- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

Euronext Amsterdam Dividend Stocks To Consider In July 2024

Reviewed by Simply Wall St

As global markets navigate through rising trade tensions and shifting economic indicators, the Euronext Amsterdam presents a unique landscape for dividend stock considerations. In this environment, understanding the resilience and potential of dividend-yielding stocks becomes particularly pertinent for investors looking to stabilize their portfolios in July 2024.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.53% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.10% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.47% | ★★★★☆☆ |

| Van Lanschot Kempen (ENXTAM:VLK) | 9.88% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.03% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 3.98% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.65% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of €13.82 billion.

Operations: ABN AMRO Bank N.V. generates revenue primarily through its Corporate Banking (€3.50 billion), Personal & Business Banking (€4.07 billion), and Wealth Management (€1.59 billion) segments.

Dividend Yield: 9.1%

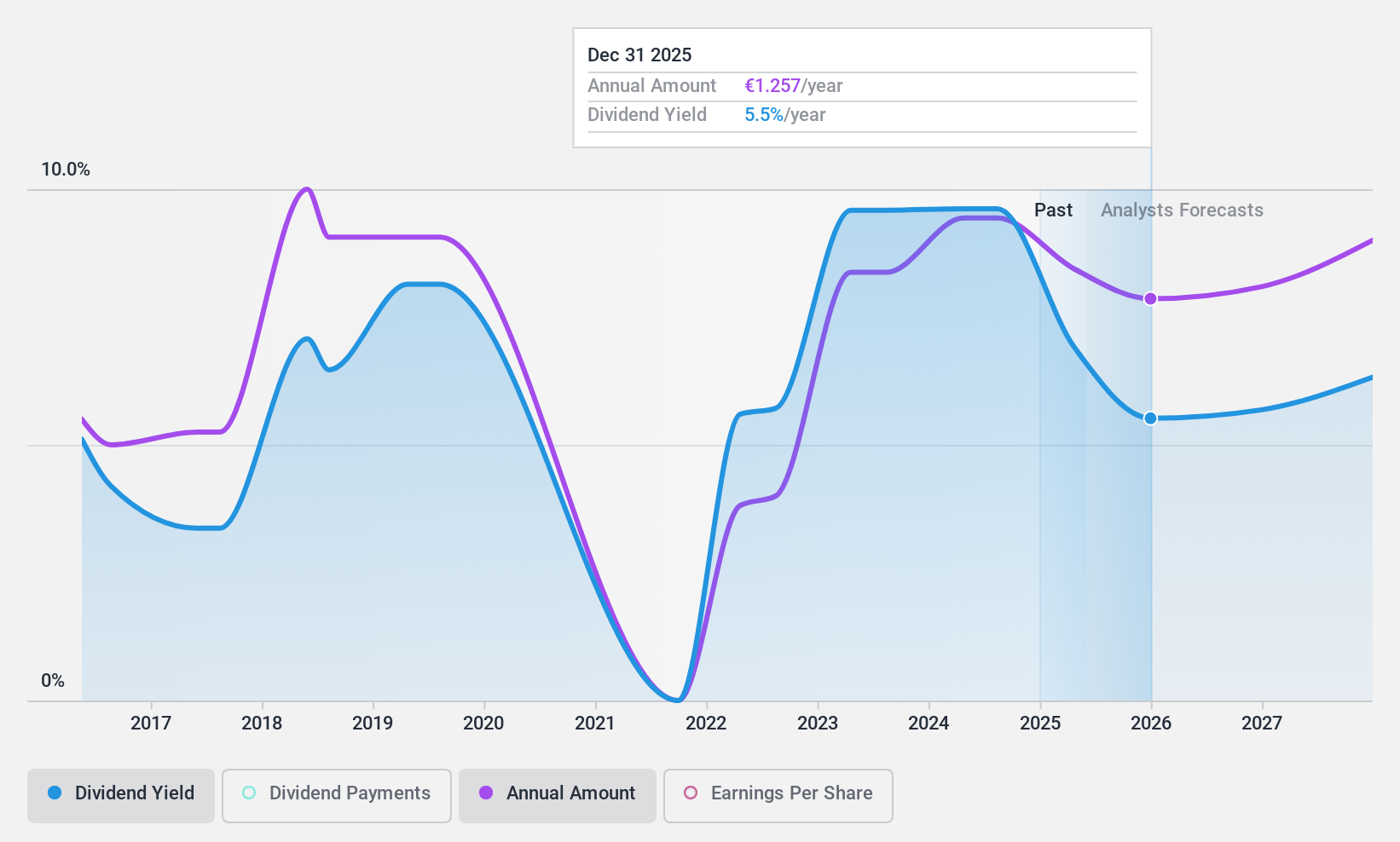

ABN AMRO Bank offers a 9.1% dividend yield, higher than the Dutch market average of 5.45%. Despite this, its dividend history is marked by instability and volatility over the past eight years. Dividends are currently covered by earnings with a payout ratio of 47.9%, forecasted to remain stable at 48.4% in three years. However, earnings are expected to decline annually by 11.3% over the next three years, raising concerns about sustained dividend payments amidst fluctuating profitability.

- Click to explore a detailed breakdown of our findings in ABN AMRO Bank's dividend report.

- Our expertly prepared valuation report ABN AMRO Bank implies its share price may be lower than expected.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands, with a market capitalization of approximately €654.55 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology segments (€1.08 billion).

Dividend Yield: 3.6%

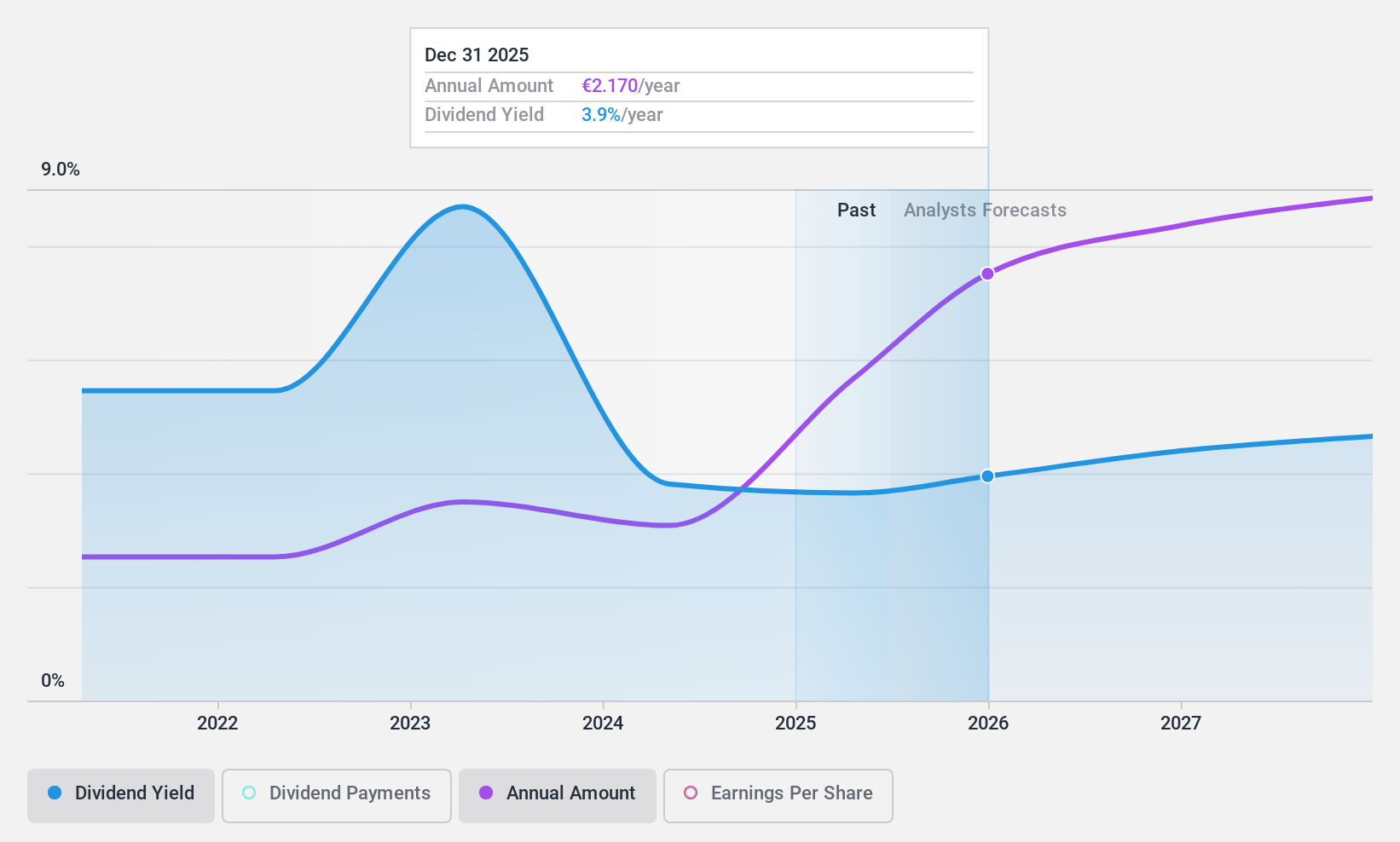

Koninklijke Heijmans exhibits a dividend yield of 3.65%, which is lower than the top quartile in the Dutch market at 5.45%. Although its dividends have shown instability over the past decade, they are supported by both earnings and cash flows, with payout ratios of 37.1% and 59% respectively. The company's share price has been highly volatile recently, adding a layer of risk for dividend reliability despite reasonable coverage metrics.

- Delve into the full analysis dividend report here for a deeper understanding of Koninklijke Heijmans.

