- Malaysia

- /

- Consumer Durables

- /

- KLSE:FIHB

Lacklustre Performance Is Driving Federal International Holdings Berhad's (KLSE:FIHB) 31% Price Drop

The Federal International Holdings Berhad (KLSE:FIHB) share price has fared very poorly over the last month, falling by a substantial 31%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

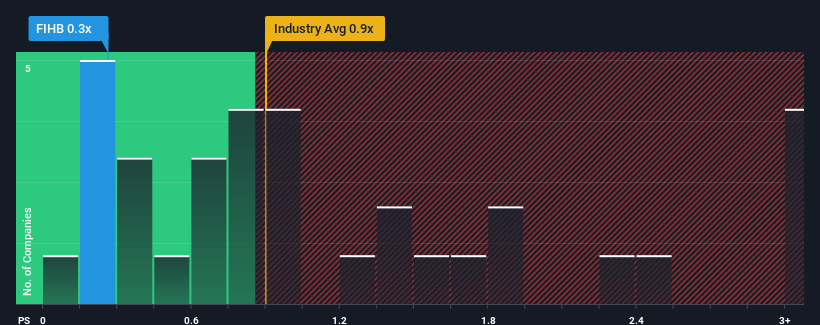

Following the heavy fall in price, given about half the companies operating in Malaysia's Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Federal International Holdings Berhad as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Federal International Holdings Berhad

How Federal International Holdings Berhad Has Been Performing

Revenue has risen at a steady rate over the last year for Federal International Holdings Berhad, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Federal International Holdings Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Federal International Holdings Berhad would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 11% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 11% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Federal International Holdings Berhad's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Federal International Holdings Berhad's P/S Mean For Investors?

The southerly movements of Federal International Holdings Berhad's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Federal International Holdings Berhad confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with Federal International Holdings Berhad (including 3 which can't be ignored).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FIHB

Federal International Holdings Berhad

An investment holding company, engages in the construction and interior fit out businesses in Malaysia.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.