- Netherlands

- /

- Construction

- /

- ENXTAM:FUR

With EPS Growth And More, Fugro (AMS:FUR) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Fugro (AMS:FUR), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Fugro

How Fast Is Fugro Growing Its Earnings Per Share?

Over the last three years, Fugro has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Fugro's EPS has grown from €0.59 to €0.66 over twelve months. This amounts to a 13% gain; a figure that shareholders will be pleased to see.

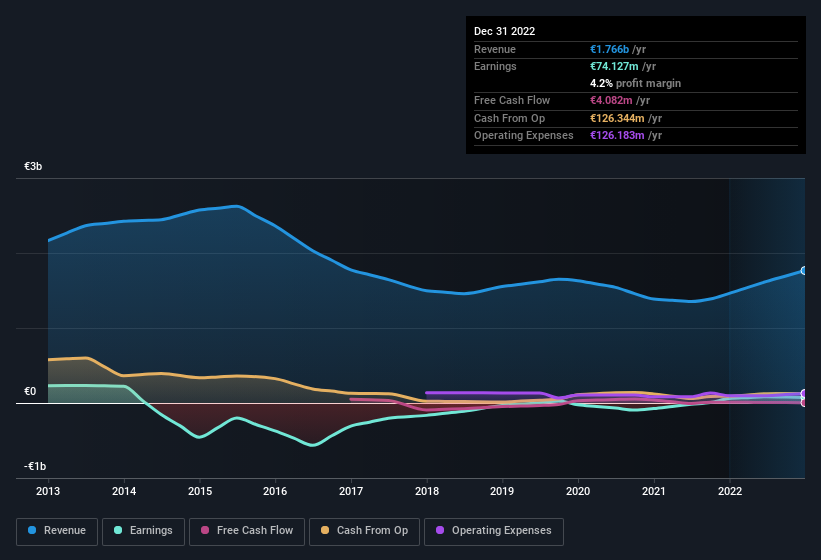

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Fugro maintained stable EBIT margins over the last year, all while growing revenue 21% to €1.8b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Fugro's future EPS 100% free.

Are Fugro Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Despite €94k worth of sales, Fugro insiders have overwhelmingly been buying the stock, spending €591k on purchases in the last twelve months. This overall confidence in the company at current the valuation signals their optimism. We also note that it was the Chairman of Management Board & CEO, Mark Rembold Heine, who made the biggest single acquisition, paying €123k for shares at about €12.28 each.

The good news, alongside the insider buying, for Fugro bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at €32m. This considerable investment should help drive long-term value in the business. Despite being just 1.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Fugro To Your Watchlist?

One positive for Fugro is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Even so, be aware that Fugro is showing 1 warning sign in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Fugro isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FUR

Fugro

Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives