- Japan

- /

- Auto Components

- /

- TSE:6584

Top Dividend Stocks For November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainty surrounding the incoming Trump administration's policies, investors are closely monitoring sector performance and interest rate expectations. With U.S. stocks experiencing volatility and mixed signals from major economies, dividend stocks remain an attractive option for those seeking steady income in uncertain times. In this context, a good dividend stock is one that not only offers reliable payouts but also demonstrates resilience amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.77% | ★★★★★☆ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

LG Uplus (KOSE:A032640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LG Uplus Corp. offers a range of telecommunication services mainly in South Korea and has a market cap of approximately ₩4.38 trillion.

Operations: LG Uplus Corp.'s revenue primarily comes from its LG U+ Division, contributing ₩13.40 billion, and the LG Hello Vision Division, adding ₩1.17 billion.

Dividend Yield: 6.2%

LG Uplus offers a dividend yield of 6.16%, placing it in the top 25% of dividend payers in the KR market. However, its dividends have been volatile over the past five years and are backed by a payout ratio of 50.5%, suggesting coverage by earnings, though cash flow coverage is higher at 78.7%. The stock trades at a significant discount to its estimated fair value but carries high debt levels, impacting financial stability.

- Take a closer look at LG Uplus' potential here in our dividend report.

- The analysis detailed in our LG Uplus valuation report hints at an deflated share price compared to its estimated value.

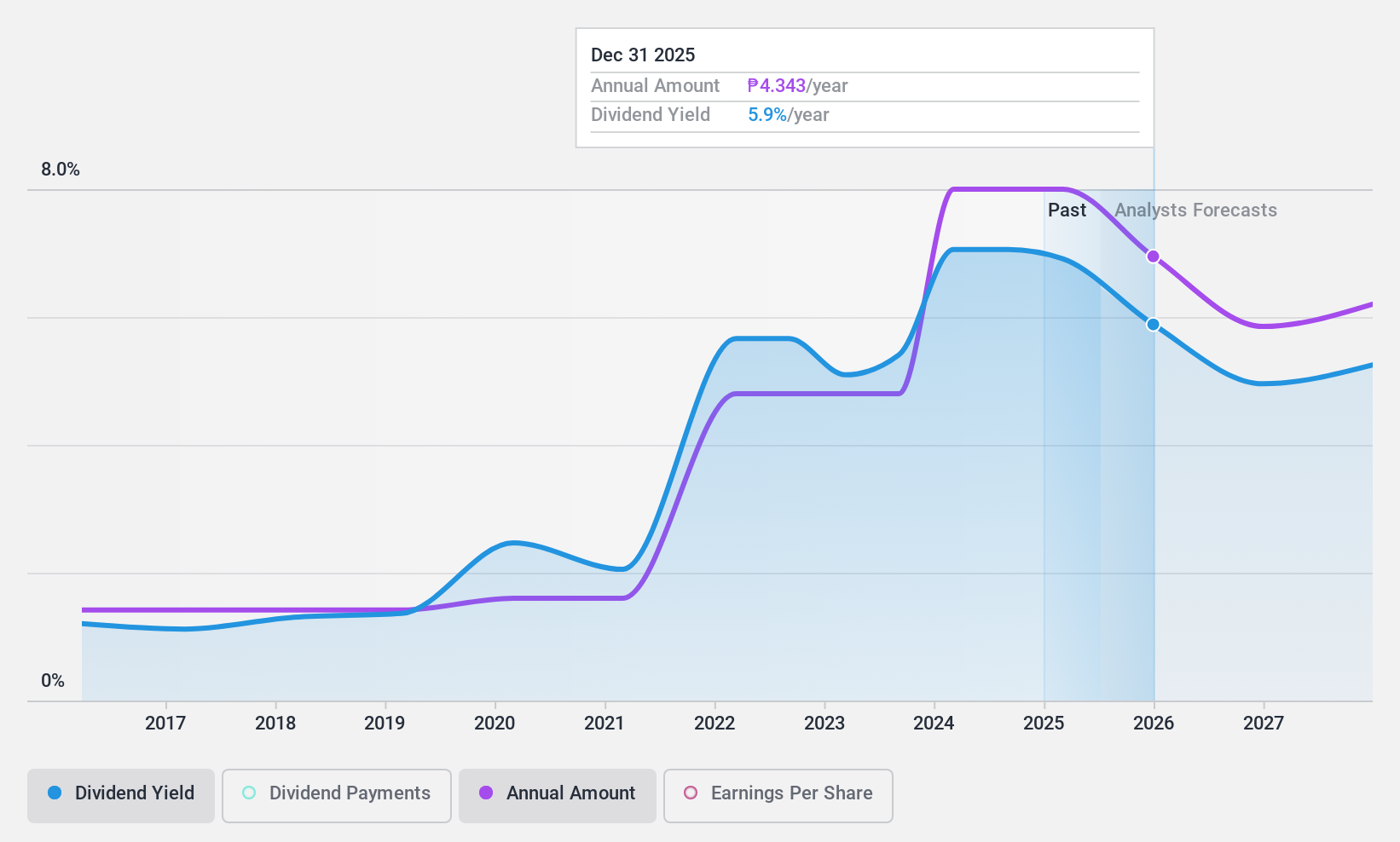

Metropolitan Bank & Trust (PSE:MBT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Metropolitan Bank & Trust Company, with a market cap of ₱331.91 billion, offers a range of commercial and investment banking products and services across the Philippines, Asia, the United States, and Europe through its subsidiaries.

Operations: Metropolitan Bank & Trust Company's revenue segments include Branch Banking at ₱65.97 billion, Consumer Banking at ₱20.44 billion, Treasury operations at ₱24.27 billion, Corporate Banking at ₱17.49 billion, and Investment Banking contributing ₱128 million.

Dividend Yield: 6.5%

Metropolitan Bank & Trust offers a dividend yield of 6.45%, slightly below the top 25% in the PH market, with stable and growing dividends over the past decade. The payout ratio is low at 29.2%, indicating strong earnings coverage, projected to remain sustainable at 37.6% in three years. Recent earnings showed growth, with net income rising to PHP 12.12 billion for Q3 and PHP 35.73 billion for nine months, supporting dividend reliability and potential future increases.

- Dive into the specifics of Metropolitan Bank & Trust here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Metropolitan Bank & Trust is priced lower than what may be justified by its financials.

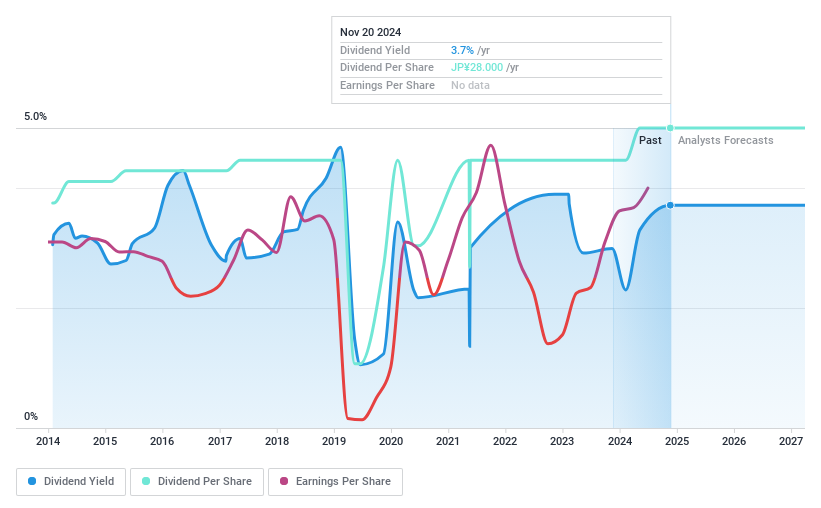

Sanoh Industrial (TSE:6584)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanoh Industrial Co., Ltd. manufactures and sells automotive parts worldwide and has a market cap of ¥25.52 billion.

Operations: Sanoh Industrial Co., Ltd.'s revenue segments are ¥29.11 billion from Asia, ¥17.97 billion from China, ¥49.48 billion from Japan, ¥22.71 billion from Europe, and ¥62.59 billion from North and South America.

Dividend Yield: 3.7%

Sanoh Industrial's dividends are well-covered by earnings, with a payout ratio of 17.7%, and cash flows, with a cash payout ratio of 26.8%. Despite this coverage, the company's dividend history over the past decade has been volatile and unreliable, experiencing significant fluctuations. Although Sanoh's dividend yield is slightly below the top 25% in Japan at 3.71%, it trades at good value compared to peers and industry benchmarks, suggesting potential for capital appreciation alongside its dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Sanoh Industrial.

- Insights from our recent valuation report point to the potential undervaluation of Sanoh Industrial shares in the market.

Taking Advantage

- Click this link to deep-dive into the 1963 companies within our Top Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6584

Flawless balance sheet, undervalued and pays a dividend.