- Netherlands

- /

- Chemicals

- /

- ENXTAM:AKZA

How Cevian Capital’s Stake and Board Support Will Impact Akzo Nobel (ENXTAM:AKZA) Investors

Reviewed by Simply Wall St

- On August 22, 2025, Cevian Capital announced it had acquired a 3.02% stake in Akzo Nobel and publicly backed the company’s board and management to deliver on strategic priorities.

- This move by a prominent activist investor highlights an external push for enhanced operating performance and portfolio focus at Akzo Nobel.

- We'll explore how Cevian Capital's involvement and vote of confidence may impact Akzo Nobel's outlook and ongoing transformation narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Akzo Nobel Investment Narrative Recap

To be a shareholder in Akzo Nobel, you need to believe in ongoing operational improvement, portfolio focus, and exposure to sustainability-driven demand. Cevian Capital’s recent public backing spotlights external confidence in management’s current direction, but it does not materially change the most important short-term catalyst, execution on cost-cutting and divestments, nor does it eliminate the ongoing risk of persistent volume declines in mature markets, which could limit near-term momentum even with activist involvement.

One of Akzo Nobel’s most relevant recent announcements is the ongoing review of its India operations, with a prospective exit from part or all of its Indian business. This stands out as management’s attempt to concentrate resources on higher-margin core businesses, a move that aligns closely with the same portfolio focus Cevian Capital is now supporting and marks an important step in addressing the company’s efficiency and growth catalysts.

But while investor support is encouraging, the ongoing risk of volume declines in key mature markets is a factor every investor should be aware of as...

Read the full narrative on Akzo Nobel (it's free!)

Akzo Nobel's outlook is for €11.0 billion in revenue and €864.0 million in earnings by 2028. This projection is based on an annual revenue growth rate of 1.5% and an earnings increase of €449.0 million from current earnings of €415.0 million.

Uncover how Akzo Nobel's forecasts yield a €68.94 fair value, a 18% upside to its current price.

Exploring Other Perspectives

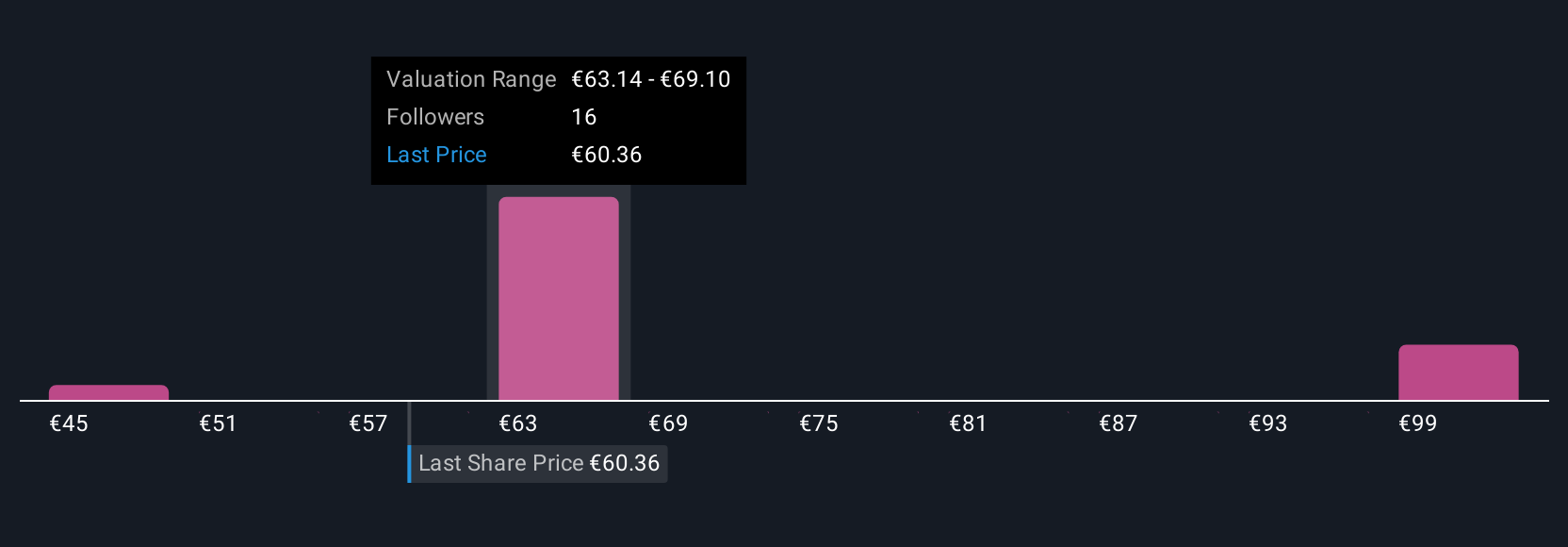

Four retail investors from the Simply Wall St Community suggest fair values for Akzo Nobel ranging from €45.23 to €105.30. With volume declines in core markets still a concern, your view on future demand could set your outlook apart from the crowd.

Explore 4 other fair value estimates on Akzo Nobel - why the stock might be worth as much as 80% more than the current price!

Build Your Own Akzo Nobel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Akzo Nobel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Akzo Nobel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Akzo Nobel's overall financial health at a glance.

No Opportunity In Akzo Nobel?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AKZA

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives