- Malaysia

- /

- Medical Equipment

- /

- KLSE:TOPGLOV

Is Top Glove Corporation Bhd (KLSE:TOPGLOV) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Top Glove Corporation Bhd. (KLSE:TOPGLOV) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Top Glove Corporation Bhd

How Much Debt Does Top Glove Corporation Bhd Carry?

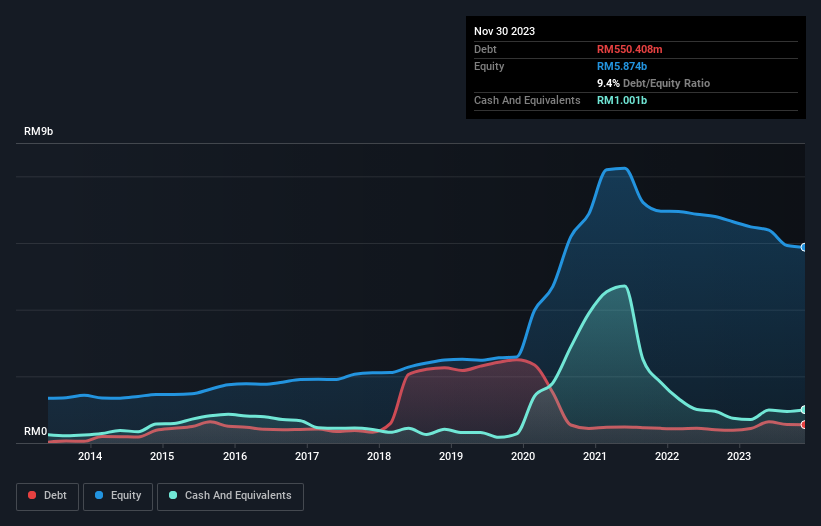

As you can see below, at the end of November 2023, Top Glove Corporation Bhd had RM550.4m of debt, up from RM383.0m a year ago. Click the image for more detail. But it also has RM1.00b in cash to offset that, meaning it has RM450.5m net cash.

How Healthy Is Top Glove Corporation Bhd's Balance Sheet?

According to the last reported balance sheet, Top Glove Corporation Bhd had liabilities of RM943.2m due within 12 months, and liabilities of RM201.5m due beyond 12 months. Offsetting this, it had RM1.00b in cash and RM215.1m in receivables that were due within 12 months. So it can boast RM71.3m more liquid assets than total liabilities.

This state of affairs indicates that Top Glove Corporation Bhd's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the RM6.45b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Top Glove Corporation Bhd boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Top Glove Corporation Bhd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Top Glove Corporation Bhd had a loss before interest and tax, and actually shrunk its revenue by 54%, to RM2.1b. That makes us nervous, to say the least.

So How Risky Is Top Glove Corporation Bhd?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Top Glove Corporation Bhd lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of RM58m and booked a RM815m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of RM450.5m. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. For riskier companies like Top Glove Corporation Bhd I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Top Glove Corporation Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TOPGLOV

Top Glove Corporation Bhd

An investment holding company, engages in the manufacture, trade, and sale of gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)