- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:EKSONS

Some Shareholders May Object To A Pay Rise For Eksons Corporation Berhad's (KLSE:EKSONS) CEO This Year

Key Insights

- Eksons Corporation Berhad to hold its Annual General Meeting on 19th of September

- Total pay for CEO Philip Chan includes RM589.1k salary

- The total compensation is 37% less than the average for the industry

- Eksons Corporation Berhad's three-year loss to shareholders was 19% while its EPS was down 9.0% over the past three years

The disappointing performance at Eksons Corporation Berhad (KLSE:EKSONS) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 19th of September. The data we gathered below shows that CEO compensation looks acceptable for now.

View our latest analysis for Eksons Corporation Berhad

How Does Total Compensation For Philip Chan Compare With Other Companies In The Industry?

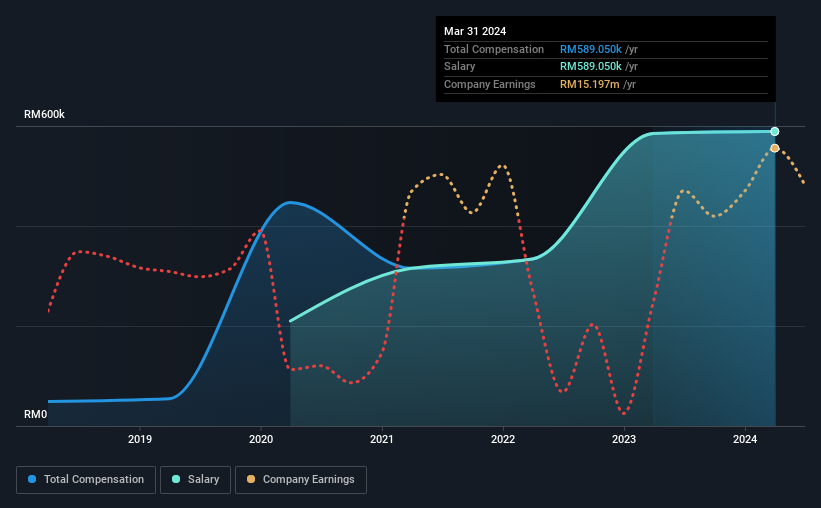

According to our data, Eksons Corporation Berhad has a market capitalization of RM104m, and paid its CEO total annual compensation worth RM589k over the year to March 2024. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth RM589k.

On comparing similar-sized companies in the Malaysia Forestry industry with market capitalizations below RM867m, we found that the median total CEO compensation was RM929k. This suggests that Philip Chan is paid below the industry median. Furthermore, Philip Chan directly owns RM227k worth of shares in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM589k | RM585k | 100% |

| Other | - | - | - |

| Total Compensation | RM589k | RM585k | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. On a company level, Eksons Corporation Berhad prefers to reward its CEO through a salary, opting not to pay Philip Chan through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Eksons Corporation Berhad's Growth Numbers

Over the last three years, Eksons Corporation Berhad has shrunk its earnings per share by 9.0% per year. Its revenue is down 48% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Eksons Corporation Berhad Been A Good Investment?

With a three year total loss of 19% for the shareholders, Eksons Corporation Berhad would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Eksons Corporation Berhad rewards its CEO solely through a salary, ignoring non-salary benefits completely. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for Eksons Corporation Berhad that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eksons Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EKSONS

Eksons Corporation Berhad

An investment holding company, manufactures and sells tropical thin plywood products in Malaysia and the Middle East.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)