- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

How Investors May Respond To ING Groep (ENXTAM:INGA) Accelerating Its €1.10 Billion Capital-Reducing Share Buyback

Reviewed by Sasha Jovanovic

- ING Groep recently reported that, as part of its previously announced €1.10 billion share buyback programme, it repurchased 2,017,765 shares between 8 and 12 December 2025, bringing total repurchases to 13,399,920 shares, or about 27.13% of the programme’s maximum value.

- The buyback, aimed at reducing ING’s share capital, highlights the bank’s ongoing focus on returning excess capital to shareholders alongside its broader digital and sustainable finance initiatives.

- We’ll now examine how progress on this capital-reducing buyback programme could influence ING Groep’s investment narrative and future capital return expectations.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

ING Groep Investment Narrative Recap

To own ING Groep, you need to believe in its ability to convert a strong digital and sustainable banking franchise into consistent earnings, despite macro and regulatory headwinds. The current €1.10 billion buyback progress looks incremental rather than a material near term catalyst, while the biggest immediate risk remains margin and revenue pressure from subdued wholesale loan demand and FX driven swings in net interest income.

The most relevant recent announcement here is ING’s Q3 2025 result, which showed modest year on year net income movement despite revenue and FX pressures. Against that backdrop, the ongoing buyback and earlier €738 million repurchase completion in mid 2025 underline how capital returns are being maintained even as the bank balances investment in digitalisation with an uncertain operating backdrop.

Yet, while capital is being returned, investors should still pay close attention to ING’s exposure to weaker wholesale loan demand and FX driven income volatility...

Read the full narrative on ING Groep (it's free!)

ING Groep’s narrative projects €24.9 billion revenue and €6.6 billion earnings by 2028. This requires 8.3% yearly revenue growth and about €1.8 billion earnings increase from €4.8 billion today.

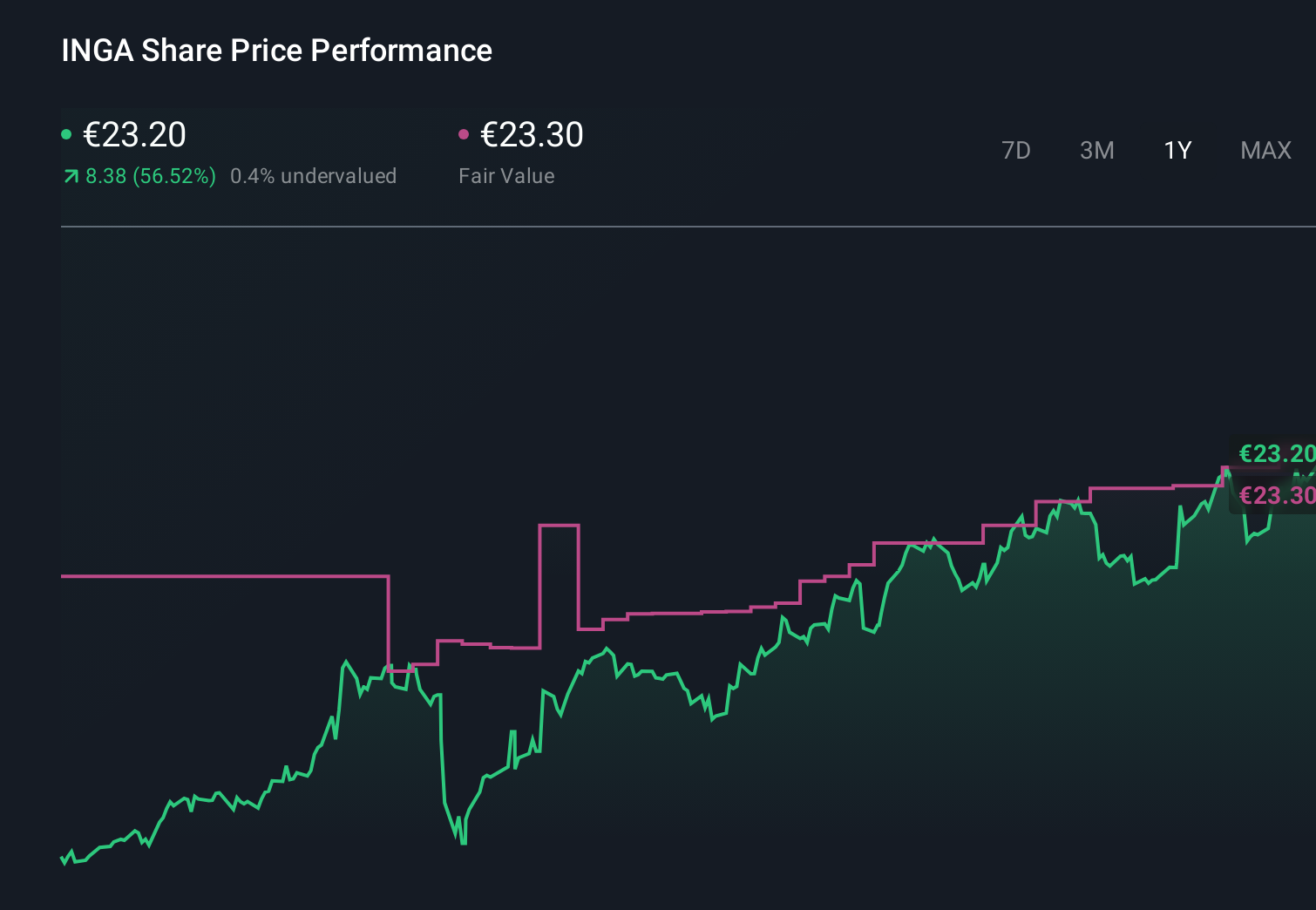

Uncover how ING Groep's forecasts yield a €23.30 fair value, in line with its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span roughly €21 to €46 per share, showing how widely individual views can differ. You can weigh these against the risk that prolonged macro uncertainty and FX headwinds keep a lid on ING’s revenue momentum and return on equity, and then explore how your own expectations compare.

Explore 10 other fair value estimates on ING Groep - why the stock might be worth as much as 98% more than the current price!

Build Your Own ING Groep Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ING Groep research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ING Groep research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ING Groep's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion