- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:ACOMO

3 Dividend Stocks On Euronext Amsterdam Yielding Over 3.3%

Reviewed by Simply Wall St

As the European Central Bank continues to ease monetary policy with consecutive rate cuts, the pan-European STOXX Europe 600 Index has seen a modest increase, reflecting optimism for further economic support. In this context, dividend stocks listed on Euronext Amsterdam yielding over 3.3% present an attractive opportunity for investors seeking income in a low-interest-rate environment.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.52% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.94% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 7.14% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.37% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 7.09% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.68% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

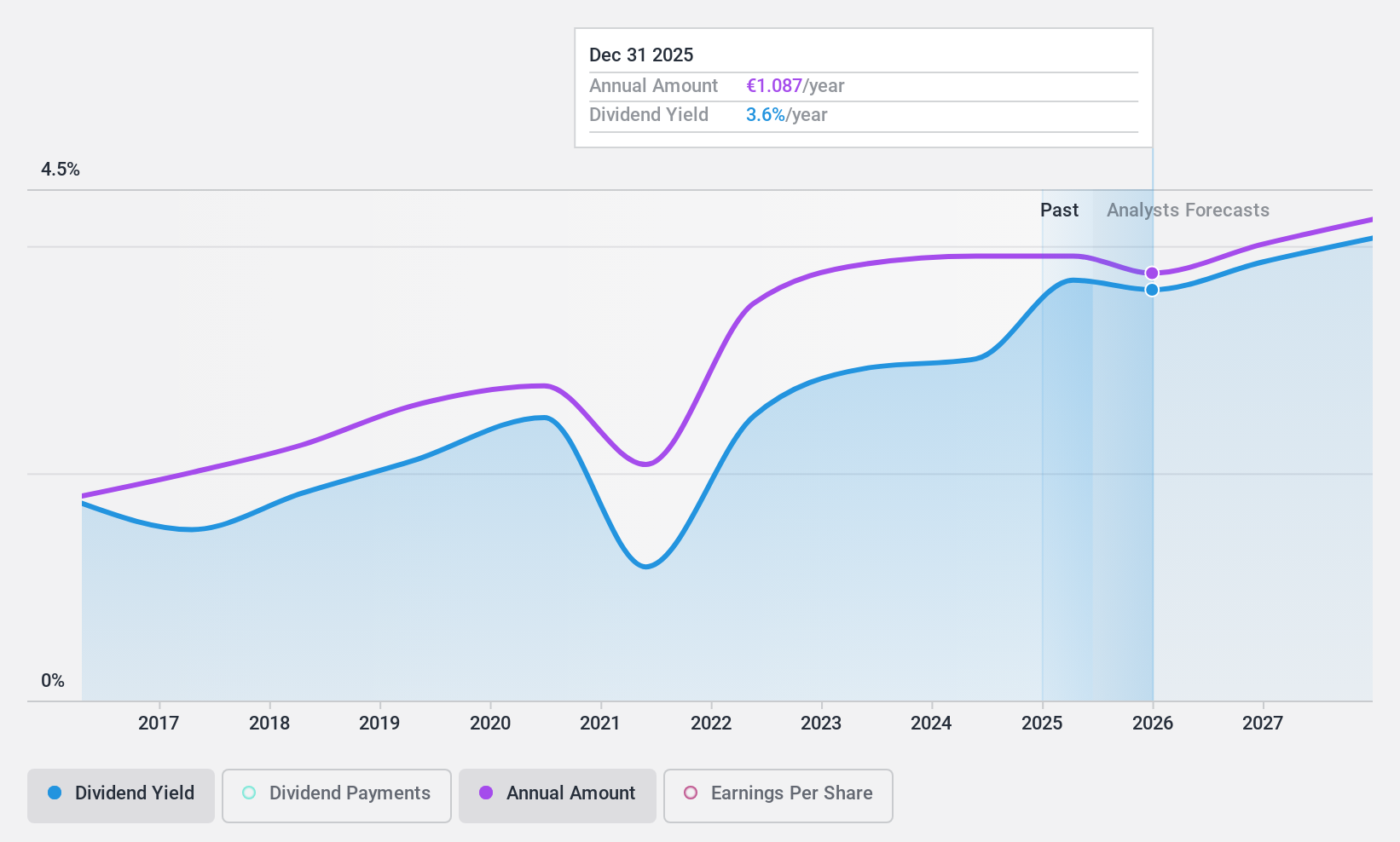

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for the aerospace, automotive, building, and maritime sectors with a market cap of €3.71 billion.

Operations: Aalberts N.V. generates revenue from its Building Technology segment, contributing €1.74 billion, and its Industrial Technology segment, contributing €1.49 billion.

Dividend Yield: 3.4%

Aalberts offers a mixed profile for dividend investors. Its 3.37% yield is below the Dutch market's top tier, but dividends have grown over the past decade despite volatility and an unstable track record. The company's dividends are well-covered by earnings (41% payout ratio) and cash flows (60.4% cash payout ratio). Recent earnings showed a slight decline, with sales at €1.62 billion and net income at €149.2 million, reflecting stable yet cautious financial management amidst market challenges.

- Unlock comprehensive insights into our analysis of Aalberts stock in this dividend report.

- According our valuation report, there's an indication that Aalberts' share price might be on the cheaper side.

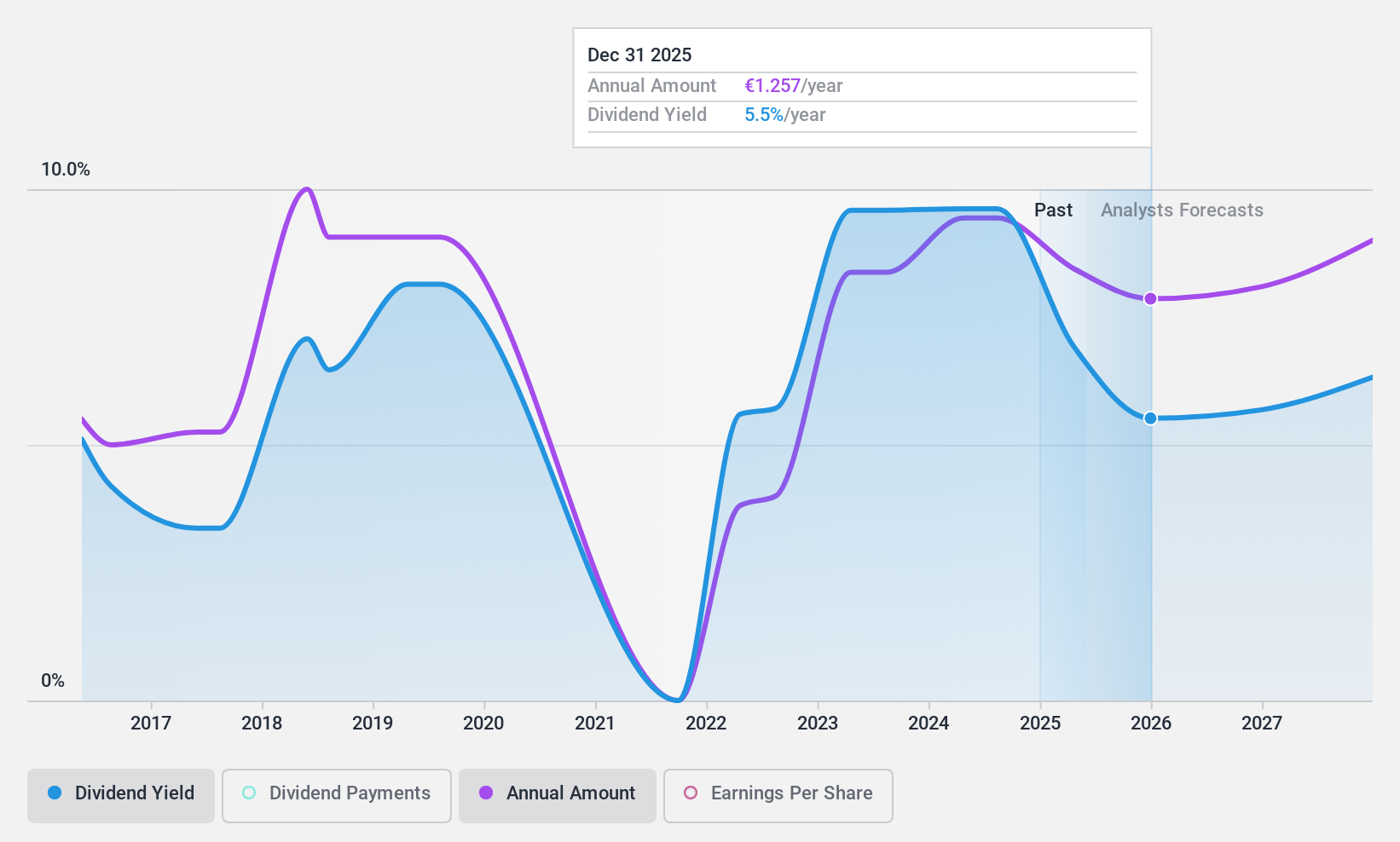

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.66 billion.

Operations: ABN AMRO Bank N.V. generates its revenue from three main segments: Corporate Banking (€3.46 billion), Wealth Management (€1.55 billion), and Personal & Business Banking (€4.02 billion).

Dividend Yield: 9.9%

ABN AMRO Bank's dividend yield is among the top 25% in the Dutch market, with a payout ratio of 50.5%, indicating dividends are covered by earnings. Despite a history of volatility and unreliability over nine years, future dividends are forecasted to remain covered by earnings. Recent financials show net income at €1.32 billion for H1 2024, slightly down from last year, amidst strategic fixed-income offerings totaling €745 million to bolster its financial position.

- Click here and access our complete dividend analysis report to understand the dynamics of ABN AMRO Bank.

- In light of our recent valuation report, it seems possible that ABN AMRO Bank is trading behind its estimated value.

