom's track record by examining our Past report.

Key Takeaways

- Reveal the 1225 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives