Key Takeaways

- Focus on sustainable product innovation and strategic divestments is driving higher margins, premium pricing, and a sharper concentration on core segments.

- Operational efficiency, supply chain optimization, and emerging market momentum position the company for improved resilience and revenue growth.

- Weak demand in mature markets, currency volatility, price competition, and increased regulatory costs threaten sustained revenue growth and profitability for Akzo Nobel.

Catalysts

About Akzo Nobel- Produces and sells paints and coatings worldwide.

- The company is capitalizing on accelerating demand for sustainable and eco-friendly coatings, highlighted by their leadership position in low-VOC and sustainable product innovations, which are set to drive premium pricing and increase net margins as regulatory and consumer preferences shift further toward sustainability.

- Ongoing efficiency and digitization initiatives, with completed SG&A programs, five additional site closures, and further operational cost-saving opportunities identified, are expected to structurally lower operating expenses and enhance EBITDA margins over the coming quarters.

- Strategic divestment of non-core or subscale businesses, such as the high-multiple India sale (with both cash proceeds for deleveraging and share buybacks, plus an ongoing royalty stream), will sharpen the portfolio's focus on higher-margin, core segments, likely boosting return on invested capital and EPS.

- Improving service levels through investment in supply chain and manufacturing optimization (e.g., OTIF metrics) are poised to support resilience, share gains in key markets, and potential top-line growth as conditions in currently weak regions (like North America or Turkey) stabilize.

- Akzo Nobel's exposure to infrastructure growth and urbanization in emerging markets is gaining momentum-evidenced by a strongly rebounding China Decorative Paints business and expected further recovery in LatAm-which positions revenue for upside as these long-term demand drivers play out.

Akzo Nobel Future Earnings and Revenue Growth

Assumptions

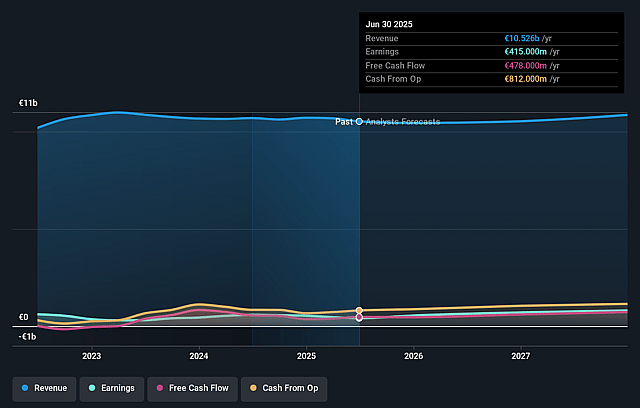

How have these above catalysts been quantified?- Analysts are assuming Akzo Nobel's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.9% today to 7.8% in 3 years time.

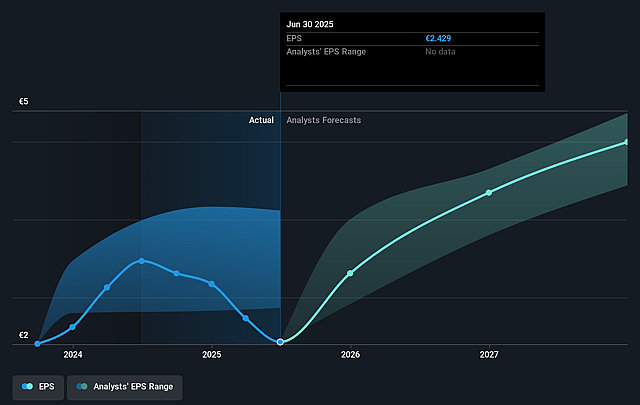

- Analysts expect earnings to reach €864.0 million (and earnings per share of €5.21) by about September 2028, up from €415.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €743.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, down from 24.3x today. This future PE is greater than the current PE for the GB Chemicals industry at 15.2x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Akzo Nobel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent volume declines in mature markets such as North America and Southern Europe, combined with ongoing market uncertainty and weak end-market demand, may constrain long-term revenue growth despite operational improvements.

- Currency volatility and prolonged foreign exchange headwinds, particularly the depreciation of the Turkish lira, Brazilian real, and related emerging market currencies, could erode revenue and profit margins as the company depends on multiple geographies for sales.

- Industry-wide price competition and difficulty extracting positive pricing in certain Coatings segments (such as Powder), amid ongoing commoditization and aggressive tactics by competitors, risk compressing net margins over time.

- The ongoing strategic shift involving portfolio disposals (e.g., India) and cost-cutting programs could limit future organic growth and reduce scale, while any failure to achieve meaningful top-line expansion in retained/core businesses may weigh on long-term earnings.

- Regulatory and geopolitical risks-including trade barriers, further regionalization, and higher compliance costs for environmental and chemical regulations-may increase ongoing SG&A and operational costs, pressuring both margins and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €68.944 for Akzo Nobel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €85.0, and the most bearish reporting a price target of just €59.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €11.0 billion, earnings will come to €864.0 million, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of €59.0, the analyst price target of €68.94 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.