- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Van Lanschot Kempen (ENXTAM:VLK): Evaluating Valuation After Strong Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Van Lanschot Kempen (ENXTAM:VLK) shares have caught the eye recently, with the stock delivering nearly 28% over the past year and close to 18% year to date. Investors may be interested in what is driving this upside and how the company’s financial progression might shape prospects going forward.

See our latest analysis for Van Lanschot Kempen.

Momentum appears to be holding up for Van Lanschot Kempen, with the stock’s recent 1-month share price return of nearly 7% reflecting renewed investor interest after a robust year. While there haven’t been headline-grabbing announcements lately, the company’s three-year total shareholder return of 274% is a clear standout. This suggests the market continues to reward its positive trajectory.

If this kind of steady progress has you curious about what else could be driving strong returns, now’s a perfect moment to discover fast growing stocks with high insider ownership

With the stock trading slightly above analyst targets and solid financial trends in place, the real question is whether Van Lanschot Kempen is still trading below its true value or if the market has already priced in its future growth.

Most Popular Narrative: 4% Overvalued

The most widely followed narrative places Van Lanschot Kempen’s fair value at €50.75, just under the last close of €52.90. This creates a narrow gap that reflects strong consensus on the current valuation. To understand what is behind this view, let’s look at what sets the company’s strategy apart according to analyst perspectives.

Expansion of specialist and alternative investment strategies (such as fiduciary management and private markets solutions) aligns with growing client demand for niche and alternative products. This diversifies and strengthens the fee pool and supports improved margin resilience.

Wondering what growth assumptions power this premium? The most popular narrative expects a transformation built on new client wins, specialist investment solutions, and an ambitious margin outlook. Want to see which bold financial forecasts are driving this target? Unlock the full picture to discover the quantitative leaps behind this strong fair value.

Result: Fair Value of €50.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or heavy reliance on the Dutch and Belgian markets could quickly challenge even the most optimistic upside for Van Lanschot Kempen.

Find out about the key risks to this Van Lanschot Kempen narrative.

Another View: The Earnings Multiple Angle

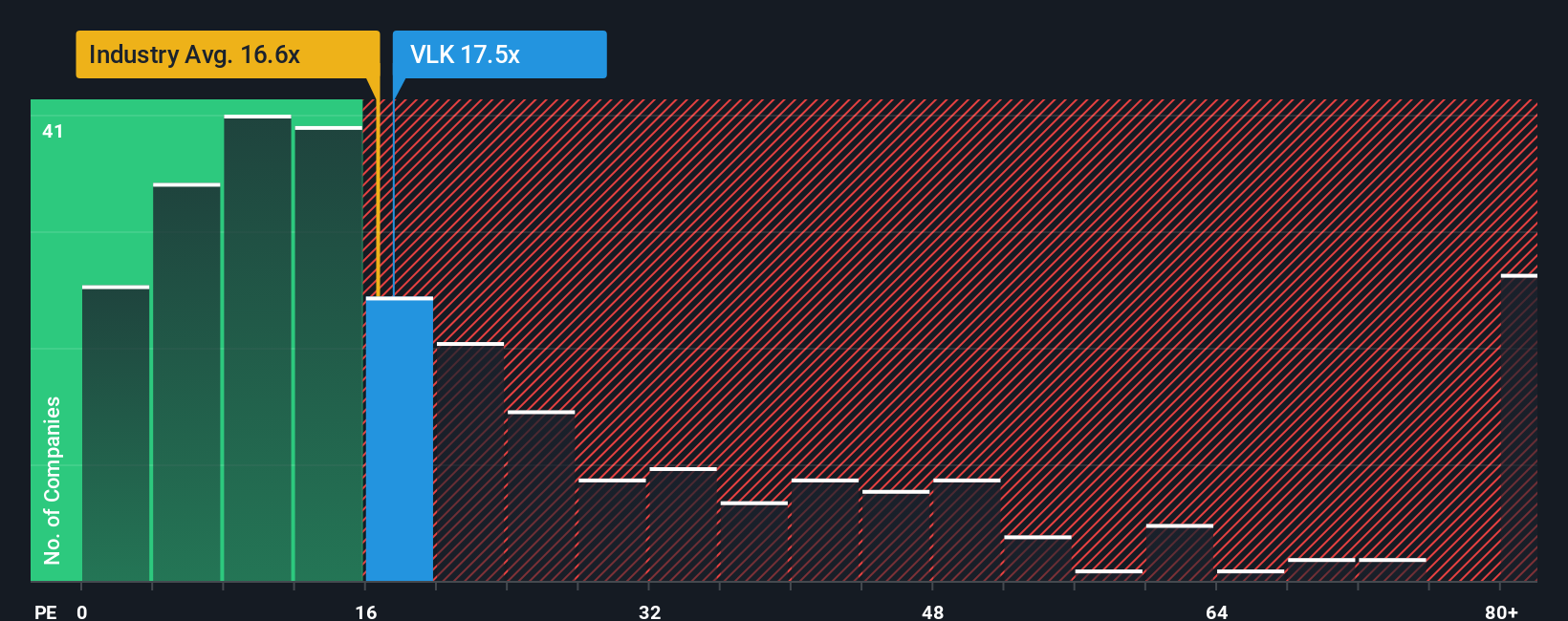

Taking a different tack, looking at Van Lanschot Kempen versus its peers and the broader industry through the price-to-earnings lens tells a more cautious story. The company trades at 17.7 times earnings, higher than both the European Capital Markets industry average of 16.8x and its estimated fair ratio of 13.3x. This premium means investors are currently paying more for each euro of profit compared to what the market typically demands, which introduces greater valuation risk if expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Van Lanschot Kempen Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build your own narrative in just a few minutes: Do it your way

A great starting point for your Van Lanschot Kempen research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You owe it to yourself to stay ahead by checking out other standout stocks making waves in promising markets. Get inspired before the next opportunity passes by.

- Unlock high-yield opportunities by checking out these 19 dividend stocks with yields > 3%, so your investments can start working harder for you today.

- Catalyze your portfolio’s future with these 26 quantum computing stocks, where tomorrow’s quantum breakthroughs could become today’s winning themes.

- Capture hidden potential with these 3582 penny stocks with strong financials and find fast movers offering financial strength in unexpected places.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands, Belgium, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)