- Malaysia

- /

- Commercial Services

- /

- KLSE:FRONTKN

Do Frontken Corporation Berhad's (KLSE:FRONTKN) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Frontken Corporation Berhad (KLSE:FRONTKN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Frontken Corporation Berhad Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Frontken Corporation Berhad managed to grow EPS by 5.6% per year, over three years. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

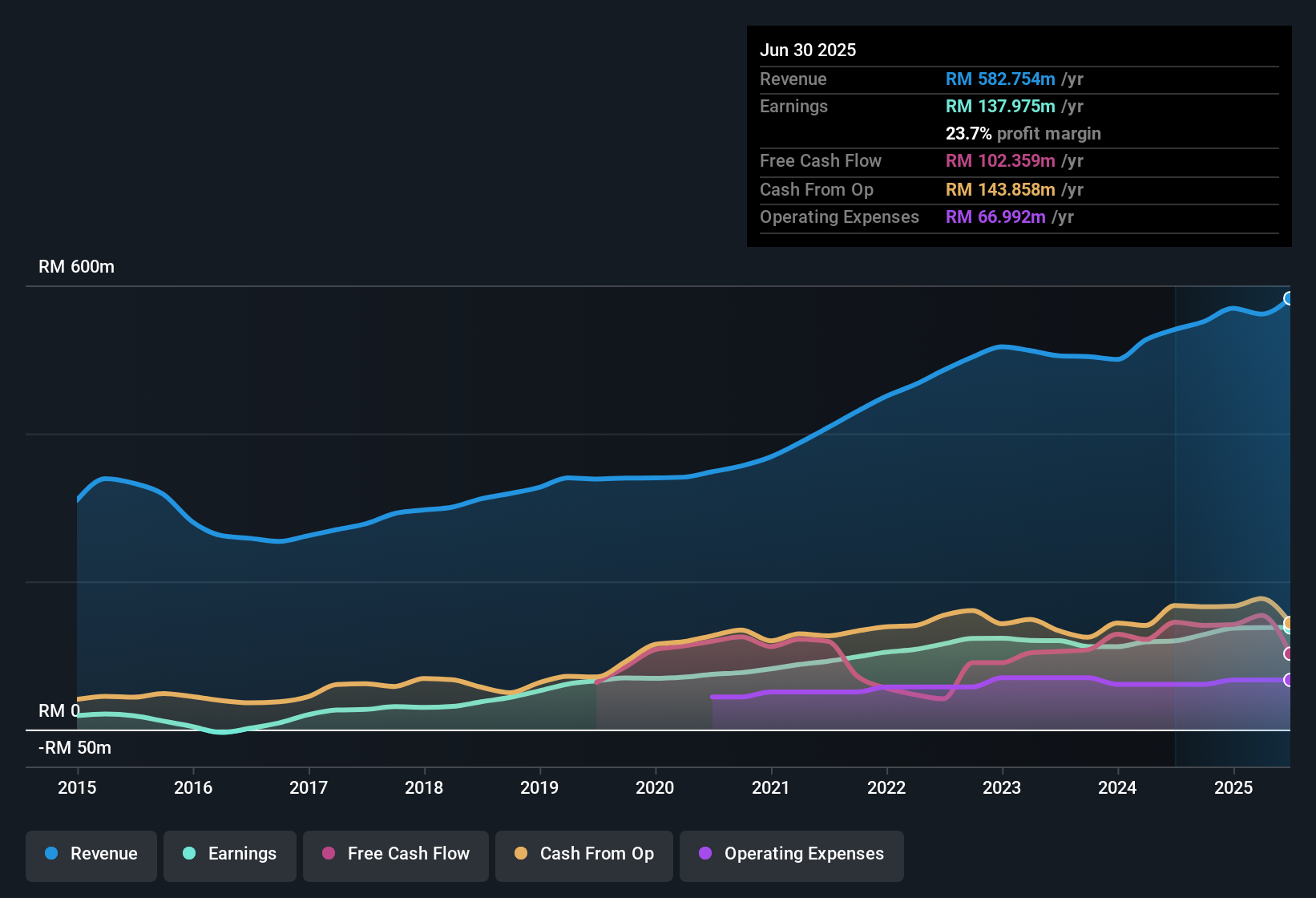

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Frontken Corporation Berhad achieved similar EBIT margins to last year, revenue grew by a solid 7.8% to RM583m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

View our latest analysis for Frontken Corporation Berhad

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Frontken Corporation Berhad?

Are Frontken Corporation Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Frontken Corporation Berhad insiders have a significant amount of capital invested in the stock. Indeed, they hold RM120m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Frontken Corporation Berhad Deserve A Spot On Your Watchlist?

One positive for Frontken Corporation Berhad is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Frontken Corporation Berhad shapes up to industry peers, when it comes to ROE.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in MY with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FRONTKN

Frontken Corporation Berhad

An investment holding company, provides surface treatment, and mechanical and chemical engineering works in Malaysia, Singapore, the Philippines, Taiwan, and Indonesia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)