- Mexico

- /

- Wireless Telecom

- /

- BMV:AMX B

3 Global Stocks That May Be Undervalued In March 2025

Reviewed by Simply Wall St

As global markets navigate heightened uncertainty, with the Federal Reserve holding rates steady and value stocks outperforming growth for several weeks, investors are keenly observing economic indicators and geopolitical developments. In such a climate, identifying undervalued stocks can be particularly appealing, as they may offer potential opportunities for long-term growth amidst mixed market signals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIP (TSE:2379) | ¥2288.00 | ¥4572.89 | 50% |

| Guizhou Space Appliance (SZSE:002025) | CN¥57.74 | CN¥114.89 | 49.7% |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK257.92 | 49.5% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.25 | RON8.44 | 49.6% |

| Bide Pharmatech (SHSE:688073) | CN¥54.20 | CN¥106.91 | 49.3% |

| Takara Bio (TSE:4974) | ¥850.00 | ¥1685.20 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.3% |

| F-Secure Oyj (HLSE:FSECURE) | €1.722 | €3.43 | 49.8% |

| Deutsche Beteiligungs (XTRA:DBAN) | €26.50 | €52.70 | 49.7% |

| Galderma Group (SWX:GALD) | CHF95.77 | CHF190.18 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

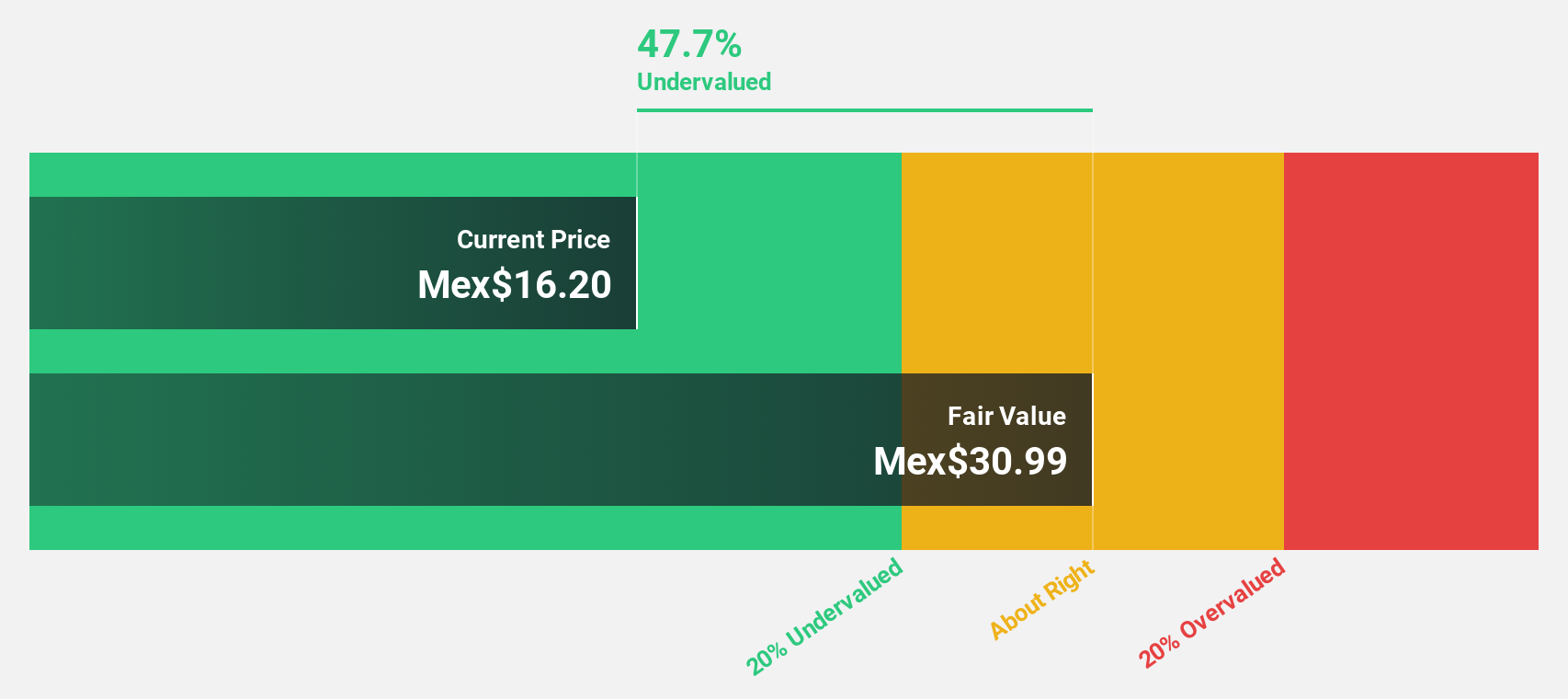

América Móvil. de (BMV:AMX B)

Overview: América Móvil, S.A.B. de C.V. is a telecommunications company offering services across Latin America and internationally, with a market cap of MX$871.91 billion.

Operations: The company generates revenue primarily from Cellular Services, amounting to MX$869.22 billion.

Estimated Discount To Fair Value: 49.1%

América Móvil's stock appears undervalued, trading at MX$14.34, significantly below its estimated fair value of MX$28.15. Despite a decline in profit margins from 9.3% to 3.3%, earnings are forecasted to grow substantially by 25.3% annually, outpacing the market average of 11.3%. However, revenue growth is expected to lag behind the market at only 5% per year, and the company maintains a high level of debt with an unstable dividend history.

- The growth report we've compiled suggests that América Móvil. de's future prospects could be on the up.

- Navigate through the intricacies of América Móvil. de with our comprehensive financial health report here.

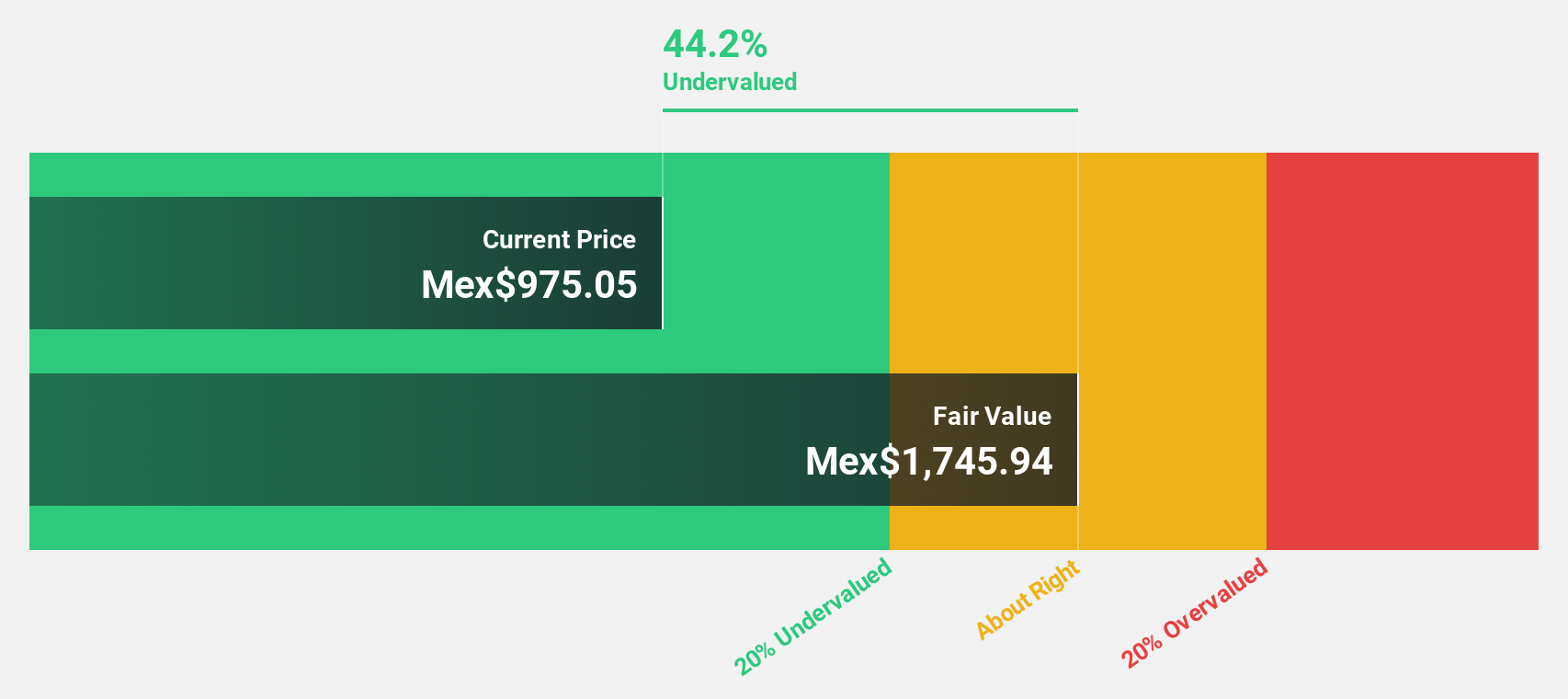

Vista Energy. de (BMV:VISTA A)

Overview: Vista Energy, S.A.B. de C.V. operates in the exploration and production of oil and gas across Latin America, with a market capitalization of approximately MX$93.28 billion.

Operations: The company's revenue segment is primarily derived from the exploration and production of crude oil, natural gas, and LPG, amounting to $1.65 billion.

Estimated Discount To Fair Value: 11.9%

Vista Energy's stock is undervalued, trading at MX$979, below its estimated fair value of MX$1111.01. The company reported fourth-quarter sales of US$471.32 million, a significant rise from the previous year, although net income fell to US$93.77 million. Despite high debt levels and volatile share prices recently, earnings are projected to grow 17.24% annually, outpacing the Mexican market average of 11.3%, driven by strong production increases in shale oil development.

- Upon reviewing our latest growth report, Vista Energy. de's projected financial performance appears quite optimistic.

- Dive into the specifics of Vista Energy. de here with our thorough financial health report.

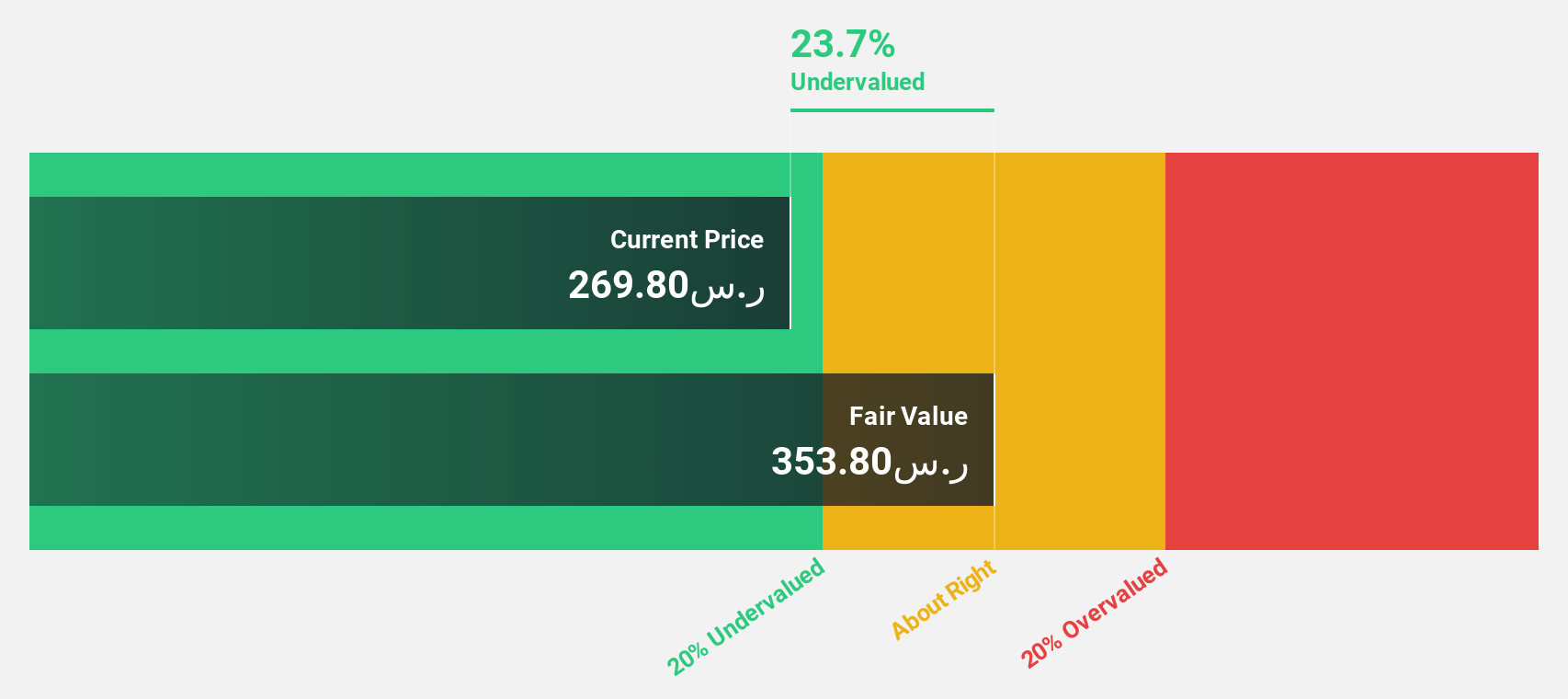

ACWA Power (SASE:2082)

Overview: ACWA Power Company, along with its subsidiaries, focuses on investing in, developing, operating, and maintaining power generation, water desalination, and green hydrogen production plants across the Kingdom of Saudi Arabia, the Middle East, Asia, and Africa with a market cap of SAR241.31 billion.

Operations: ACWA Power's revenue primarily comes from its Thermal and Water Desalination segment, generating SAR4.86 billion, followed by the Renewables segment with SAR1.43 billion.

Estimated Discount To Fair Value: 27%

ACWA Power's stock is trading at SAR332.6, significantly below its estimated fair value of SAR455.33, suggesting it is undervalued based on cash flows. The company reported annual sales of SAR6.3 billion and net income of SAR1.76 billion for 2024, showing growth from the previous year despite interest payments not being well covered by earnings. Earnings are projected to grow 21.3% annually, surpassing the Saudi market average growth rate of 6.7%.

- Our growth report here indicates ACWA Power may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in ACWA Power's balance sheet health report.

Key Takeaways

- Gain an insight into the universe of 508 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:AMX B

América Móvil. de

Provides telecommunications services in Latin America and internationally.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion