- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

Top Dividend Stocks On Euronext Amsterdam For October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising oil prices and geopolitical tensions, the European indices, including those in the Netherlands, have faced recent downturns. Despite these challenges, dividend stocks on Euronext Amsterdam continue to attract attention for their potential to provide steady income streams amidst market volatility. In evaluating such stocks, investors often look for companies with strong fundamentals and a history of stable dividend payouts as a buffer against economic uncertainties.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.27% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.22% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.54% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 7.00% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.29% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 7.01% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €13.18 billion.

Operations: ABN AMRO Bank N.V.'s revenue is primarily derived from Personal & Business Banking (€4.02 billion), Corporate Banking (€3.46 billion), and Wealth Management (€1.55 billion).

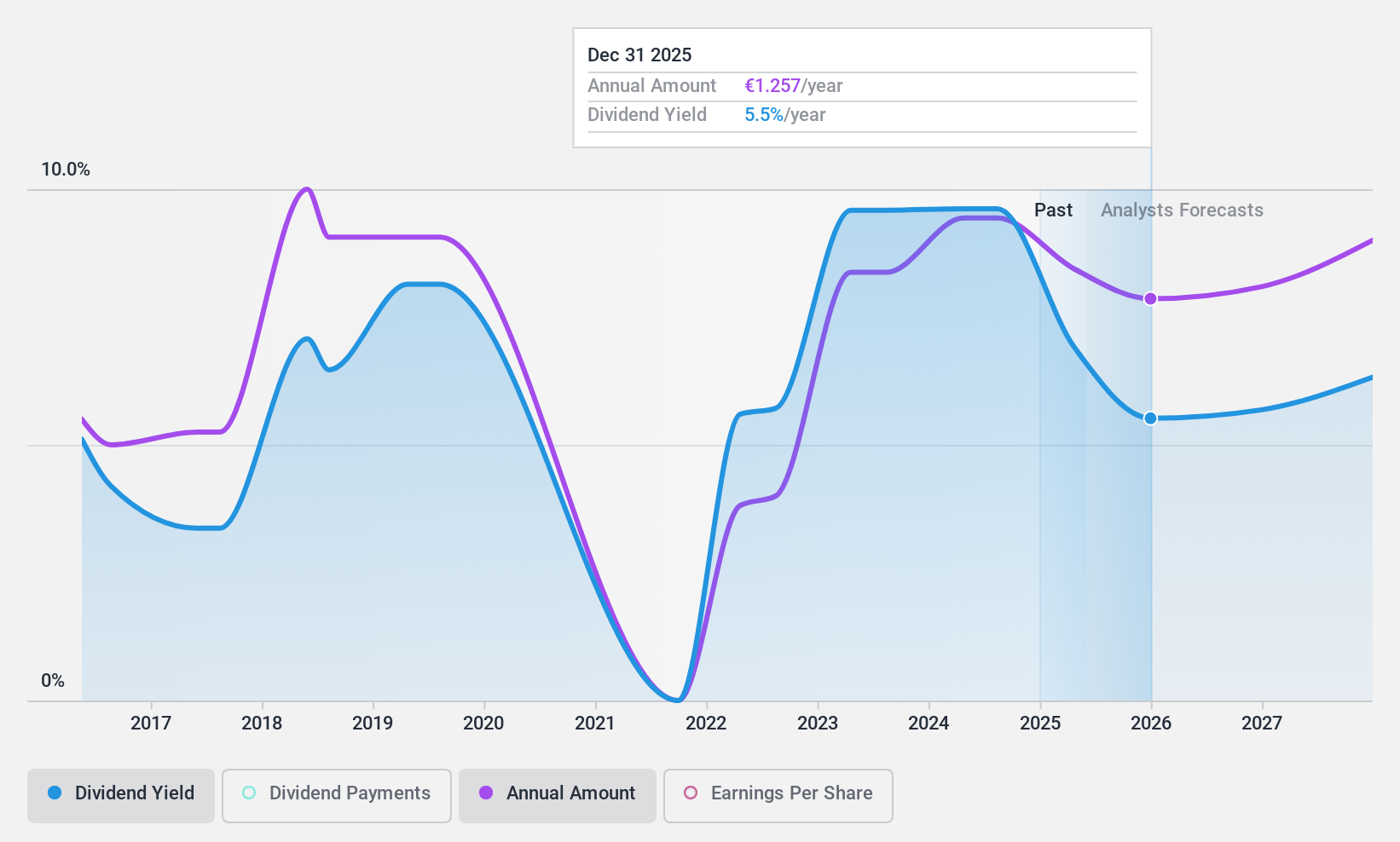

Dividend Yield: 9.5%

ABN AMRO Bank offers a competitive dividend yield of 9.54%, surpassing the Dutch market average. Despite having paid dividends for only nine years, its payout ratio of 50.5% suggests dividends are covered by earnings and expected to remain so in three years at 47.1%. However, dividend payments have been volatile, reflecting an unstable track record. Recent leadership changes include appointing Serena Fioravanti as Chief Risk Officer, potentially impacting future risk management strategies.

- Unlock comprehensive insights into our analysis of ABN AMRO Bank stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of ABN AMRO Bank shares in the market.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €729.66 million.

Operations: Koninklijke Heijmans N.V.'s revenue is segmented into Connecting, which generated €871.03 million, and Segment Adjustment, contributing €1.83 billion.

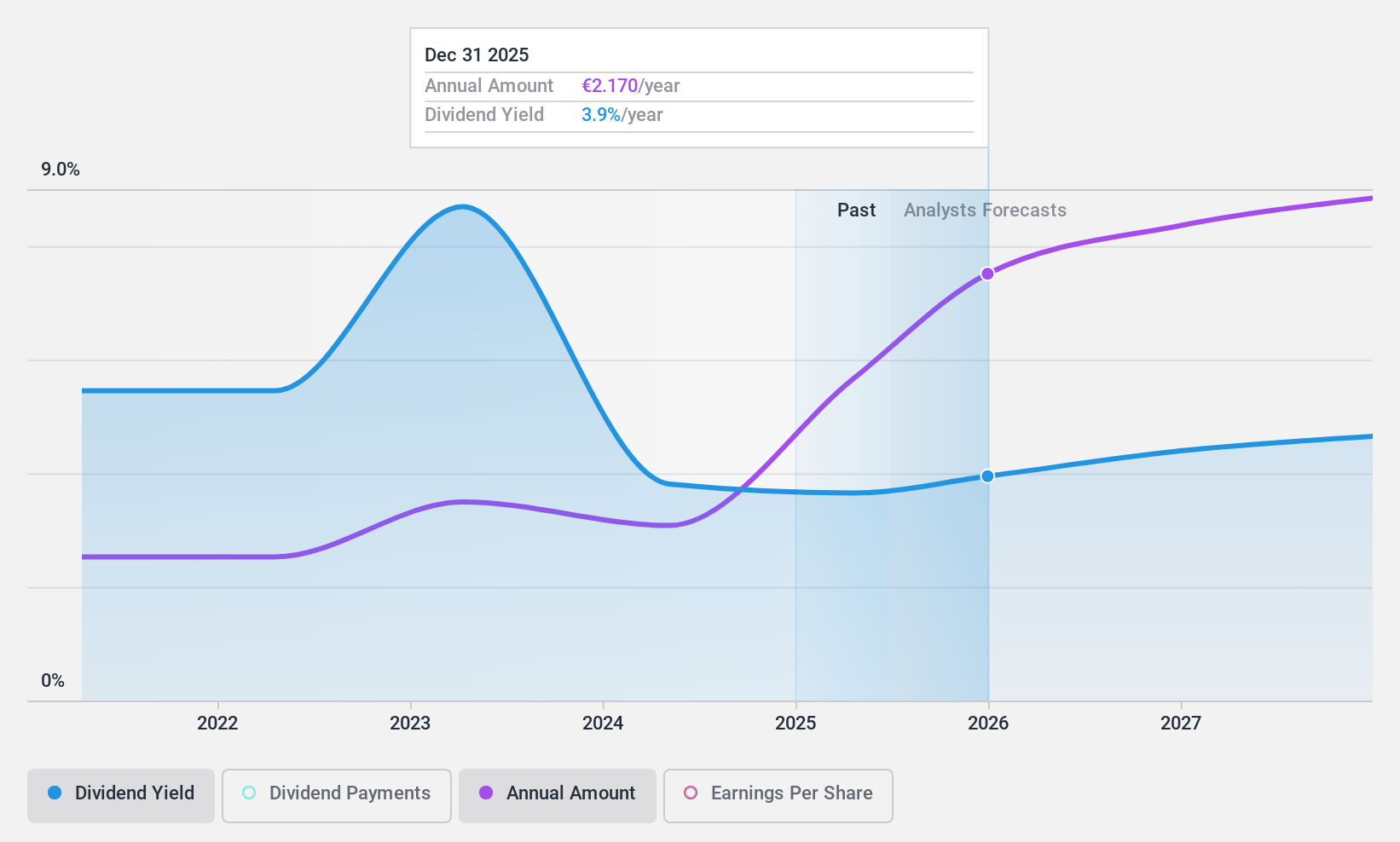

Dividend Yield: 3.3%

Koninklijke Heijmans has shown strong earnings growth, with a 65.5% increase over the past year and sales reaching €1.22 billion in H1 2024. Despite this, its dividend yield of 3.27% is below the top tier in the Dutch market, and dividends have been volatile over the past decade. However, with a payout ratio of 30%, dividends are well covered by earnings and cash flows, indicating sustainability despite historical instability.

- Click here to discover the nuances of Koninklijke Heijmans with our detailed analytical dividend report.

- According our valuation report, there's an indication that Koninklijke Heijmans' share price might be on the cheaper side.

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and internationally with a market cap of €2.79 billion.

Operations: Signify N.V.'s revenue is derived from its Conventional segment, which amounts to €519 million.

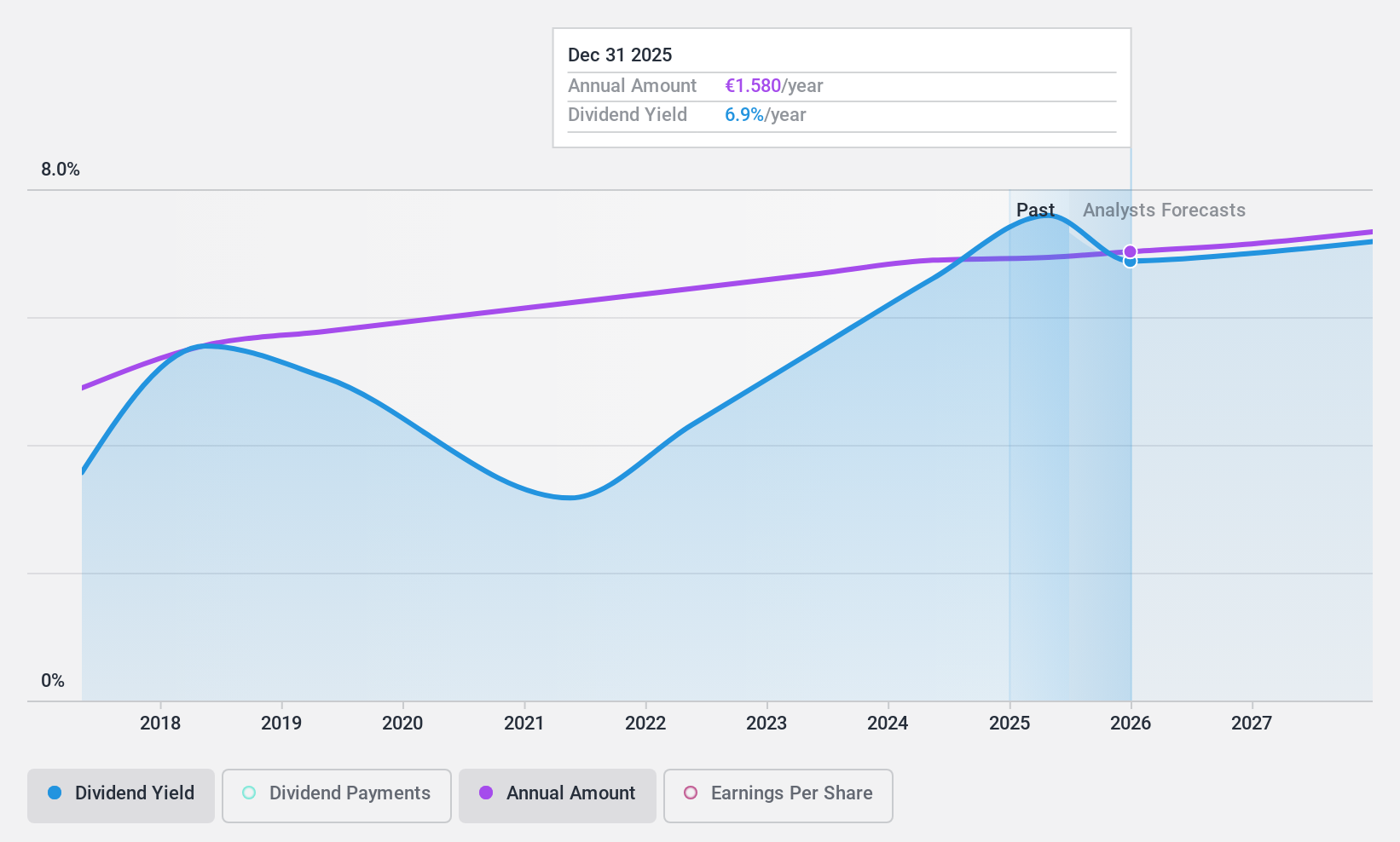

Dividend Yield: 7.0%

Signify's dividend yield is among the top 25% in the Dutch market, yet its track record is unstable, with payments being volatile over its eight-year history. Despite this, dividends are well covered by earnings and cash flows, with a payout ratio of 80.4% and cash payout ratio of 34.2%. Recent earnings growth supports coverage; however, Signify was recently dropped from the FTSE All-World Index, which may impact investor sentiment.

- Click here and access our complete dividend analysis report to understand the dynamics of Signify.

- In light of our recent valuation report, it seems possible that Signify is trading behind its estimated value.

Next Steps

- Navigate through the entire inventory of 7 Top Euronext Amsterdam Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands and internationally.

Undervalued with excellent balance sheet and pays a dividend.