- Japan

- /

- Construction

- /

- TSE:1835

Discovering Three Undiscovered Gems With Robust Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by volatility, with U.S. stocks declining amid cautious Federal Reserve commentary and political uncertainty over a potential government shutdown. Smaller-cap indexes have particularly felt the pressure, highlighting the need for investors to carefully consider economic indicators and broader market sentiment when evaluating potential opportunities in this segment. In such an environment, identifying stocks with strong fundamentals and growth potential becomes crucial. This article explores three lesser-known companies that could offer robust opportunities despite current market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Top Union Electronics | 1.25% | 6.67% | 17.52% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Union Coop | NA | -4.69% | -14.06% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ShinHsiung Natural Gas (TPEX:8908)

Simply Wall St Value Rating: ★★★★★☆

Overview: ShinHsiung Natural Gas Inc. is a company that supplies natural gas in Taiwan with a market capitalization of NT$13.81 billion.

Operations: The primary revenue stream for ShinHsiung Natural Gas comes from its Gas Sales Segment, generating NT$6.75 billion, followed by the Installation and Electricity Sales Segments with NT$308.78 million and NT$124.05 million respectively.

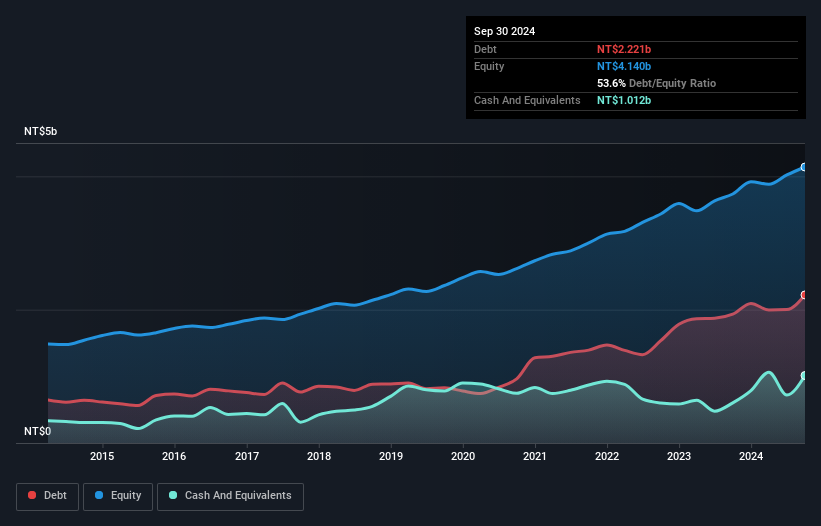

ShinHsiung Natural Gas, a smaller player in the energy sector, has shown promising financial health with high-quality earnings and a satisfactory net debt to equity ratio of 29.2%. Its interest payments are well covered by EBIT at 57.6 times, indicating strong financial management. Over the past year, earnings growth of 6.4% surpassed the industry average of 6.1%, reflecting robust performance amidst sector challenges. Recent results highlight sales rising to TWD 1,983 million from TWD 1,698 million year-on-year for Q3 2024 and net income increasing to TWD 135 million from TWD 108 million, showcasing steady progress in profitability.

Totetsu Kogyo (TSE:1835)

Simply Wall St Value Rating: ★★★★★★

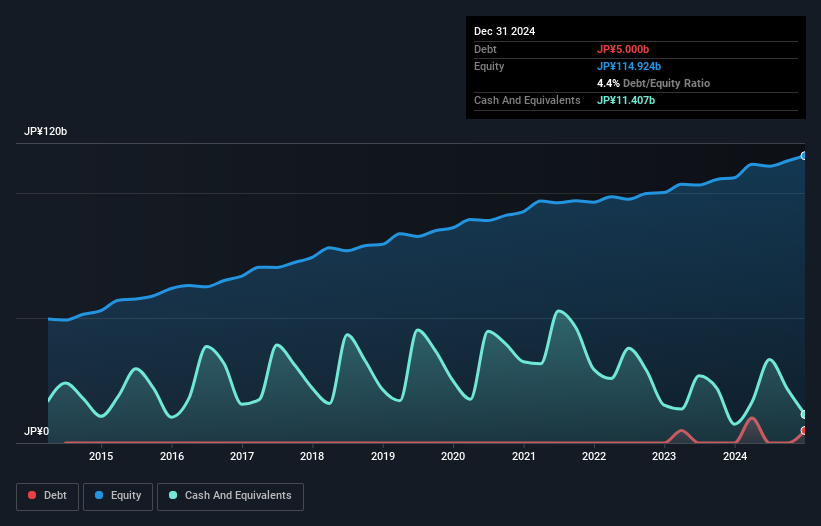

Overview: Totetsu Kogyo Co., Ltd. operates in Japan, focusing on railway track maintenance, civil engineering, architectural, and environmental businesses with a market capitalization of ¥111.22 billion.

Operations: Totetsu Kogyo generates revenue primarily from its Civil Engineering Business, contributing ¥93.02 billion, and Construction Business, adding ¥46.10 billion.

Totetsu Kogyo, a construction player with a market cap under the radar, shows promising financial health. It operates debt-free, eliminating concerns over interest payments and highlighting its robust position. Despite earnings growth of 16.8% last year not matching the industry’s 20.7%, it still trades at an attractive 47% below estimated fair value, suggesting potential upside for investors eyeing undervalued opportunities. The company boasts high-quality past earnings and maintains a positive free cash flow trajectory, indicating operational efficiency. With projected annual earnings growth of 6.85%, Totetsu Kogyo seems poised for steady progress in the coming years.

- Click to explore a detailed breakdown of our findings in Totetsu Kogyo's health report.

Examine Totetsu Kogyo's past performance report to understand how it has performed in the past.

Yulon Nissan Motor (TWSE:2227)

Simply Wall St Value Rating: ★★★★★★

Overview: Yulon Nissan Motor Co., Ltd, along with its subsidiaries, focuses on the research, design, development, and sale of vehicles both in Taiwan and internationally with a market cap of NT$23.64 billion.

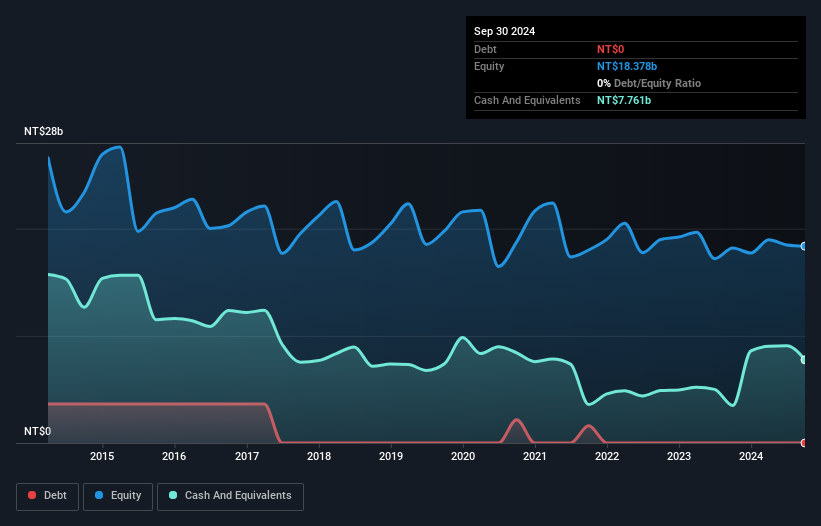

Operations: The primary revenue stream for Yulon Nissan Motor comes from vehicle sales, amounting to NT$21.51 billion, followed by parts sales at NT$3.50 billion. The company's financial performance is influenced significantly by its net profit margin trends over time.

Yulon Nissan Motor, a smaller player in the auto industry, has shown mixed financial performance recently. The company reported third-quarter sales of TWD 5.23 billion, down from TWD 6.35 billion the previous year, with net income dropping to TWD 102 million from TWD 384 million. Despite these figures, Yulon Nissan's earnings per share for nine months rose to TWD 3.61 compared to last year's TWD 3. This entity is debt-free and boasts a price-to-earnings ratio of 17.9x, which is attractive compared to the Taiwan market average of 21x, indicating potential value for investors seeking undiscovered opportunities in this sector.

- Navigate through the intricacies of Yulon Nissan Motor with our comprehensive health report here.

Evaluate Yulon Nissan Motor's historical performance by accessing our past performance report.

Key Takeaways

- Gain an insight into the universe of 4632 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Totetsu Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1835

Totetsu Kogyo

Engages in the railway track maintenance, civil engineering, architectural, and environmental businesses in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives