As European markets grapple with renewed tariff threats from the Trump administration, major stock indexes have experienced declines, reflecting broader economic uncertainties. Despite these challenges, penny stocks—often smaller or newer companies—remain an intriguing investment area due to their potential for growth and value creation. By focusing on those with solid financial foundations and promising growth trajectories, investors can uncover opportunities in this niche market segment.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.315 | SEK2.22B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.00 | SEK196.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.88 | PLN131.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.60 | PLN12.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.87 | €60.53M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.956 | €32.01M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.69 | €17.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.185 | €301.67M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CSP International Fashion Group (BIT:CSP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CSP International Fashion Group S.p.A. is engaged in the production and sale of hosiery and underwear across Italy, France, the European Union, and international markets with a market cap of €12.97 million.

Operations: The company's revenue is primarily derived from its operations in France (€55.78 million) and Italy (€38.92 million).

Market Cap: €12.97M

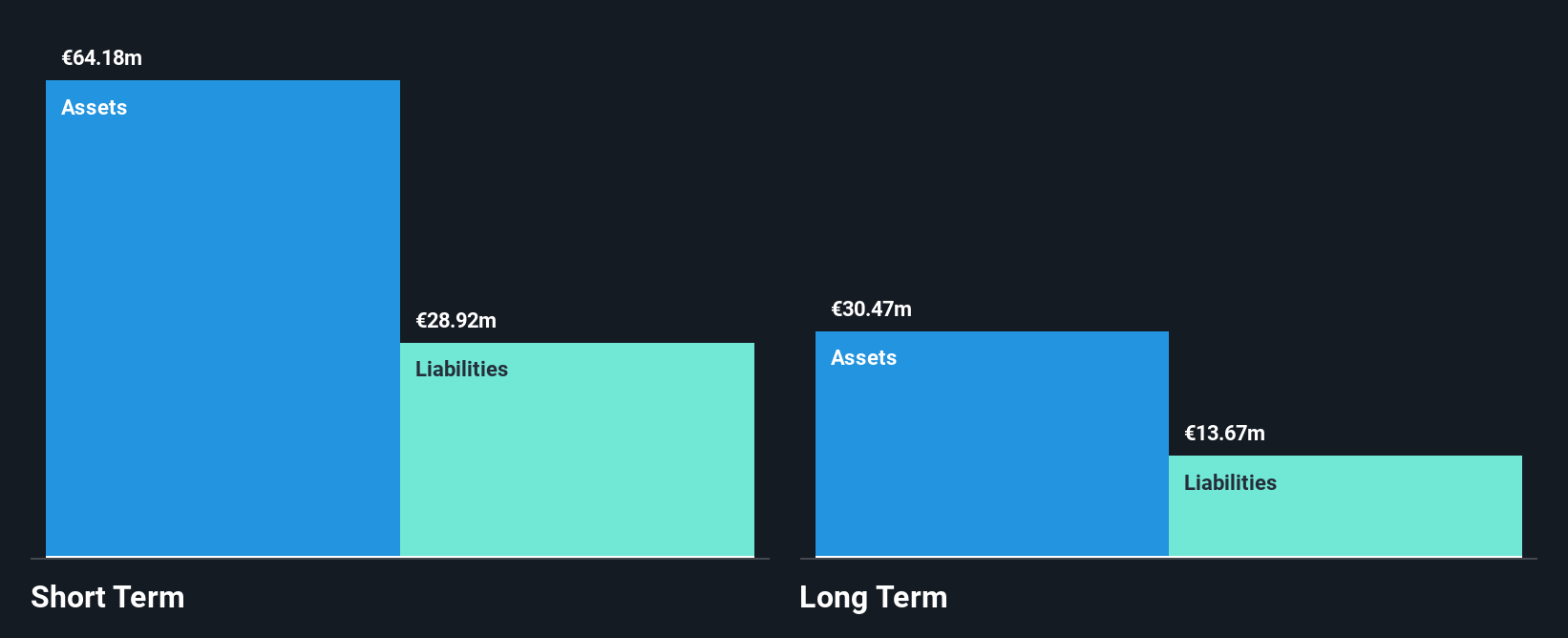

CSP International Fashion Group, with a market cap of €12.97 million, is navigating challenging financial waters as it remains unprofitable. Despite this, the company has managed to reduce its losses by 55.6% annually over the past five years and maintains a robust cash runway exceeding three years due to positive free cash flow. CSP's short-term assets (€64.2M) comfortably cover both its short-term (€28.9M) and long-term liabilities (€13.7M), indicating strong balance sheet management despite a recent net loss of €0.365 million for 2024 compared to a net income in the previous year.

- Click here and access our complete financial health analysis report to understand the dynamics of CSP International Fashion Group.

- Gain insights into CSP International Fashion Group's past trends and performance with our report on the company's historical track record.

Raisio (HLSE:RAIVV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Raisio plc, with a market cap of €396.55 million, is engaged in the production and sale of food and food ingredients across Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Operations: The company's revenue is derived from Healthy Food (€155.8 million) and Healthy Ingredients (€110.8 million).

Market Cap: €396.55M

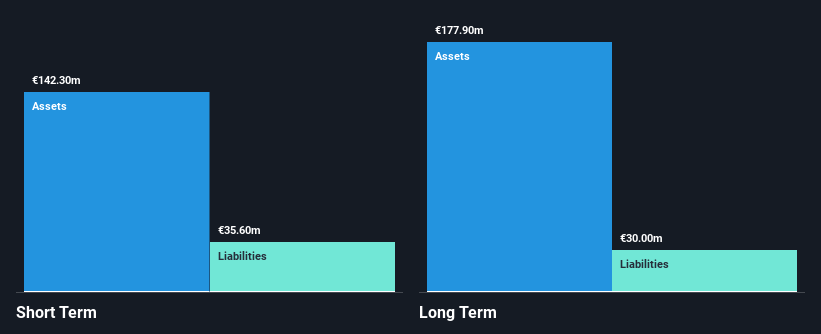

Raisio plc, with a market cap of €396.55 million, is showing mixed signals as a penny stock investment. The company reported improved earnings for Q1 2025, with sales rising to €57.8 million and net income increasing to €5.1 million compared to the previous year. Despite this growth, Raisio's dividend yield of 5.58% is not well covered by earnings, indicating potential sustainability concerns. Positively, the company's debt is well-managed with operating cash flow significantly exceeding debt levels and short-term assets covering both short- and long-term liabilities comfortably, highlighting financial stability amidst its strategic growth plans through 2027.

- Get an in-depth perspective on Raisio's performance by reading our balance sheet health report here.

- Gain insights into Raisio's future direction by reviewing our growth report.

Instabank (OB:INSTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Instabank ASA offers a range of banking products and services in Norway, with a market cap of NOK934.31 million.

Operations: Instabank ASA has not reported any specific revenue segments.

Market Cap: NOK934.31M

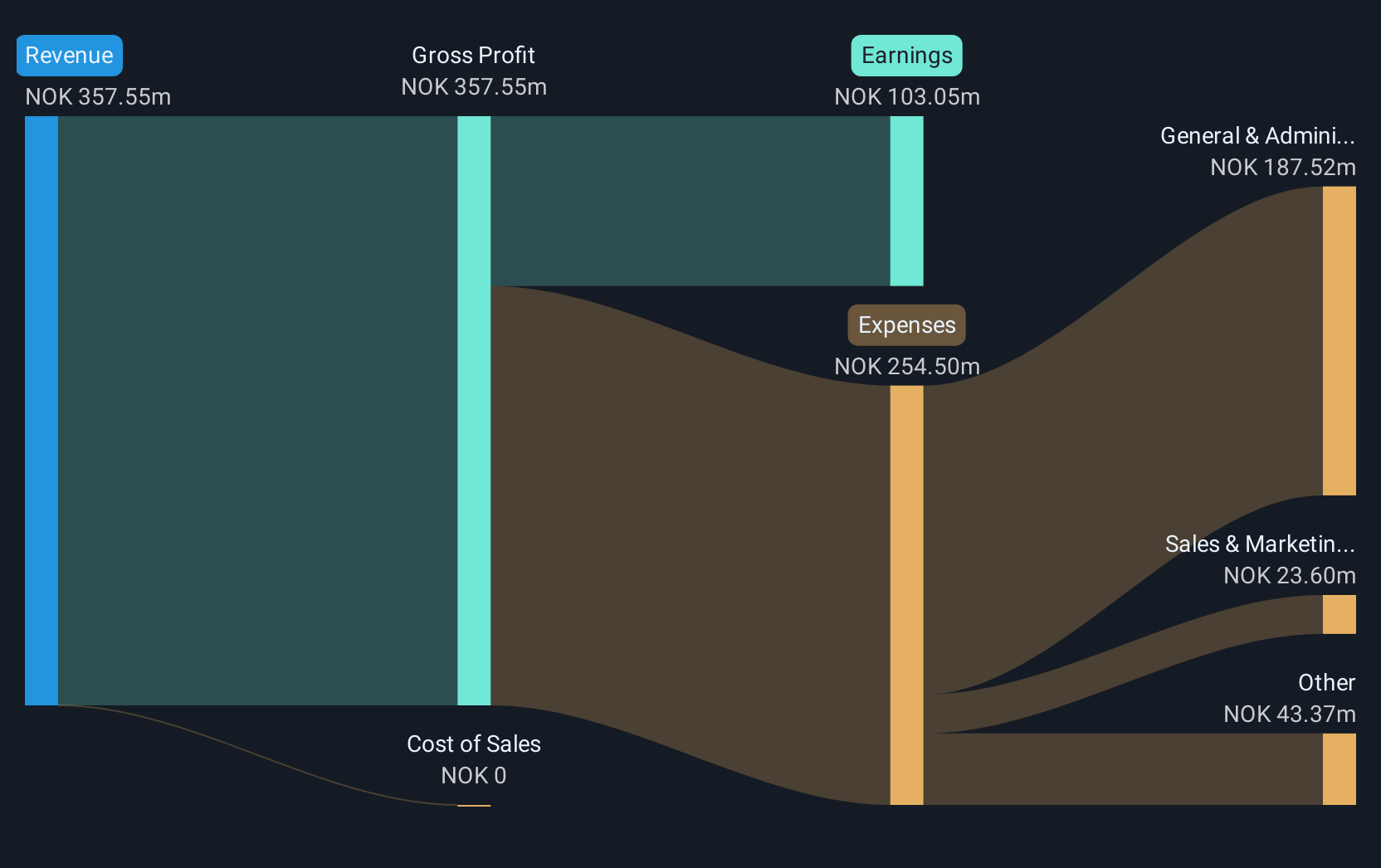

Instabank ASA, with a market cap of NOK 934.31 million, presents both opportunities and challenges as an investment. The bank's earnings have shown consistent growth, increasing by 8% over the past year and exceeding industry averages. However, its return on equity remains low at 9.7%. Instabank maintains a stable financial position with primarily low-risk funding sources and an appropriate loans-to-assets ratio of 85%. Recent strategic moves include a partnership with smartmiete.de to expand in Germany and the completion of an NOK 80 million fixed-income offering to bolster its financial flexibility for future growth initiatives.

- Dive into the specifics of Instabank here with our thorough balance sheet health report.

- Evaluate Instabank's prospects by accessing our earnings growth report.

Make It Happen

- Get an in-depth perspective on all 445 European Penny Stocks by using our screener here.

- Interested In Other Possibilities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CSP

CSP International Fashion Group

Produces and sells hosiery and underwear in Italy, France, European Union, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives