In a week marked by cautious commentary from the Federal Reserve and political uncertainty, U.S. stocks experienced broad-based declines, with smaller-cap indexes feeling the brunt of investor apprehension. As interest rate expectations shift and economic indicators show mixed signals, the search for promising opportunities becomes more crucial than ever in navigating these turbulent waters. In such an environment, identifying stocks with strong fundamentals and potential for growth can offer investors a chance to capitalize on market inefficiencies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Top Union Electronics | 1.25% | 6.67% | 17.52% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Union Coop | NA | -4.69% | -14.06% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi (IBSE:BTCIM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi operates in the cement industry both in Turkey and internationally, with a market capitalization of TRY24.81 billion.

Operations: Batiçim generates revenue primarily from Stone and Soil Based Products at TRY4.84 billion, followed by Ready Mixed Concrete at TRY2.93 billion. Electricity Production contributes TRY1.21 billion, while Port Services add TRY837.89 million to its revenue streams.

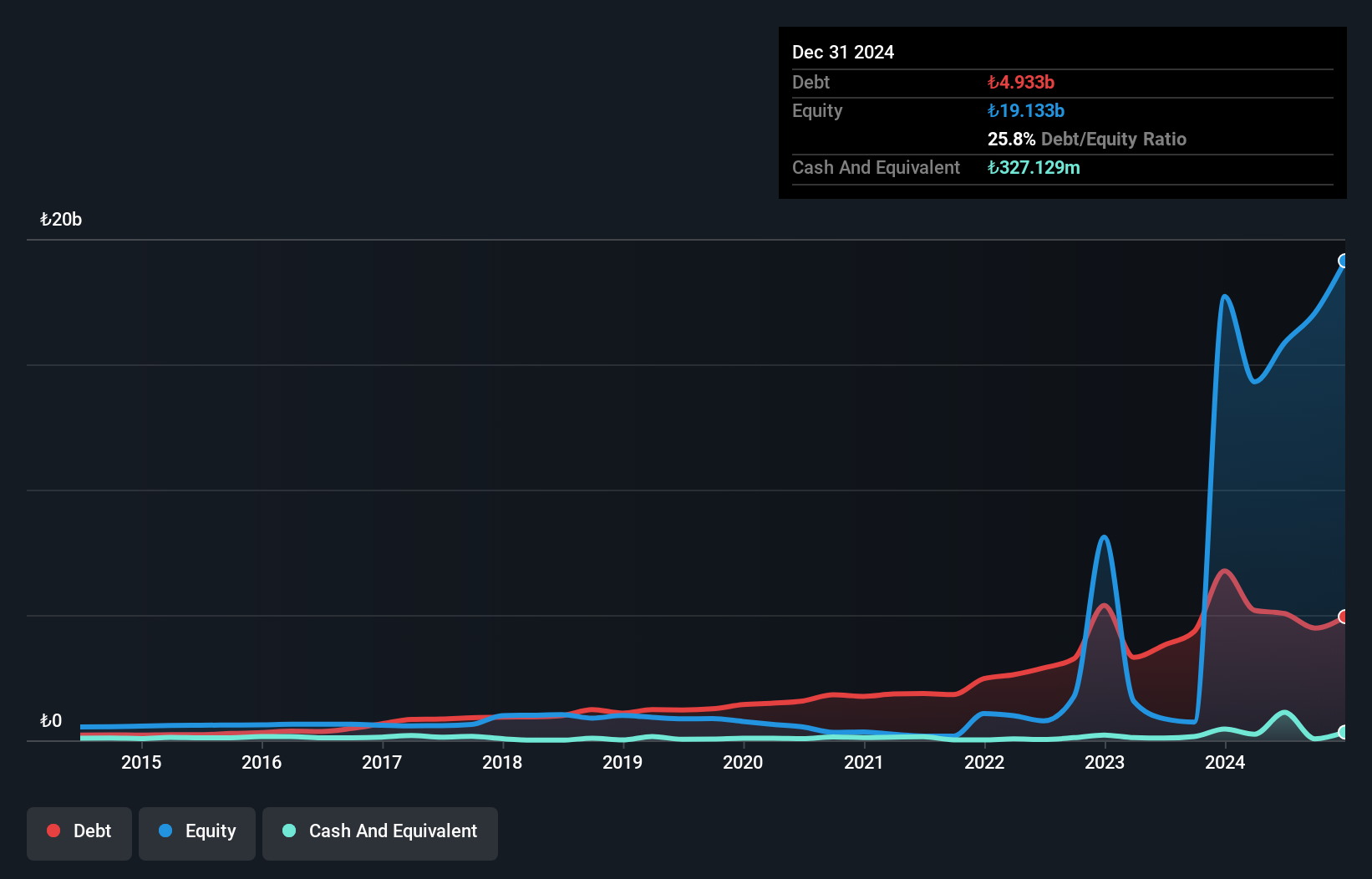

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi, a smaller player in the cement industry, showcases a satisfactory net debt to equity ratio of 25.9%, reflecting prudent financial management. Despite earnings growth of 547% over the past year, recent results indicate challenges with a third-quarter net loss of TRY 198 million compared to last year's net income of TRY 94.77 million. The company's price-to-earnings ratio stands at an attractive 9.5x against the TR market's 15.6x, suggesting potential undervaluation despite current hurdles in sales and profitability metrics.

SOLiD (KOSDAQ:A050890)

Simply Wall St Value Rating: ★★★★★★

Overview: SOLiD, Inc. develops, manufactures, and sells parts, products, and equipment for mobile and digital communication networks with a market cap of ₩386.63 billion.

Operations: The primary revenue stream for SOLiD, Inc. is the manufacture and sales of communication equipment, generating ₩408 billion. The IoT business contributes ₩1.98 billion, while the national defense project adds ₩74.12 billion to the revenue mix.

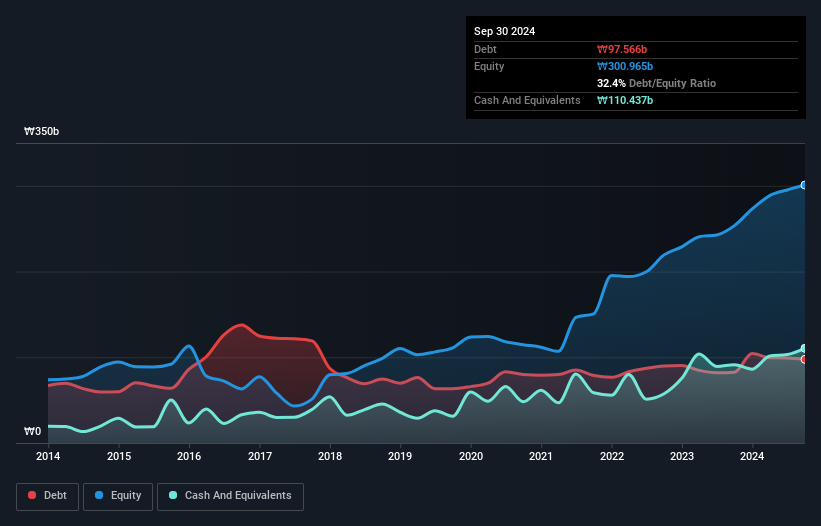

SOLiD, a promising player in the communications sector, is trading at 65.5% below its estimated fair value, indicating potential undervaluation. The company has demonstrated high-quality earnings with a robust EBIT covering interest payments 33.6 times over, which suggests strong financial health and operational efficiency. Over the past five years, SOLiD has successfully reduced its debt-to-equity ratio from 57% to 32.4%, reflecting prudent financial management and a focus on strengthening its balance sheet. With earnings growth of 21.8% in the past year surpassing industry averages by a wide margin, SOLiD appears well-positioned for continued success in an evolving market landscape.

- Get an in-depth perspective on SOLiD's performance by reading our health report here.

Evaluate SOLiD's historical performance by accessing our past performance report.

Kagome (TSE:2811)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kagome Co., Ltd. is engaged in the manufacturing, purchasing, and selling of food products both in Japan and internationally, with a market capitalization of ¥2.76 billion.

Operations: Kagome generates revenue through the manufacturing, purchasing, and selling of food products across Japan and international markets. The company has a market capitalization of ¥2.76 billion.

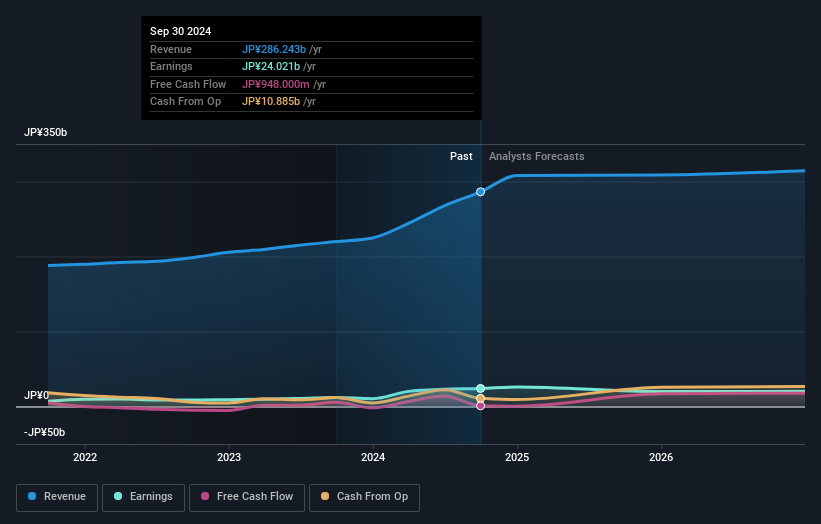

Kagome, a notable player in the food industry, has demonstrated impressive growth with earnings surging by 100% over the past year, outpacing its industry's 20%. Despite an increase in debt to equity from 28.5% to 54.8% over five years, its interest payments are comfortably covered by EBIT at a ratio of 15.9x. Trading at nearly half of its estimated fair value suggests potential undervaluation in the market. The company plans to distribute dividends totaling JPY 52 per share for fiscal year-end December 2024, alongside projected revenue of JPY 300 billion and net income of JPY 24 billion.

- Click here and access our complete health analysis report to understand the dynamics of Kagome.

Examine Kagome's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click here to access our complete index of 4632 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kagome might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2811

Kagome

Manufactures, purchases, and sells food products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives