- Italy

- /

- Capital Markets

- /

- BIT:AZM

3 European Dividend Stocks With Up To 6.9% Yield To Boost Your Portfolio

Reviewed by Simply Wall St

As European markets navigate a period of mixed returns, with the pan-European STOXX Europe 600 Index remaining relatively stable and inflation hitting the ECB's target, investors are increasingly looking towards dividend stocks as a reliable source of income. In such an environment, selecting stocks that offer solid dividend yields can provide stability and potential growth to a portfolio, making them an attractive option for those seeking to enhance their investment strategy amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.08% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.72% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.88% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.36% | ★★★★★★ |

| ERG (BIT:ERG) | 5.42% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.12% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.42% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

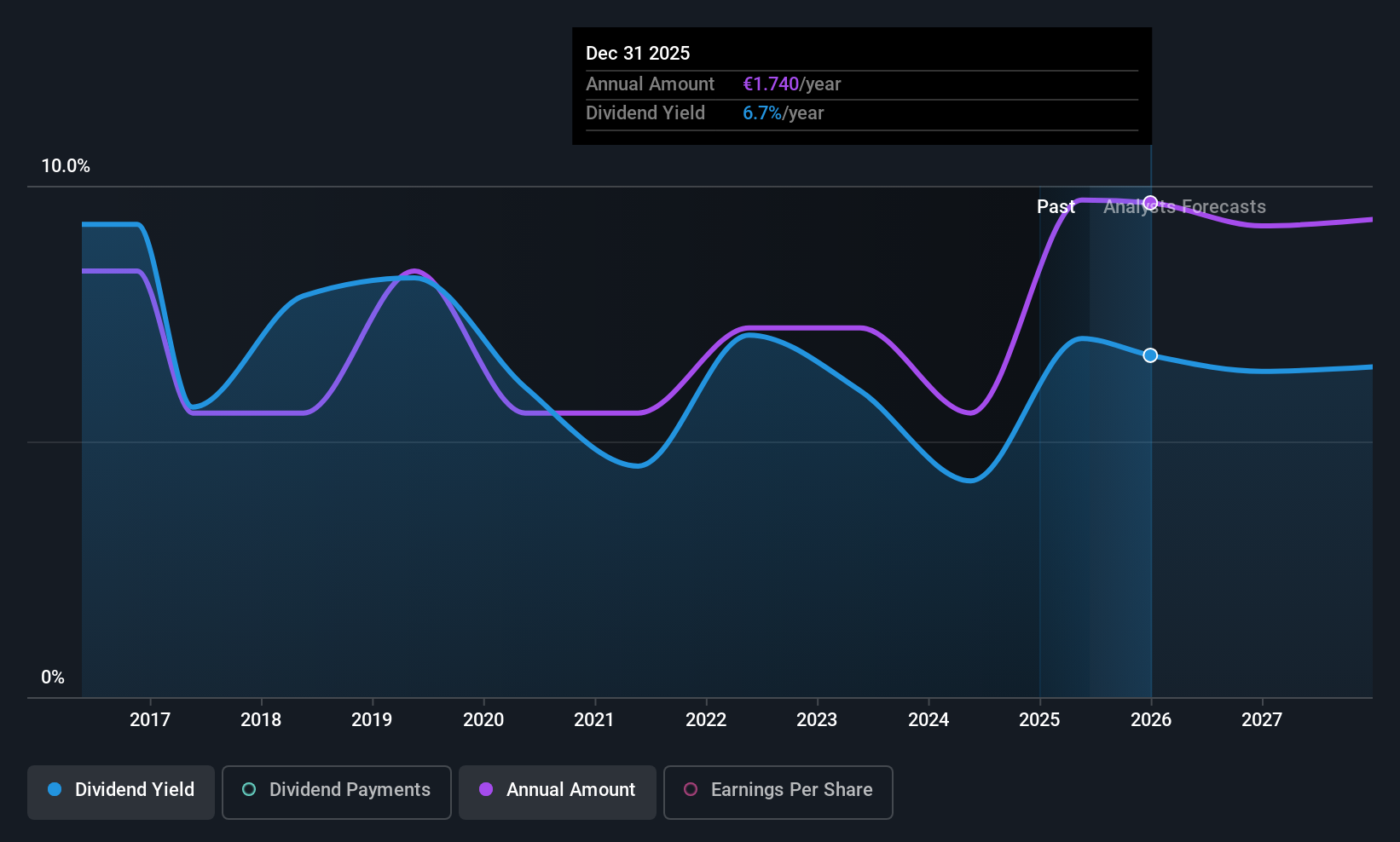

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market capitalization of approximately €4.17 billion.

Operations: Azimut Holding S.p.A. generates its revenue primarily from asset management, amounting to €1.40 billion.

Dividend Yield: 6%

Azimut Holding's dividend yield of 5.96% ranks in the top 25% of Italian dividend payers, yet it is not well covered by free cash flows, with a high cash payout ratio of 523.9%. Despite a reasonably low earnings payout ratio of 44.1%, dividends have been volatile over the past decade. Recent strategic initiatives, such as forming TNB with FSI SGR S.p.A., aim to enhance Azimut's global presence and financial advisory capabilities, potentially impacting future earnings stability and growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Azimut Holding.

- Our valuation report unveils the possibility Azimut Holding's shares may be trading at a discount.

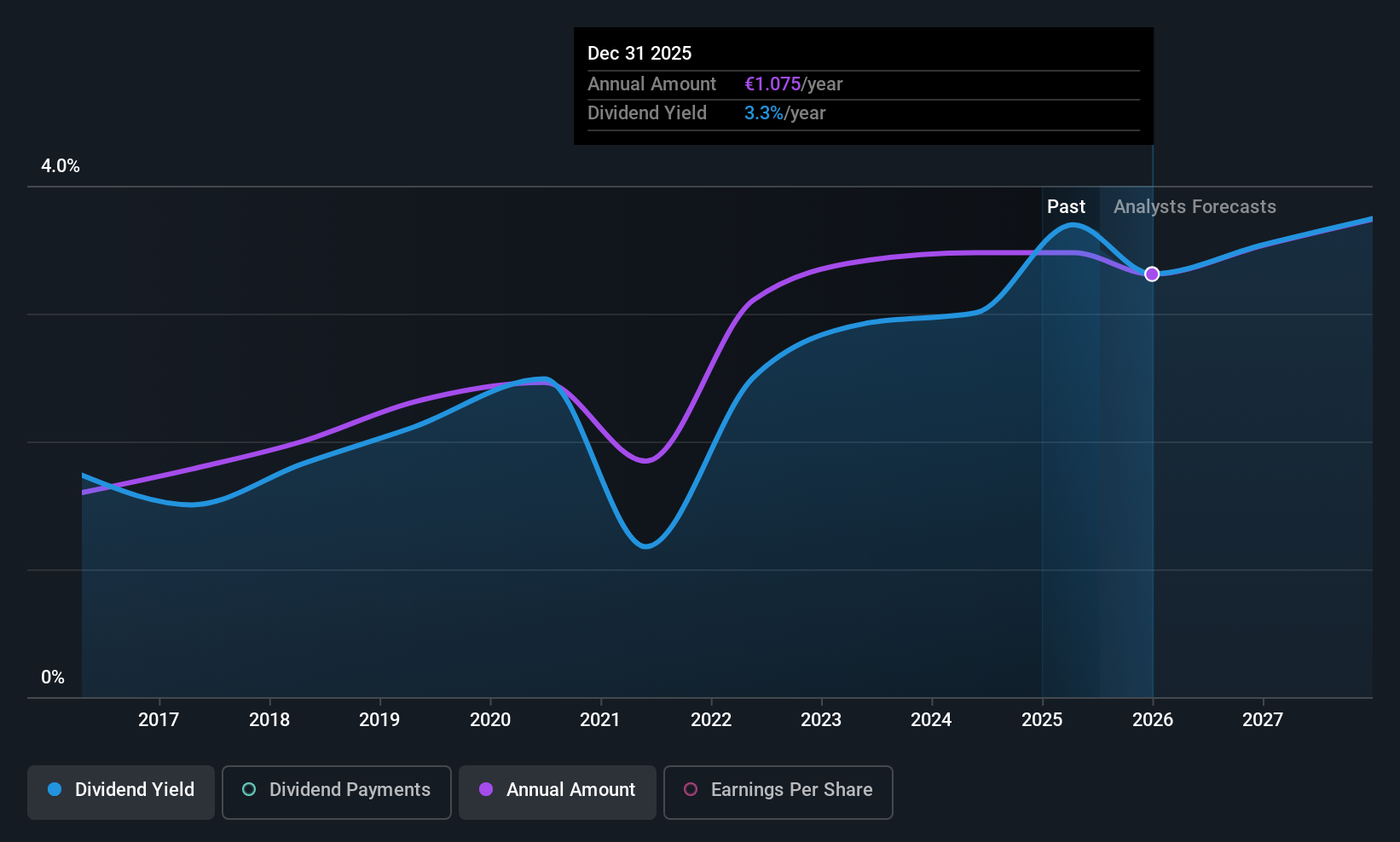

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for the building, industry, and semiconductor markets across Europe, the United States, the Asia Pacific, the Middle East, and Africa with a market capitalization of approximately €3.63 billion.

Operations: Aalberts N.V. generates revenue from its segments with €1.60 billion in Building Technology, €1.06 billion in Industrial Technology, and €501.30 million in Semicon.

Dividend Yield: 3.4%

Aalberts has shown a volatile dividend history over the past decade, with payments covered by earnings and cash flows, maintaining payout ratios of 69.8% and 72.3%, respectively. Despite trading significantly below fair value estimates, its dividend yield of 3.38% lags behind top-tier Dutch payers. Recent debt financing of approximately US$600 million enhances capital structure for strategic growth under the 'Thrive 2030' strategy but profit margins have declined from last year’s figures, impacting overall financial stability.

- Dive into the specifics of Aalberts here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aalberts shares in the market.

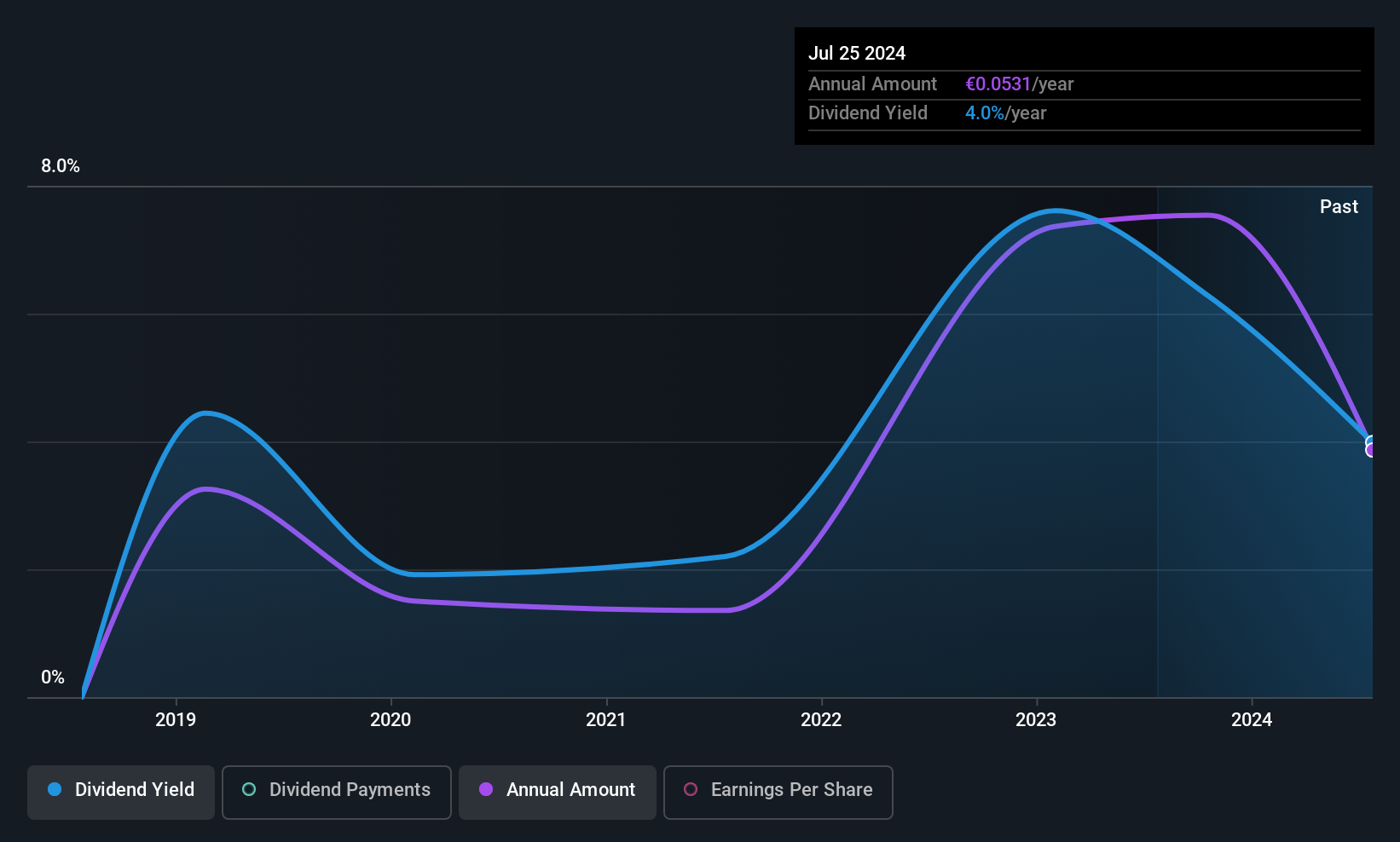

ZCCM Investments Holdings (ENXTPA:MLZAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZCCM Investments Holdings Plc is a diversified mining investment and operations company with activities in Zambia and internationally, and it has a market cap of €276.66 million.

Operations: ZCCM Investments Holdings Plc generates revenue through its diversified mining investments and operations both within Zambia and on an international scale.

Dividend Yield: 7.0%

ZCCM Investments Holdings' dividend payments are well-covered by earnings and cash flows, with a low payout ratio of 1.3% and a cash payout ratio of 36.5%. Despite its dividends being volatile over the past decade, the company recently proposed a final dividend increase to ZMW 3.29 per share for 2024. However, ongoing arbitration with Trafigura over a USD100 million guarantee could impact financial stability, alongside recent leadership changes which may influence strategic direction.

- Unlock comprehensive insights into our analysis of ZCCM Investments Holdings stock in this dividend report.

- Our valuation report here indicates ZCCM Investments Holdings may be undervalued.

Make It Happen

- Delve into our full catalog of 230 Top European Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AZM

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)