We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Public Packages Holdings Berhad's (KLSE:PPHB) CEO For Now

Key Insights

- Public Packages Holdings Berhad to hold its Annual General Meeting on 29th of May

- CEO Chiew Koay's total compensation includes salary of RM300.0k

- The overall pay is 448% above the industry average

- Over the past three years, Public Packages Holdings Berhad's EPS grew by 21% and over the past three years, the total shareholder return was 45%

Under the guidance of CEO Chiew Koay, Public Packages Holdings Berhad (KLSE:PPHB) has performed reasonably well recently. As shareholders go into the upcoming AGM on 29th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Public Packages Holdings Berhad

Comparing Public Packages Holdings Berhad's CEO Compensation With The Industry

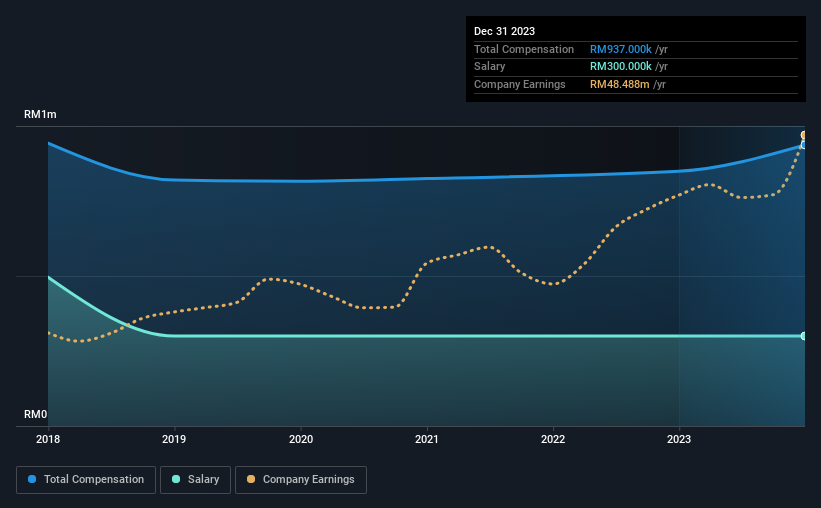

According to our data, Public Packages Holdings Berhad has a market capitalization of RM252m, and paid its CEO total annual compensation worth RM937k over the year to December 2023. Notably, that's an increase of 10% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at RM300k.

For comparison, other companies in the Malaysia Packaging industry with market capitalizations below RM939m, reported a median total CEO compensation of RM171k. Hence, we can conclude that Chiew Koay is remunerated higher than the industry median. Furthermore, Chiew Koay directly owns RM2.8m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM300k | RM300k | 32% |

| Other | RM637k | RM549k | 68% |

| Total Compensation | RM937k | RM849k | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. Public Packages Holdings Berhad pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Public Packages Holdings Berhad's Growth Numbers

Over the past three years, Public Packages Holdings Berhad has seen its earnings per share (EPS) grow by 21% per year. In the last year, its revenue is down 6.3%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Public Packages Holdings Berhad Been A Good Investment?

Most shareholders would probably be pleased with Public Packages Holdings Berhad for providing a total return of 45% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Public Packages Holdings Berhad that you should be aware of before investing.

Switching gears from Public Packages Holdings Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PPHB

Public Packages Holdings Berhad

An investment holding company, engages in the production and sale of paper packaging products in Malaysia, the Asia Pacific, Europe, the United States, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.