- Malaysia

- /

- Medical Equipment

- /

- KLSE:COMFORT

Does Comfort Gloves Berhad (KLSE:COMFORT) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Comfort Gloves Berhad (KLSE:COMFORT). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Comfort Gloves Berhad

How Fast Is Comfort Gloves Berhad Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Comfort Gloves Berhad's EPS went from RM0.13 to RM1.01 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

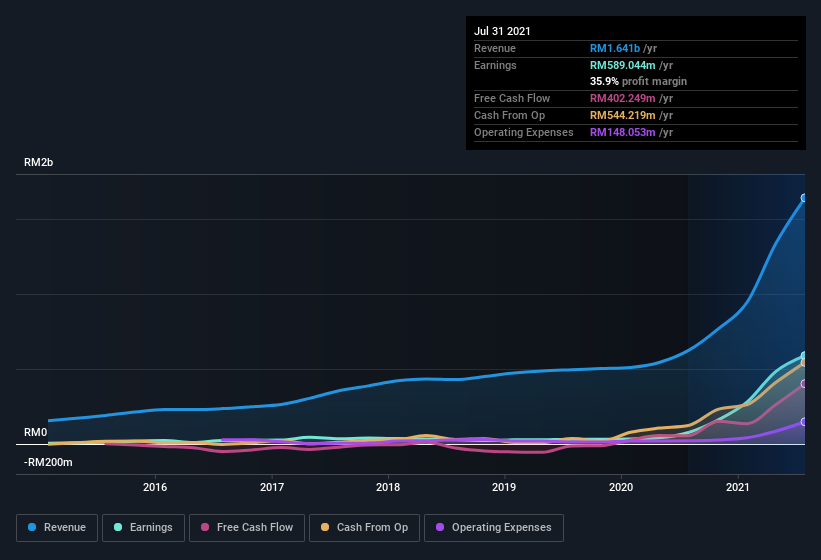

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Comfort Gloves Berhad is growing revenues, and EBIT margins improved by 31.0 percentage points to 48%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Comfort Gloves Berhad is no giant, with a market capitalization of RM551m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Comfort Gloves Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Comfort Gloves Berhad shares worth a considerable sum. Indeed, they hold RM93m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 17% of the company; visible skin in the game.

Does Comfort Gloves Berhad Deserve A Spot On Your Watchlist?

Comfort Gloves Berhad's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Comfort Gloves Berhad is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Comfort Gloves Berhad (1 doesn't sit too well with us) you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:COMFORT

Comfort Gloves Berhad

An investment holding company, manufactures and trades in nitrile and latex gloves in Malaysia, the United States, Canada, Asia, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives