- Switzerland

- /

- Marine and Shipping

- /

- SWX:KNIN

European Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of U.S.-China trade tensions, major indices like the STOXX Europe 600 and Germany’s DAX have seen notable gains. In this environment, dividend stocks can offer investors a potential source of steady income and stability, making them an attractive consideration for those looking to diversify their portfolios amidst evolving economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.37% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.52% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.80% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.29% | ★★★★★★ |

| ERG (BIT:ERG) | 5.52% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 234 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sparebanken Norge (OB:SBNOR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Vest is a financial services company offering banking and financing services in the counties of Vestland and Rogaland, Norway, with a market cap of NOK16.68 billion.

Operations: Sparebanken Vest generates revenue through several segments: Estate Agency Business (NOK316 million), Banking Operations - Treasury (NOK1.52 billion), Banking Operations - Bulder Bank (NOK371 million), Banking Operations - Retail Market (NOK3.22 billion), and Banking Operations - Corporate Market (NOK2.33 billion).

Dividend Yield: 5.6%

Sparebanken Norge's dividend payments are currently well-covered by earnings, with a payout ratio of 49.9%, and are forecasted to remain sustainable over the next three years at 70.3%. However, its dividend yield of 5.59% is lower than the top quartile in Norway, and its historical dividend track record has been volatile. Despite this, recent earnings growth and a fair valuation position it as an attractive consideration for investors seeking potential value in European dividend stocks.

- Delve into the full analysis dividend report here for a deeper understanding of Sparebanken Norge.

- Our valuation report unveils the possibility Sparebanken Norge's shares may be trading at a discount.

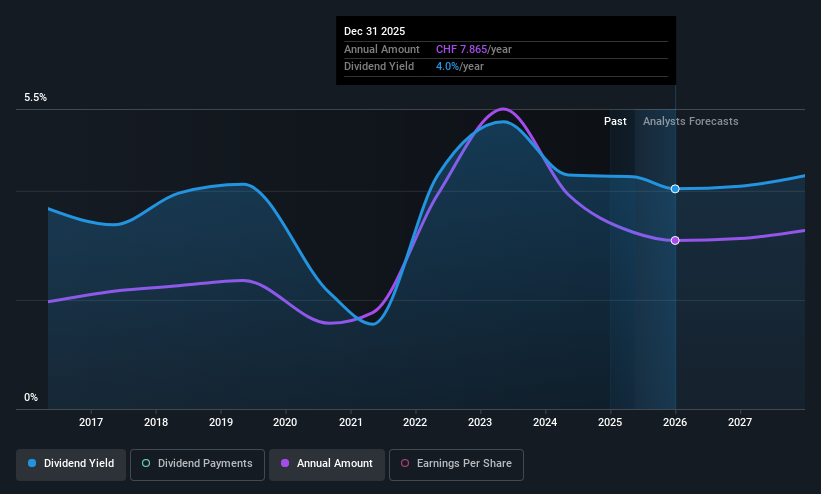

Kuehne + Nagel International (SWX:KNIN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuehne + Nagel International AG, along with its subsidiaries, offers integrated logistics services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region and has a market capitalization of CHF23.09 billion.

Operations: Kuehne + Nagel International AG generates revenue through its Air Logistics segment at CHF13.62 billion, Sea Logistics at CHF11.84 billion, Road Logistics at CHF4.89 billion, and Contract Logistics also at CHF4.90 billion.

Dividend Yield: 4.2%

Kuehne + Nagel International offers a dividend yield of 4.24%, placing it among the top 25% in the Swiss market. Dividends are covered by earnings and cash flows, with payout ratios of 81.6% and 67.3%, respectively, indicating sustainability despite a volatile dividend history over the past decade. Recent earnings growth, with Q1 sales at CHF 6.33 billion and net income at CHF 291 million, supports its position as a viable option for dividend-focused investors in Europe.

- Click here to discover the nuances of Kuehne + Nagel International with our detailed analytical dividend report.

- The analysis detailed in our Kuehne + Nagel International valuation report hints at an deflated share price compared to its estimated value.

Amadeus FiRe (XTRA:AAD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Amadeus FiRe AG offers personnel and training services in Germany with a market cap of €434.57 million.

Operations: Amadeus FiRe AG generates revenue from its services in Germany, with €165.74 million from training and €254.84 million from personal services.

Dividend Yield: 5%

Amadeus FiRe AG's dividend yield of 5.04% ranks it in the top 25% of German dividend payers, though its history is marked by volatility and recent decreases. The company's dividends are covered by earnings and cash flows, with payout ratios of 88.5% and 61.1%, respectively, suggesting sustainability despite a decline in net income to €32.85 million for 2024 from €41.25 million the previous year, alongside lower sales figures at €436.91 million.

- Unlock comprehensive insights into our analysis of Amadeus FiRe stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Amadeus FiRe is priced lower than what may be justified by its financials.

Make It Happen

- Explore the 234 names from our Top European Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuehne + Nagel International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KNIN

Kuehne + Nagel International

Provides integrated logistics services in Europe, the Middle East, Africa, the Americas, the Asia-Pacific.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives