- Spain

- /

- Specialty Stores

- /

- BME:ITX

Top European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets experience a modest uptick, with the pan-European STOXX Europe 600 Index gaining 1.03% amid expectations of U.S. interest rate cuts, investors are closely watching for opportunities to enhance their portfolios in this evolving economic landscape. In such an environment, dividend stocks can offer a reliable income stream and potential stability, making them an attractive option for those looking to bolster their investment strategies amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.82% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.43% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.50% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.90% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.30% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.45% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.44% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★☆ |

Click here to see the full list of 220 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Intesa Sanpaolo (BIT:ISP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intesa Sanpaolo S.p.A. is a financial institution offering a range of products and services mainly in Italy, with a market cap of €98.96 billion.

Operations: Intesa Sanpaolo S.p.A. generates revenue through several segments including Domestic Commercial Banking (€10.77 billion), IMI Corporate & Investment Banking (€4.36 billion), Private Banking (€3.34 billion), International Banks (€3.10 billion), Insurance (€1.75 billion), Asset Management (€990 million), and Management Center (€1.67 billion).

Dividend Yield: 6.1%

Intesa Sanpaolo's dividend appeal is bolstered by a high yield of 6.09%, placing it among the top 25% in the Italian market. Despite a volatile dividend history, recent earnings growth and a low payout ratio of 33.4% suggest dividends are well-covered and sustainable, with future coverage projected at 72.3%. The company announced €3.2 billion in interim dividends for 2025, reflecting confidence in its financial health despite challenges like high bad loans at 2.1%.

- Click here and access our complete dividend analysis report to understand the dynamics of Intesa Sanpaolo.

- Our valuation report here indicates Intesa Sanpaolo may be overvalued.

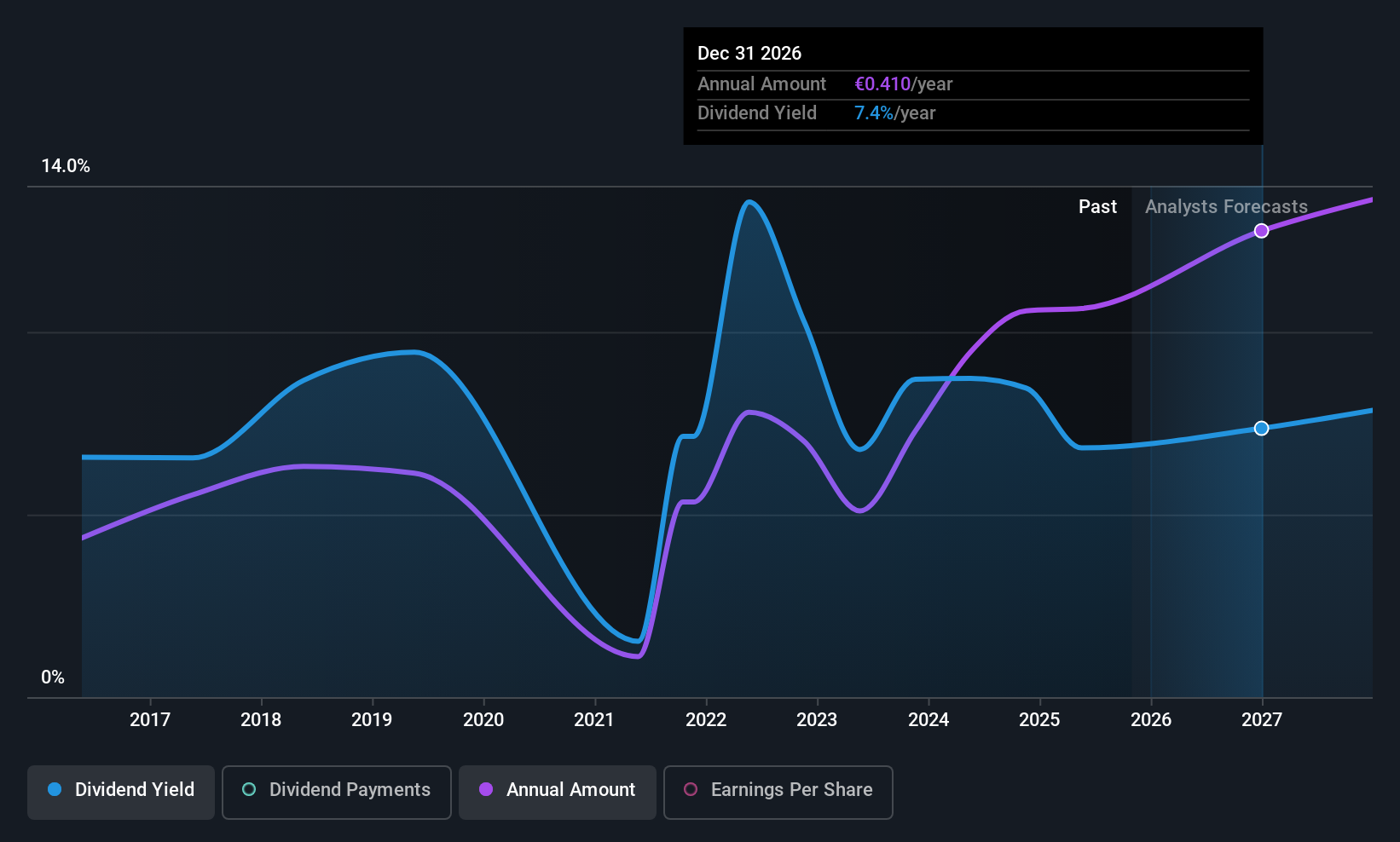

Industria de Diseño Textil (BME:ITX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Industria de Diseño Textil, S.A., known for its global retail and online distribution of clothing, footwear, accessories, and household products across various regions including Spain, Europe, the Americas, and Asia, has a market capitalization of approximately €144.52 billion.

Operations: Industria de Diseño Textil, S.A.'s revenue segments include Zara/Zara Home/Lefties generating €28.08 billion and Bershka contributing €2.99 billion.

Dividend Yield: 3.6%

Industria de Diseño Textil's dividend profile shows a mixed picture. Recent earnings results indicate stable growth, with net income slightly rising to €2.79 billion for the half year ended July 31, 2025. Dividends are covered by earnings (59.8% payout ratio) and cash flows (88.4% cash payout ratio), but the dividend yield of 3.62% is below top-tier levels in Spain, and the company's dividends have been volatile over the past decade, indicating some reliability concerns despite a history of increases.

- Unlock comprehensive insights into our analysis of Industria de Diseño Textil stock in this dividend report.

- The valuation report we've compiled suggests that Industria de Diseño Textil's current price could be inflated.

Sparebanken Norge (OB:SBNOR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Vest is a financial services company offering banking and financing services in Vestland and Rogaland, Norway, with a market cap of NOK18.90 billion.

Operations: Sparebanken Vest generates its revenue primarily through its Banking Operations in the Retail Market (NOK3.44 billion), Corporate Market (NOK2.44 billion), Bulder Bank (NOK395 million), and its Estate Agency Business (NOK392 million).

Dividend Yield: 4.9%

Sparebanken Norge's dividend history reveals volatility over the past decade, though recent earnings growth suggests potential stability. The bank's dividends are currently covered by earnings with a payout ratio of 48.3%, expected to rise to 69.2% in three years, indicating sustainability. However, its dividend yield at 4.93% lags behind top-tier Norwegian payers. Recent debt issuances of NOK 8.5 billion and SEK 500 million highlight ongoing financial management efforts amidst fluctuating funding risks.

- Delve into the full analysis dividend report here for a deeper understanding of Sparebanken Norge.

- The analysis detailed in our Sparebanken Norge valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 217 more companies for you to explore.Click here to unveil our expertly curated list of 220 Top European Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ITX

Industria de Diseño Textil

Engages in the retail and online distribution of clothing, footwear, accessories, and household products in Spain, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)