- Insights from our recent valuation report point to the potential overvaluation of Koninklijke Heijmans shares in the market.

Koninklijke KPN (ENXTAM:KPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands with a market capitalization of approximately €14.82 billion.

Operations: Koninklijke KPN N.V. generates revenue primarily through three segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4%

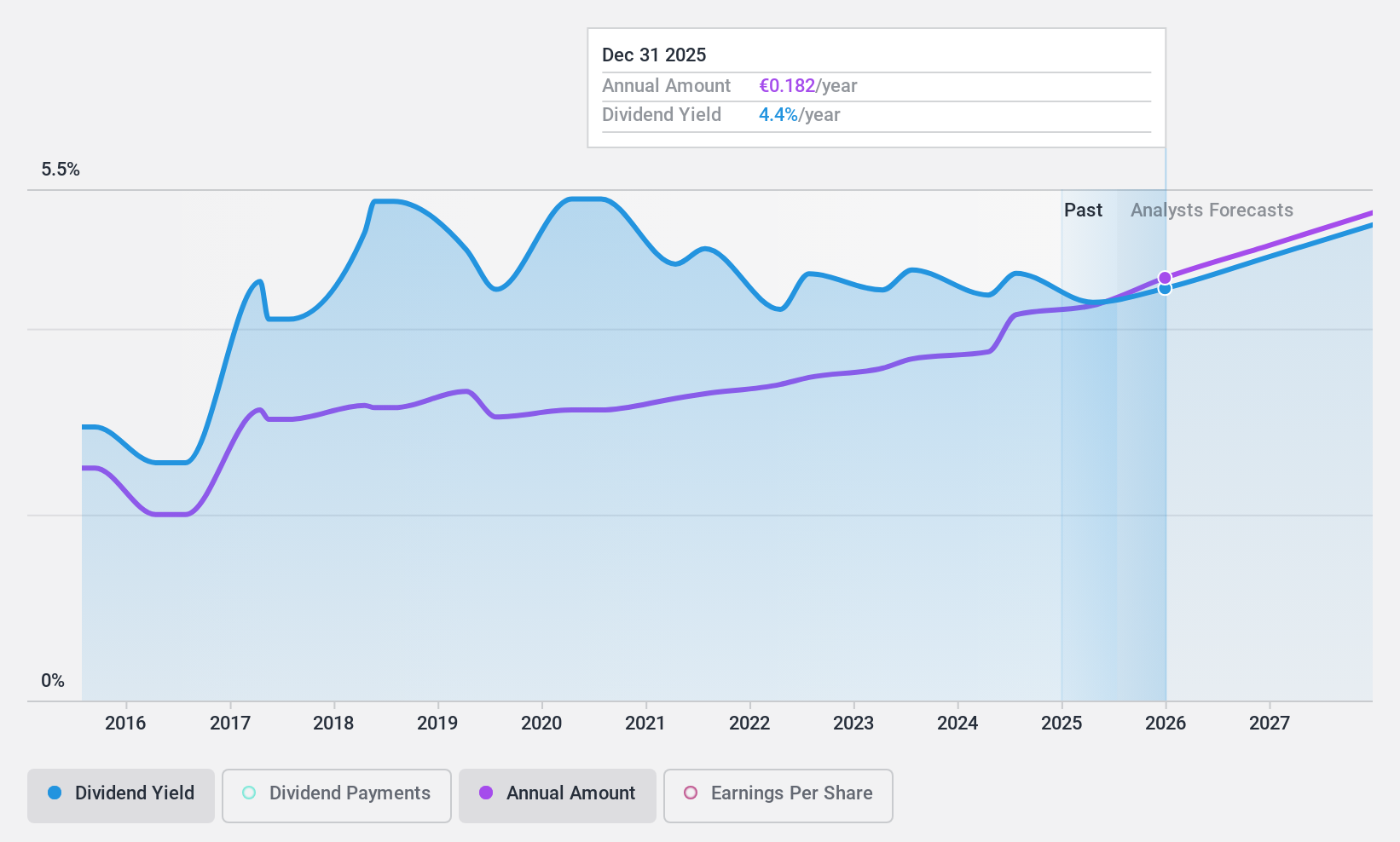

Koninklijke KPN's dividend yield stands at 3.98%, below the top quartile of Dutch dividend stocks at 5.45%. Despite a 10-year history of inconsistent dividends, recent financial strategies may bolster its position. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 78.4% and 59.6% respectively, indicating sustainability from current income rather than capital reserves. Strategic expansions into 5G and a partnership in TowerCo highlight proactive steps towards growth and operational efficiency, potentially enhancing future dividend reliability despite an overall volatile track record.

- Get an in-depth perspective on Koninklijke KPN's performance by reading our dividend report here.

- Our valuation report here indicates Koninklijke KPN may be undervalued.

Summing It All Up

- Click here to access our complete index of 7 Top Euronext Amsterdam Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ABN AMRO Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives