- Malaysia

- /

- Healthcare Services

- /

- KLSE:IHH

IHH Healthcare Berhad (KLSE:IHH) shareholders have earned a 6.7% CAGR over the last five years

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. Buying under-rated businesses is one path to excess returns. For example, the IHH Healthcare Berhad (KLSE:IHH) share price is up 28% in the last 5 years, clearly besting the market return of around 12% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 12%, including dividends.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

We check all companies for important risks. See what we found for IHH Healthcare Berhad in our free report.While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

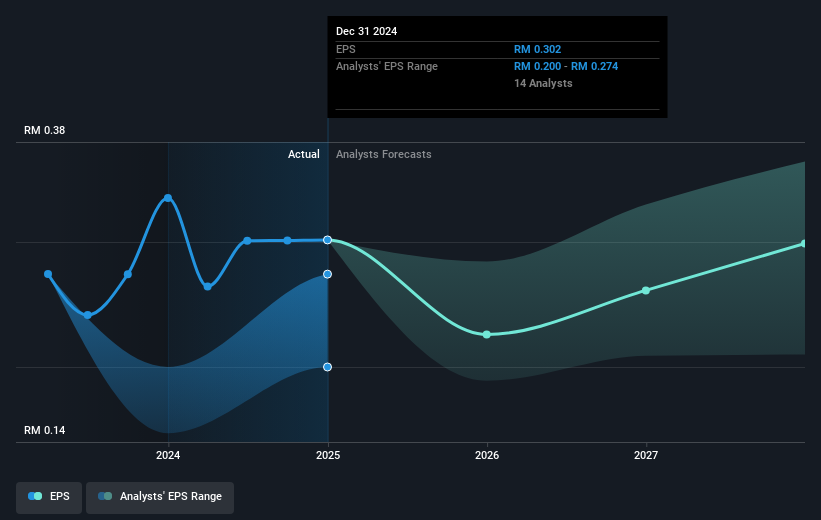

During five years of share price growth, IHH Healthcare Berhad achieved compound earnings per share (EPS) growth of 42% per year. The EPS growth is more impressive than the yearly share price gain of 5% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into IHH Healthcare Berhad's key metrics by checking this interactive graph of IHH Healthcare Berhad's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of IHH Healthcare Berhad, it has a TSR of 38% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that IHH Healthcare Berhad has rewarded shareholders with a total shareholder return of 12% in the last twelve months. And that does include the dividend. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before deciding if you like the current share price, check how IHH Healthcare Berhad scores on these 3 valuation metrics.

We will like IHH Healthcare Berhad better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IHH

IHH Healthcare Berhad

An investment holding company, offers healthcare services in Malaysia, Singapore, Turkey, India, China, Japan, Europe, and internationally.

Good value average dividend payer.

Market Insights

Community Narratives