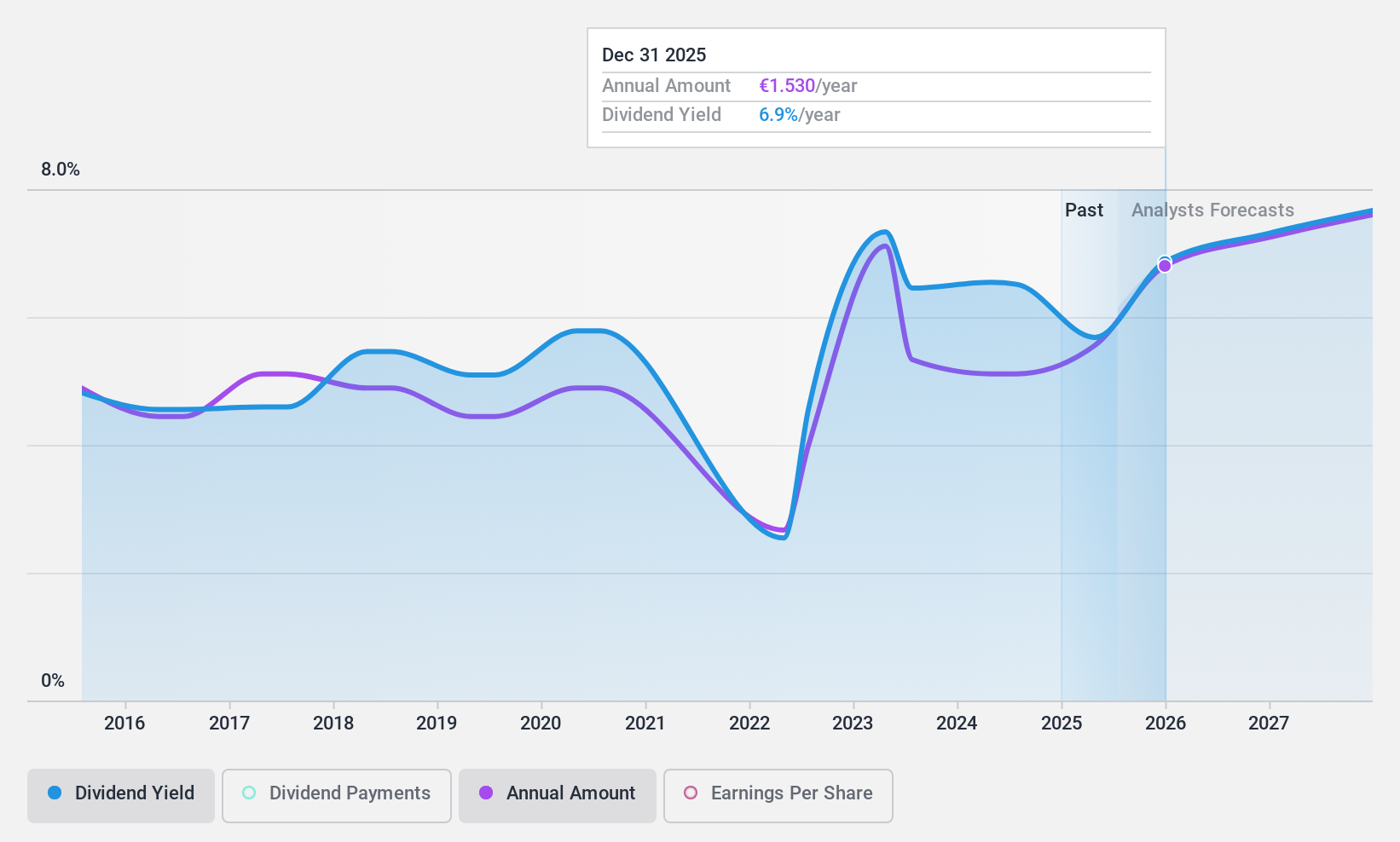

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V. operates in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients for the food and beverage industry across various regions including Europe and North America, with a market cap of €510.02 million.

Operations: Acomo N.V.'s revenue is primarily derived from its segments in Spices and Nuts (€445.76 million), Organic Ingredients (€429.28 million), Edible Seeds (€246.52 million), Tea (€124.04 million), and Food Solutions (€23.47 million).

Dividend Yield: 6.7%

Acomo's dividend yield of 6.68% ranks in the top 25% of Dutch payers, but its high payout ratio (95.7%) raises concerns about sustainability, as dividends aren't well covered by earnings. Despite a decade-long increase, dividends have been volatile and unreliable. The cash payout ratio is more reasonable at 51%, suggesting some coverage by cash flows, yet high debt levels may pose risks. Its P/E ratio of 14.4x offers relative value compared to the market average.

- Get an in-depth perspective on Acomo's performance by reading our dividend report here.

- Our expertly prepared valuation report Acomo implies its share price may be too high.

Next Steps

- Unlock more gems! Our Top Euronext Amsterdam Dividend Stocks screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Top Euronext Amsterdam Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ACOMO

Acomo

Engages in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry in the Netherlands, other European countries, North America, and internationally.

Solid track record average dividend payer.

Market Insights

Community Narratives