- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:ITMAX

ITMAX System Berhad's (KLSE:ITMAX) 27% Jump Shows Its Popularity With Investors

ITMAX System Berhad (KLSE:ITMAX) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 53%.

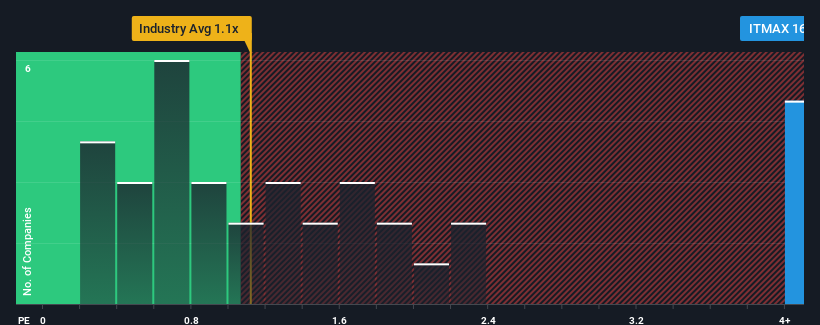

After such a large jump in price, you could be forgiven for thinking ITMAX System Berhad is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 16.1x, considering almost half the companies in Malaysia's Electronic industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for ITMAX System Berhad

How Has ITMAX System Berhad Performed Recently?

ITMAX System Berhad certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think ITMAX System Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For ITMAX System Berhad?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like ITMAX System Berhad's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 49% gain to the company's top line. Pleasingly, revenue has also lifted 201% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 37% over the next year. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why ITMAX System Berhad's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in ITMAX System Berhad have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into ITMAX System Berhad shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for ITMAX System Berhad with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ITMAX

ITMAX System Berhad

An investment holding company, engages in the supply, installation, and provision of public space networked systems in Malaysia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)