- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Undervalued Small Caps With Insider Buying For January 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by stronger-than-expected U.S. labor market data and persistent inflation concerns, small-cap stocks have notably underperformed, with the Russell 2000 Index entering correction territory. Amid these choppy market conditions, investors often look for opportunities in small-cap companies that demonstrate potential resilience through strong fundamentals and strategic insider buying activity.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.1x | 3.2x | 45.69% | ★★★★★★ |

| 4imprint Group | 14.9x | 1.2x | 42.77% | ★★★★★☆ |

| Paradeep Phosphates | 24.5x | 0.8x | 28.22% | ★★★★★☆ |

| ABG Sundal Collier Holding | 12.5x | 2.1x | 41.98% | ★★★★☆☆ |

| Quanex Building Products | 31.0x | 0.8x | 41.59% | ★★★★☆☆ |

| Logistri Fastighets | 12.4x | 8.8x | 43.18% | ★★★★☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.4x | 21.50% | ★★★★☆☆ |

| Savaria | 30.5x | 1.6x | 29.00% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| ProPetro Holding | NA | 0.7x | 16.76% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

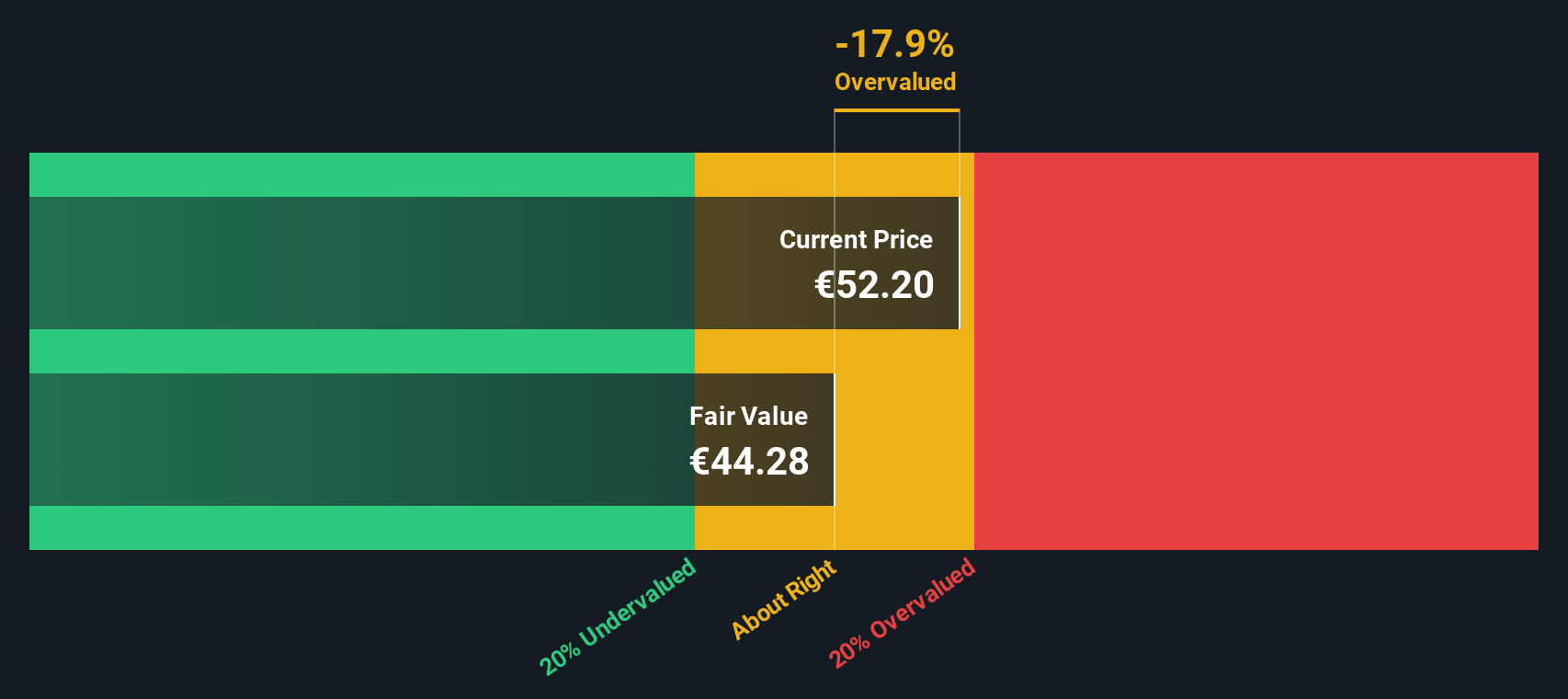

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Value Rating: ★★★★☆☆

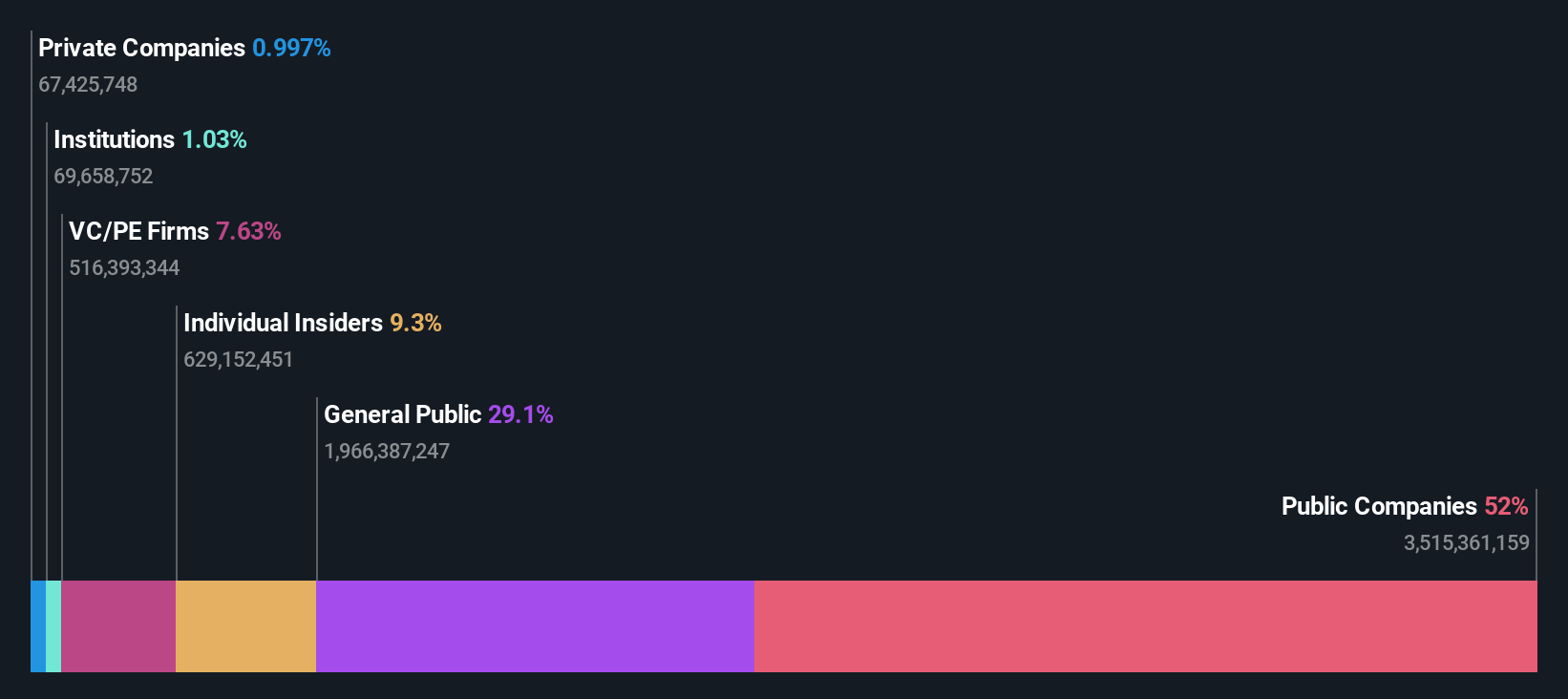

Overview: Van Lanschot Kempen is a Dutch financial institution focused on private banking, asset management, and investment banking services with a market cap of approximately €1.49 billion.

Operations: Van Lanschot Kempen generates revenue primarily through its investment banking clients, with a notable segment adjustment of €593.40 million. The company has consistently achieved a gross profit margin of 100%, indicating that all reported revenues translate directly into gross profit. Operating expenses are substantial, with general and administrative costs being the largest component, reaching up to €478.82 million in recent periods. The net income margin shows variability, peaking at 22.22% and reflecting fluctuations in profitability over time due to changes in operating expenses relative to revenue growth.

PE: 13.4x

Van Lanschot Kempen, a financial services company, shows promise in the undervalued small-cap segment. With earnings projected to grow by 6.86% annually, it faces challenges with a low bad loan allowance of 30%. Insider confidence is reflected through share purchases over the past year. The recent appointment of an experienced former UBS executive as COO in Switzerland might enhance strategic direction starting February 2025. This mix of growth potential and leadership change positions them for interesting future developments.

- Click here to discover the nuances of Van Lanschot Kempen with our detailed analytical valuation report.

Evaluate Van Lanschot Kempen's historical performance by accessing our past performance report.

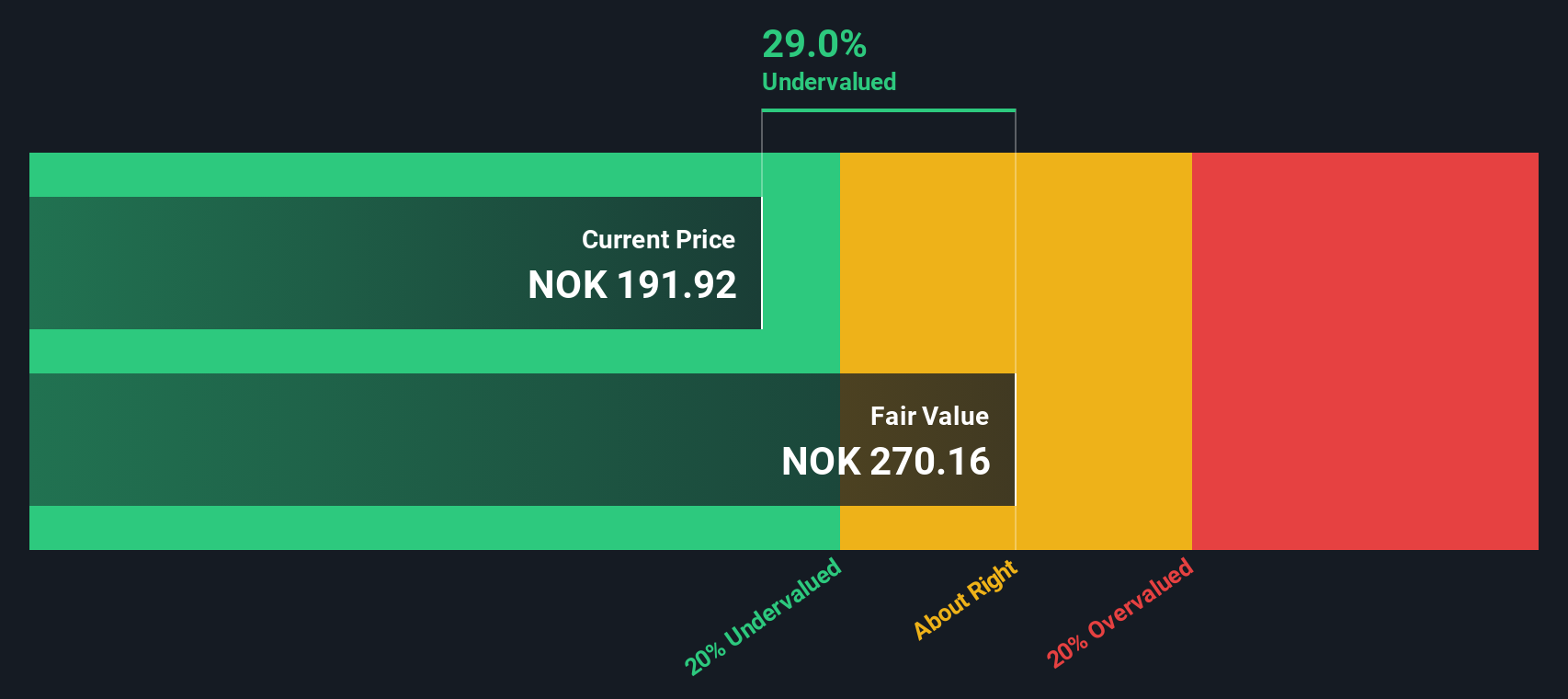

SpareBank 1 Østlandet (OB:SPOL)

Simply Wall St Value Rating: ★★★★★☆

Overview: SpareBank 1 Østlandet operates as a financial services provider with activities spanning retail and corporate banking, real estate brokerage, and financial partnerships, with a market capitalization of NOK 12.34 billion.

Operations: SpareBank 1 Østlandet generates revenue primarily from its Retail and Corporate Divisions, with additional contributions from subsidiaries like Eiendomsmegler 1 Innlandet AS and Sparebank 1 Finans Østlandet Group. The company has consistently achieved a gross profit margin of 100%, indicating that it incurs no cost of goods sold. Operating expenses include significant allocations to general and administrative functions, which have been as high as NOK 1.40 billion in recent periods. Net income margin has shown variability, reaching up to 39.37% in some quarters, reflecting the company's ability to manage its operating costs relative to revenue effectively.

PE: 7.3x

SpareBank 1 Østlandet, a smaller player in the financial sector, has shown promising growth with net income rising to NOK 1,080 million in Q3 2024 from NOK 417 million the previous year. Insider confidence is evident as an insider recently purchased shares worth approximately NOK 532,000. The bank maintains a low allowance for bad loans at 36%, suggesting cautious risk management. With revenue projected to grow annually by around 2.44%, its prospects appear steady amidst industry fluctuations.

- Unlock comprehensive insights into our analysis of SpareBank 1 Østlandet stock in this valuation report.

Gain insights into SpareBank 1 Østlandet's past trends and performance with our Past report.

Yixin Group (SEHK:2858)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Yixin Group is a Chinese company primarily engaged in providing transaction platform services and self-operated financing solutions, with a market capitalization of CN¥4.92 billion.

Operations: The company generates revenue primarily from its Transaction Platform Business and Self-Operated Financing Business, with the former contributing significantly more to total revenue. Over recent periods, the gross profit margin has shown a decreasing trend, reaching 39.14% as of June 2024. Operating expenses are largely driven by sales and marketing costs, which have consistently been a major component of the company's expenditure.

PE: 6.7x

Yixin Group, a smaller company in its sector, has recently seen insider confidence with key figures purchasing shares over the past six months. Despite a volatile share price in the last quarter, earnings are projected to grow at 19.56% annually. The company's financial position shows room for improvement as debt isn't well covered by operating cash flow and relies entirely on riskier external borrowing rather than customer deposits. Recent board changes may influence strategic direction moving forward.

- Take a closer look at Yixin Group's potential here in our valuation report.

Gain insights into Yixin Group's historical performance by reviewing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 171 more companies for you to explore.Click here to unveil our expertly curated list of 174 Undervalued Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives