- Malaysia

- /

- Construction

- /

- KLSE:NAIM

Shareholders May Not Be So Generous With Naim Holdings Berhad's (KLSE:NAIM) CEO Compensation And Here's Why

Key Insights

- Naim Holdings Berhad will host its Annual General Meeting on 30th of May

- Salary of RM1.70m is part of CEO Hasmi Bin Hasnan's total remuneration

- Total compensation is 184% above industry average

- Naim Holdings Berhad's total shareholder return over the past three years was 79% while its EPS was down 13% over the past three years

Naim Holdings Berhad (KLSE:NAIM) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 30th of May. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Naim Holdings Berhad

How Does Total Compensation For Hasmi Bin Hasnan Compare With Other Companies In The Industry?

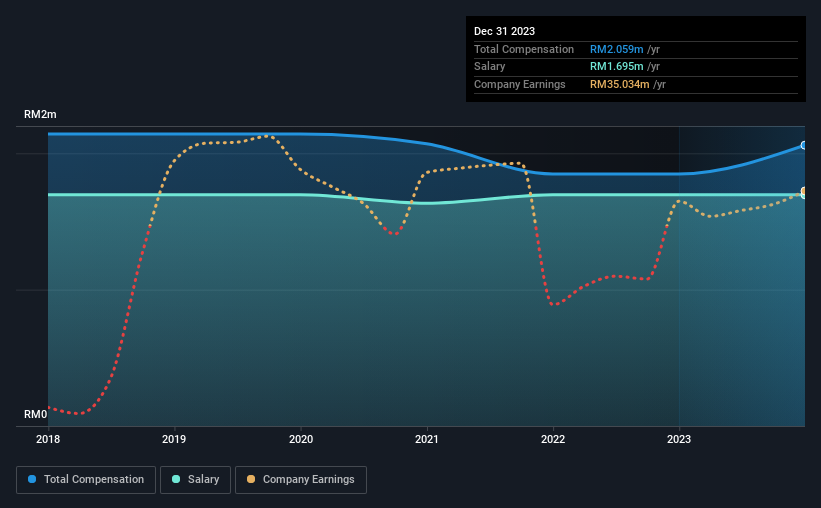

Our data indicates that Naim Holdings Berhad has a market capitalization of RM591m, and total annual CEO compensation was reported as RM2.1m for the year to December 2023. Notably, that's an increase of 11% over the year before. Notably, the salary which is RM1.70m, represents most of the total compensation being paid.

In comparison with other companies in the Malaysian Construction industry with market capitalizations under RM942m, the reported median total CEO compensation was RM726k. This suggests that Hasmi Bin Hasnan is paid more than the median for the industry. What's more, Hasmi Bin Hasnan holds RM66m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM1.7m | RM1.7m | 82% |

| Other | RM364k | RM153k | 18% |

| Total Compensation | RM2.1m | RM1.8m | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. There isn't a significant difference between Naim Holdings Berhad and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Naim Holdings Berhad's Growth

Over the last three years, Naim Holdings Berhad has shrunk its earnings per share by 13% per year. Its revenue is down 14% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Naim Holdings Berhad Been A Good Investment?

We think that the total shareholder return of 79%, over three years, would leave most Naim Holdings Berhad shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Naim Holdings Berhad (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Naim Holdings Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Naim Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NAIM

Naim Holdings Berhad

An investment holding company, engages in the property development and construction businesses in Malaysia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives