- Japan

- /

- Semiconductors

- /

- TSE:6890

Best Dividend Stocks For Income In December 2024

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and looming political uncertainties, investors are navigating a complex landscape marked by fluctuating interest rates and economic indicators. Amid this backdrop, dividend stocks can offer a reliable source of income, providing stability through regular payouts even as broader market conditions remain volatile.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1935 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

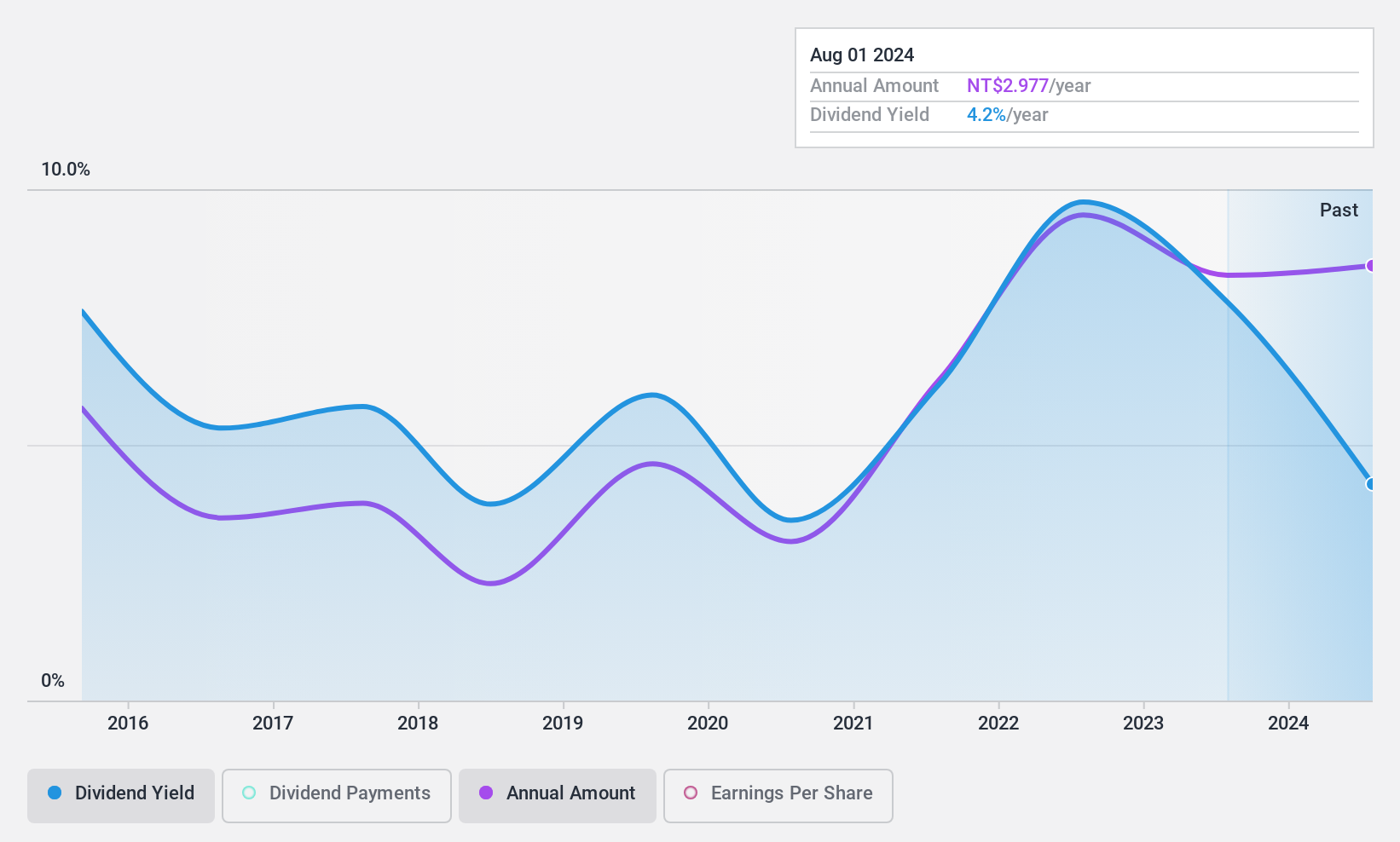

Ubright Optronics (TPEX:4933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ubright Optronics Corporation is a Taiwanese company that manufactures and sells optical films, with a market capitalization of NT$5.50 billion.

Operations: Ubright Optronics Corporation generates revenue from its Manufacturing and Trading Business of Polishing Film, amounting to NT$2.76 billion.

Dividend Yield: 4.4%

Ubright Optronics' dividend payments are covered by both earnings and cash flows, with payout ratios of 50.7% and 58.7% respectively. However, the dividends have been volatile over the past decade, showing instability despite recent growth in payments. The stock trades below its estimated fair value but offers a dividend yield slightly lower than the top tier in Taiwan's market. Recent earnings showed increased sales but decreased quarterly net income year-over-year to TWD 101.89 million.

- Click here to discover the nuances of Ubright Optronics with our detailed analytical dividend report.

- The analysis detailed in our Ubright Optronics valuation report hints at an deflated share price compared to its estimated value.

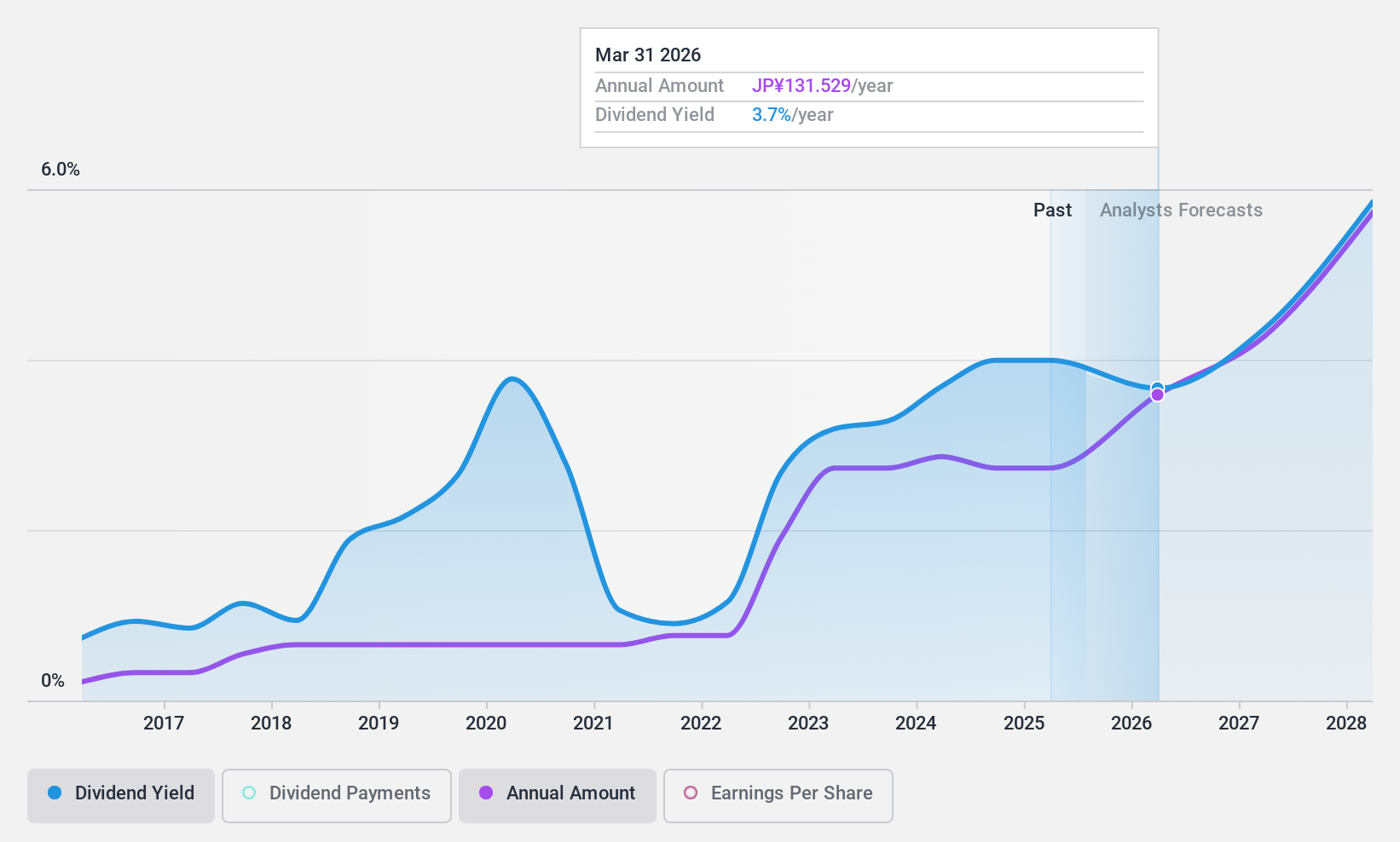

Ferrotec Holdings (TSE:6890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ferrotec Holdings Corporation operates in semiconductor equipment-related and electronic device businesses both in Japan and internationally, with a market cap of ¥119.04 billion.

Operations: Ferrotec Holdings Corporation generates revenue from its Semiconductor Equipment Related Business, which accounts for ¥153.86 billion, and its Electronic Device business, contributing ¥57.85 billion.

Dividend Yield: 4%

Ferrotec Holdings offers a dividend yield in the top 25% of the Japanese market, yet its dividends are not well covered by free cash flow and have been unreliable over the past decade. While recent buybacks aim to enhance shareholder returns, profit margins have declined from last year. The stock trades at a lower price-to-earnings ratio than the market average, suggesting good value despite volatile dividend payments. Earnings cover dividends with a modest payout ratio of 30.9%.

- Dive into the specifics of Ferrotec Holdings here with our thorough dividend report.

- Our valuation report unveils the possibility Ferrotec Holdings' shares may be trading at a discount.

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shibaura Electronics Co., Ltd. is a Japanese company that manufactures and sells thermistor elements and related products, with a market cap of ¥47.80 billion.

Operations: Shibaura Electronics Co., Ltd.'s revenue segments include the manufacturing and sale of thermistor elements and products utilizing these elements in Japan.

Dividend Yield: 4.6%

Shibaura Electronics Ltd. offers a dividend yield in the top 25% of the Japanese market, supported by earnings and cash flows with payout ratios of 61.4% and 63%, respectively. However, its dividend history has been unreliable and volatile over the past decade despite some growth. The stock trades at a significant discount to its estimated fair value, indicating potential value for investors seeking dividends amidst an unstable track record.

- Take a closer look at Shibaura ElectronicsLtd's potential here in our dividend report.

- The valuation report we've compiled suggests that Shibaura ElectronicsLtd's current price could be quite moderate.

Turning Ideas Into Actions

- Gain an insight into the universe of 1935 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6890

Ferrotec

Engages in semiconductor equipment-related, electronic device, and other businesses in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives