This article will reflect on the compensation paid to Yong Chua who has served as CEO of Lii Hen Industries Bhd (KLSE:LIIHEN) since 2006. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Lii Hen Industries Bhd

How Does Total Compensation For Yong Chua Compare With Other Companies In The Industry?

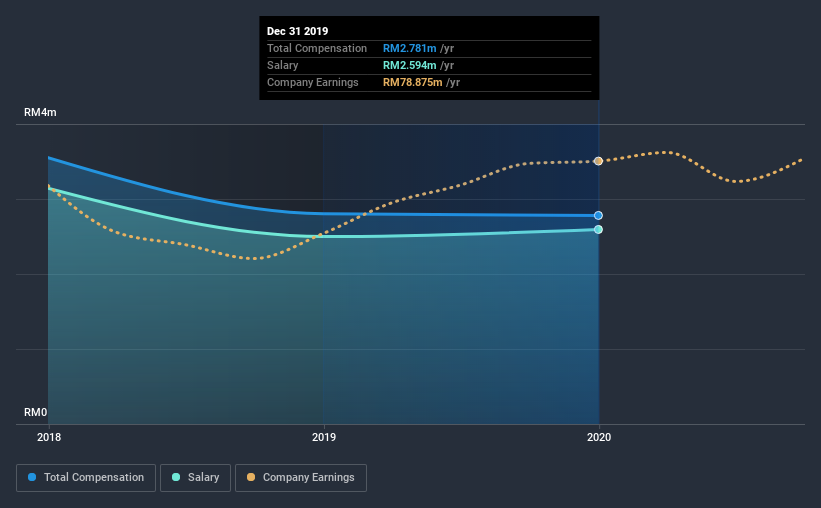

According to our data, Lii Hen Industries Bhd has a market capitalization of RM711m, and paid its CEO total annual compensation worth RM2.8m over the year to December 2019. This means that the compensation hasn't changed much from last year. Notably, the salary which is RM2.59m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from RM406m to RM1.6b, the reported median CEO total compensation was RM1.4m. Accordingly, our analysis reveals that Lii Hen Industries Bhd pays Yong Chua north of the industry median. Moreover, Yong Chua also holds RM1.6m worth of Lii Hen Industries Bhd stock directly under their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM2.6m | RM2.5m | 93% |

| Other | RM187k | RM305k | 7% |

| Total Compensation | RM2.8m | RM2.8m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. There isn't a significant difference between Lii Hen Industries Bhd and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Lii Hen Industries Bhd's Growth

Over the past three years, Lii Hen Industries Bhd has seen its earnings per share (EPS) grow by 1.1% per year. In the last year, its revenue is up 5.9%.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. Considering these factors we'd say performance has been pretty decent, though not amazing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Lii Hen Industries Bhd Been A Good Investment?

Boasting a total shareholder return of 36% over three years, Lii Hen Industries Bhd has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As previously discussed, Yong is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Still, shareholder returns for the company are very impressive for the last three years. Albeit, EPS growth has not been as impressive over the same time frame. All things considered, we don't think there's a reason to criticize CEO compensation, though we hope Lii Hen Industries Bhd will post healthier EPS growth moving forward.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Lii Hen Industries Bhd that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Lii Hen Industries Bhd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LIIHEN

Lii Hen Industries Bhd

An investment holding company, manufactures and sells furniture in North America, Asia, Oceania, Africa, and Europe.

Excellent balance sheet moderate and pays a dividend.

Market Insights

Community Narratives