- Norway

- /

- Renewable Energy

- /

- OB:CLOUD

European Stocks Trading At An Estimated 22.5% To 47.9% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the backdrop of political turmoil in France and trade tensions impacting European markets, investors have witnessed a pullback with major indices like Germany’s DAX and France’s CAC 40 experiencing declines. Despite these challenges, opportunities may arise as certain European stocks are trading significantly below their intrinsic value, presenting potential for those seeking to identify undervalued investments.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.18 | €2.32 | 49.2% |

| Profoto Holding (OM:PRFO) | SEK17.85 | SEK35.19 | 49.3% |

| Mo-BRUK (WSE:MBR) | PLN301.00 | PLN583.85 | 48.4% |

| Micro Systemation (OM:MSAB B) | SEK63.00 | SEK122.92 | 48.7% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.29 | 49.5% |

| High Quality Food (BIT:HQF) | €0.604 | €1.21 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.368 | €0.72 | 48.6% |

| Atea (OB:ATEA) | NOK143.80 | NOK282.84 | 49.2% |

| Allegro.eu (WSE:ALE) | PLN33.20 | PLN66.10 | 49.8% |

| Aker BioMarine (OB:AKBM) | NOK87.40 | NOK170.77 | 48.8% |

Let's explore several standout options from the results in the screener.

Amper (BME:AMP)

Overview: Amper, S.A. offers technological, industrial, and engineering solutions across defense, security, energy, sustainability, and telecommunications sectors both in Spain and internationally with a market cap of €299.08 million.

Operations: Revenue segments for Amper include €300.94 million from Energy and Sustainability and €87.66 million from Defense, Security, and Telecommunications.

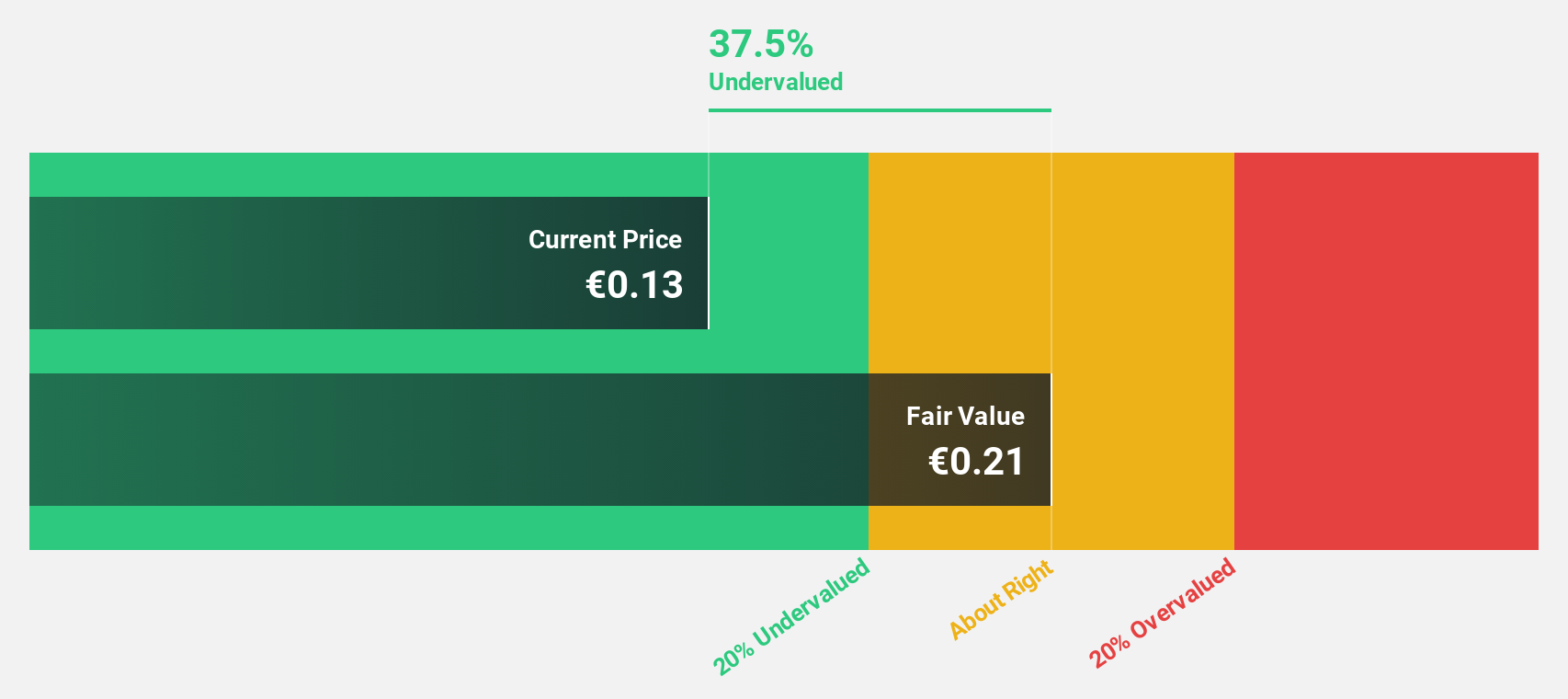

Estimated Discount To Fair Value: 37.8%

Amper, S.A. is trading at €0.13, significantly below its estimated fair value of €0.21, indicating it may be undervalued based on cash flows. Despite recent shareholder dilution and volatile share price, Amper's earnings are expected to grow significantly at 30.8% annually over the next three years—outpacing the Spanish market's 5.1%. Recent earnings reports show a return to profitability with net income of €3.04 million for H1 2025 from a previous loss, though sales declined year-over-year.

- Upon reviewing our latest growth report, Amper's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Amper stock in this financial health report.

Cloudberry Clean Energy (OB:CLOUD)

Overview: Cloudberry Clean Energy ASA is a renewable energy company operating in Norway, Denmark, Switzerland, and Sweden, with a market cap of NOK4.33 billion.

Operations: The company's revenue segments are comprised of Projects generating NOK136 million, Commercial contributing NOK455 million, and Asset Management bringing in NOK66 million.

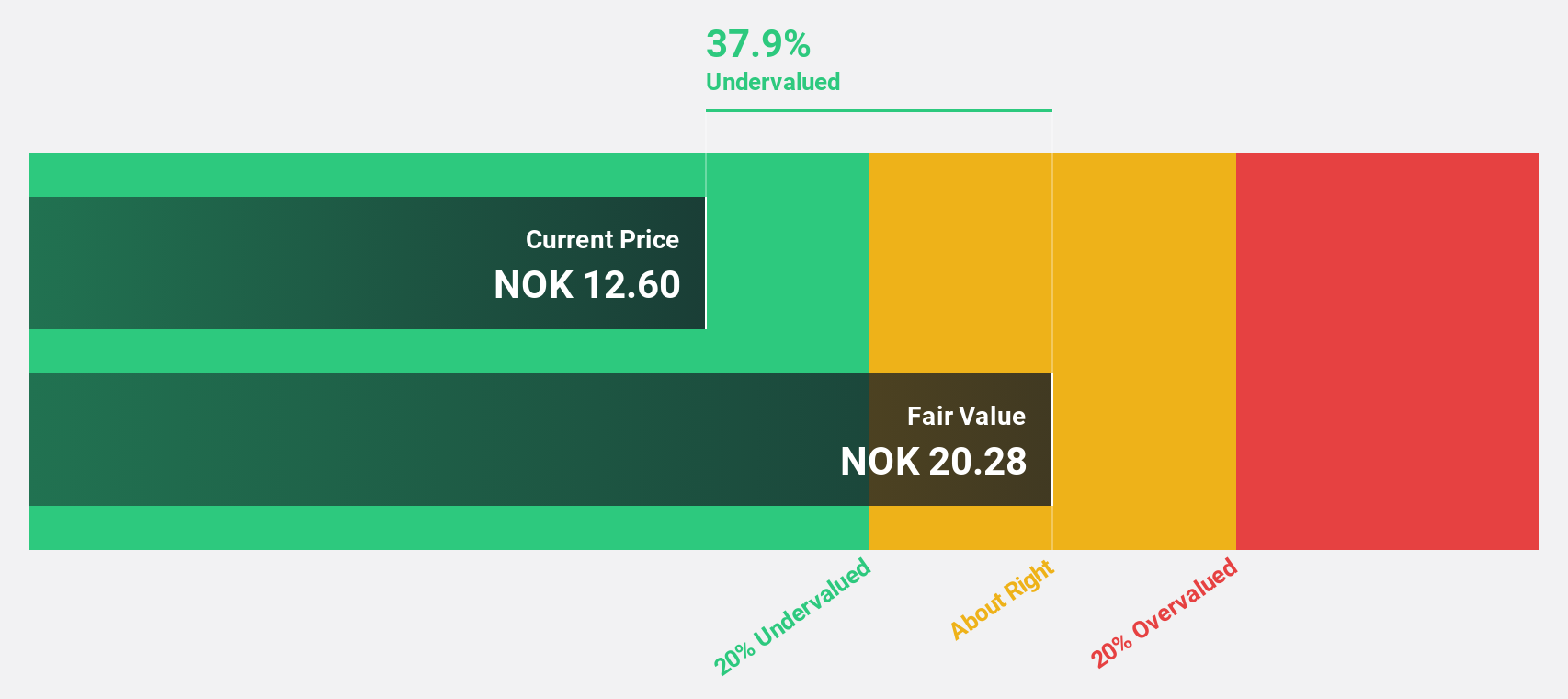

Estimated Discount To Fair Value: 22.5%

Cloudberry Clean Energy is trading at NOK 13.6, below its estimated fair value of NOK 17.55, reflecting undervaluation based on cash flows. Despite recent losses—NOK 34 million for H1 2025—its revenue is forecast to grow at 16.9% annually, outpacing the Norwegian market's growth rate of 2.6%. The company is expected to achieve profitability within three years, with earnings projected to grow significantly at an above-market rate during this period.

- In light of our recent growth report, it seems possible that Cloudberry Clean Energy's financial performance will exceed current levels.

- Dive into the specifics of Cloudberry Clean Energy here with our thorough financial health report.

Norconsult (OB:NORCO)

Overview: Norconsult ASA offers consultancy services in community planning, engineering design, and architecture across the Nordics and internationally, with a market cap of NOK14.78 billion.

Operations: The company's revenue segments include Sweden (NOK 1.99 billion), Denmark (NOK 897 million), Norway Regions (NOK 2.95 billion), Renewable Energy (NOK 948 million), Norway Head Office (NOK 3.14 billion), and Digital and Techno-Garden (NOK 1.13 billion).

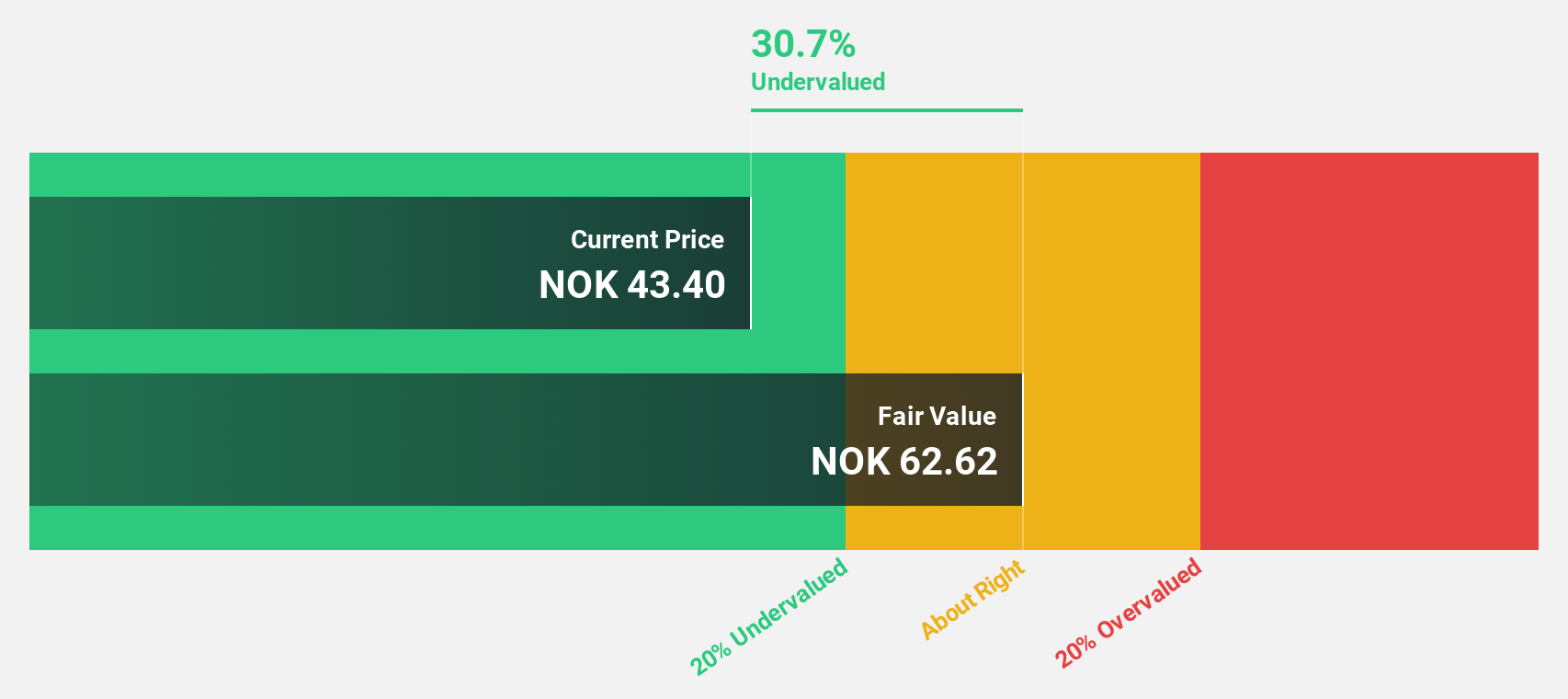

Estimated Discount To Fair Value: 47.9%

Norconsult is trading at NOK 47.65, significantly below its estimated fair value of NOK 91.38, highlighting its undervaluation based on cash flows. Recent earnings reports show a mixed performance with net income declining in Q2 but improving over the first half of 2025 compared to the previous year. Earnings are forecast to grow annually by 14.8%, surpassing Norwegian market expectations, while revenue growth is modest yet above the market average.

- Our growth report here indicates Norconsult may be poised for an improving outlook.

- Navigate through the intricacies of Norconsult with our comprehensive financial health report here.

Key Takeaways

- Discover the full array of 209 Undervalued European Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CLOUD

Cloudberry Clean Energy

Operates as a renewable energy company in Norway, Denmark, Switzerland, and Sweden.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)