- Singapore

- /

- Industrial REITs

- /

- SGX:DHLU

3 Undervalued Small Caps With Insider Action Across Global Markets

Reviewed by Simply Wall St

In the current global market landscape, major stock indexes have shown mixed performance, with the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 Index, a key benchmark for small-cap stocks, experienced a decline. This divergence highlights the complex dynamics at play as growth shares outpace value stocks and economic indicators such as job growth rebound amid geopolitical uncertainties. In this environment, identifying small-cap stocks that demonstrate resilience and potential can be particularly valuable for investors looking to navigate these fluctuations.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.2x | 0.8x | 28.86% | ★★★★★☆ |

| Maharashtra Seamless | 11.9x | 2.1x | 24.39% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.4x | 2.1x | 40.51% | ★★★★☆☆ |

| PSC | 7.6x | 0.4x | 43.44% | ★★★★☆☆ |

| Avia Avian | 14.9x | 3.4x | 19.32% | ★★★★☆☆ |

| Logistri Fastighets | 12.7x | 9.0x | 41.19% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 46.64% | ★★★★☆☆ |

| L.G. Balakrishnan & Bros | 15.0x | 1.7x | -50.05% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.3x | 10.89% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

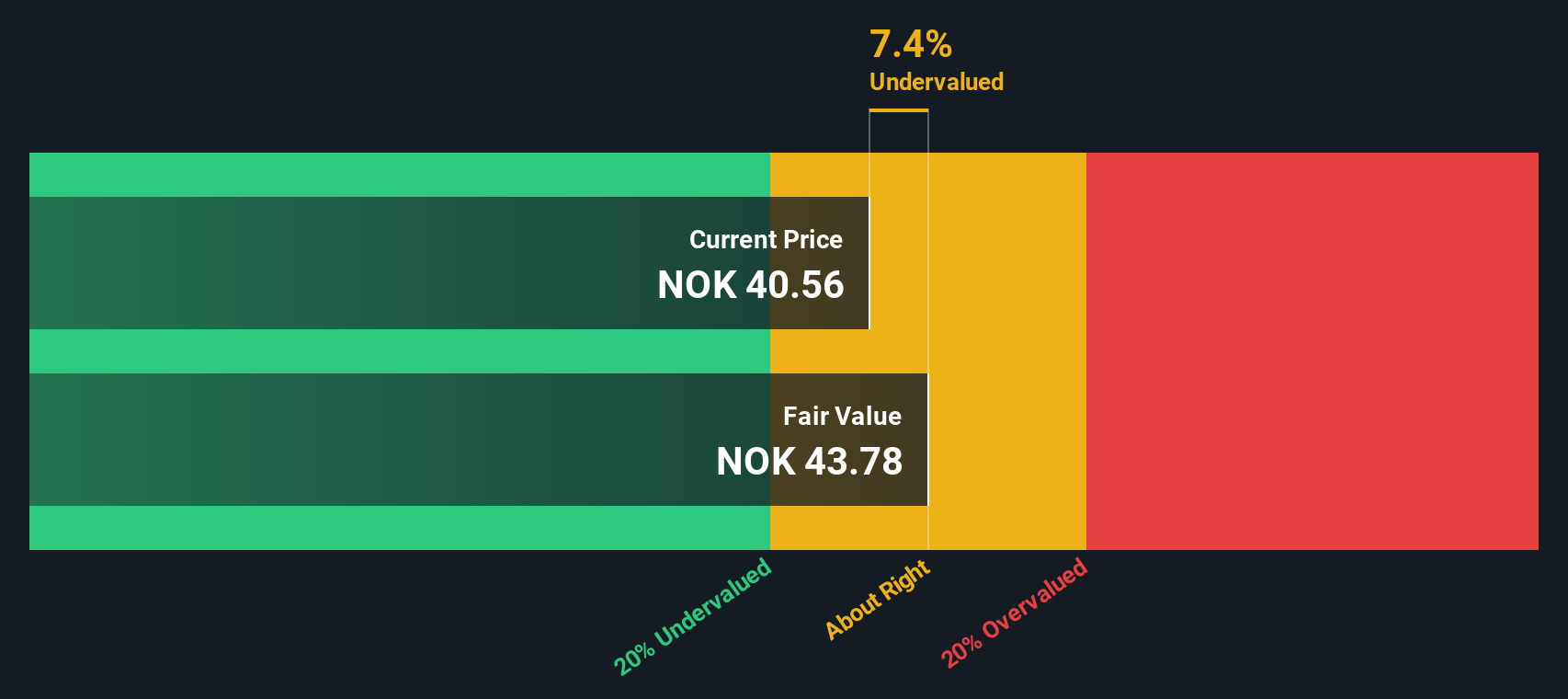

Borr Drilling (OB:BORR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Borr Drilling is an offshore drilling contractor specializing in the operation of jack-up rigs, with a market capitalization of approximately $1.13 billion.

Operations: The company generates revenue primarily through dayrate contracts, with a gross profit margin reaching 55.56% as of September 2024. Operating expenses include significant costs in general and administrative areas, alongside depreciation and amortization expenses. The net income margin has shown improvement over time, turning positive in recent periods with a net income of $84.2 million by September 2024.

PE: 11.0x

Borr Drilling, a company with external borrowing as its primary funding source, recently secured a $58 million contract for its Norve rig in West Africa. Despite the temporary suspension of Arabia II operations in Saudi Arabia, Borr's Q3 2024 revenue rose to US$241.6 million from US$191.5 million the previous year. With earnings forecasted to grow by 45% annually and insider confidence shown through share purchases earlier this year, Borr remains an intriguing prospect within its industry context.

- Click to explore a detailed breakdown of our findings in Borr Drilling's valuation report.

Gain insights into Borr Drilling's past trends and performance with our Past report.

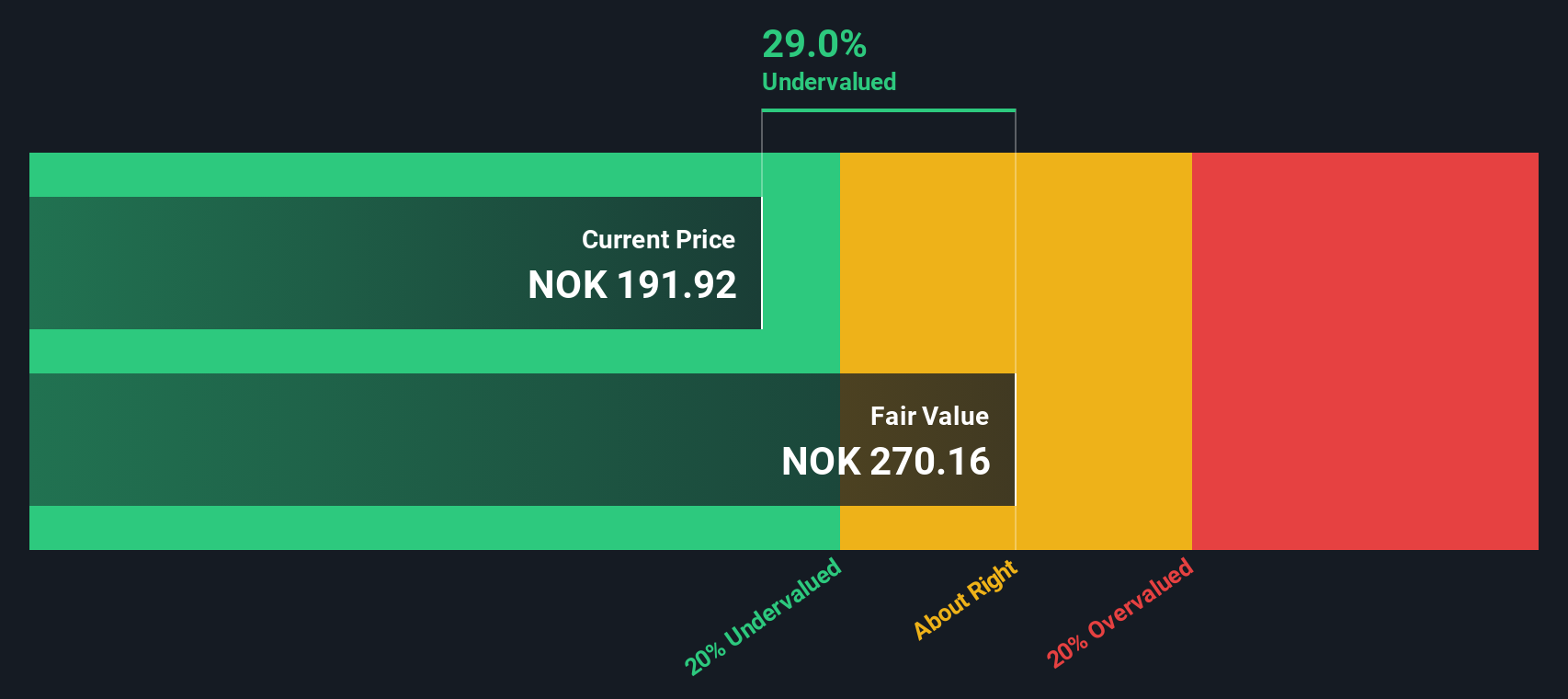

SpareBank 1 Østlandet (OB:SPOL)

Simply Wall St Value Rating: ★★★★★☆

Overview: SpareBank 1 Østlandet is a Norwegian financial institution offering a range of banking services through its retail and corporate divisions, with a market capitalization of NOK 10.50 billion.

Operations: SpareBank 1 Østlandet derives significant revenue from its Retail and Corporate Divisions, contributing NOK 2.49 billion and NOK 2.06 billion, respectively. The company has consistently achieved a gross profit margin of 100% over the periods analyzed. Operating expenses primarily consist of general and administrative costs, which reached NOK 1.33 billion in the latest period reported. Net income margin exhibited variability, peaking at approximately 39.37% in recent quarters.

PE: 7.1x

SpareBank 1 Østlandet, a smaller player in the financial sector, has caught attention with its impressive earnings growth. For Q3 2024, net income jumped to NOK 1,080 million from NOK 417 million the previous year. Over nine months ending September 30, it reached NOK 2,655 million compared to NOK 1,649 million last year. Insider confidence is evident as Klara-Lise Aasen purchased shares worth over NOK 531K in recent months. Despite a low bad loan allowance of 36%, revenue is expected to grow annually by about 2.51%.

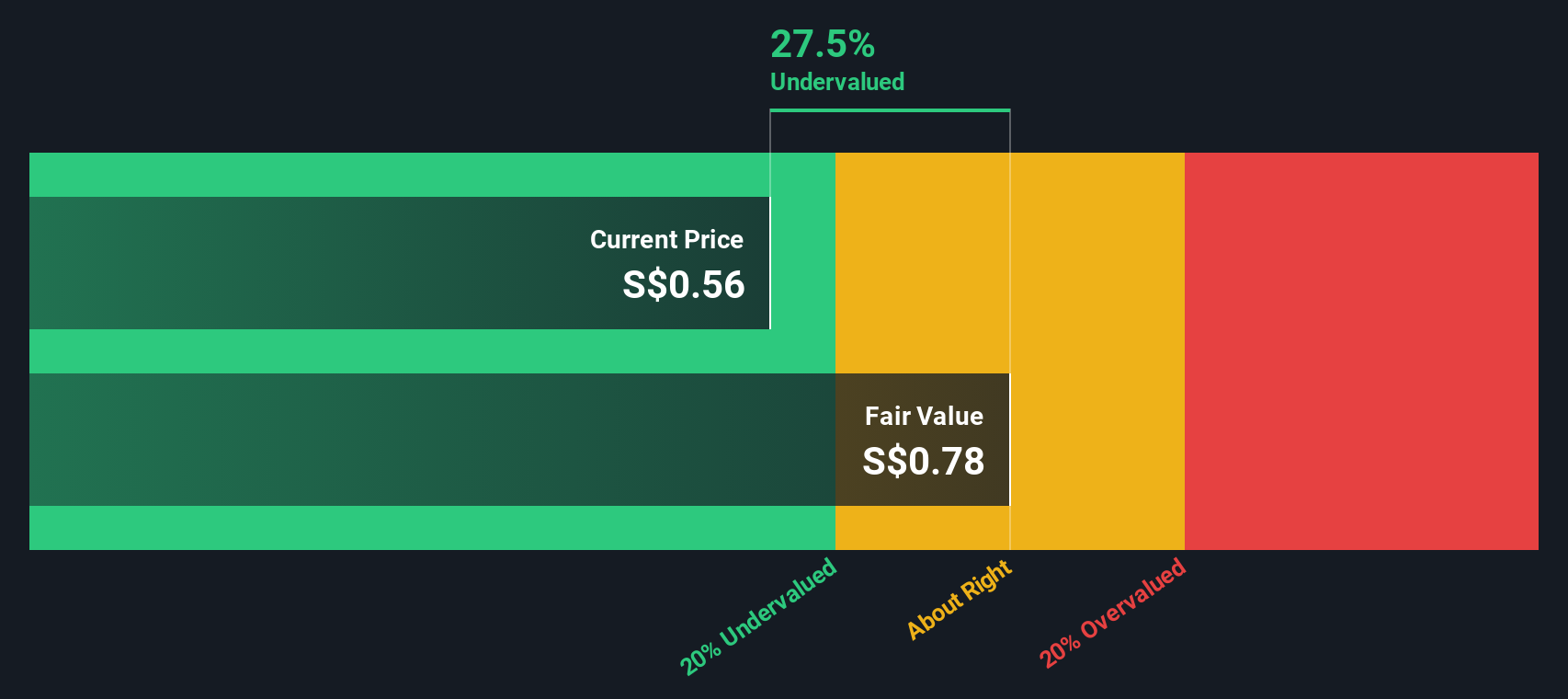

Daiwa House Logistics Trust (SGX:DHLU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiwa House Logistics Trust operates as a real estate investment trust focusing on commercial properties, with a market capitalization of S$0.62 billion.

Operations: Daiwa House Logistics Trust generates revenue primarily from its commercial REIT segment, with the latest reported figure at SGD 56.53 million. The cost of goods sold (COGS) for the same period was SGD 13.11 million, resulting in a gross profit margin of 76.81%. Operating expenses were recorded at SGD 5.65 million, while non-operating expenses showed a credit of SGD 3.73 million, contributing to a net income margin of 73.43%.

PE: 9.9x

Daiwa House Logistics Trust, a smaller player in the logistics sector, has recently seen insider confidence with share purchases from July to September 2024. While revenue is projected to grow at 3.79% annually, earnings are expected to decline by an average of 10.5% per year over the next three years due to high-risk external borrowing and one-off items impacting results. Investors should weigh these factors when considering its potential for growth within its industry context.

Next Steps

- Dive into all 184 of the Undervalued Small Caps With Insider Buying we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:DHLU

Daiwa House Logistics Trust

Daiwa House Logistics Trust (“DHLT”) is a Singapore real estate investment trust (“REIT”) established with the investment strategy of principally investing in a portfolio of income-producing logistics and industrial real estate assets located across Asia.

Good value average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)