- South Korea

- /

- Telecom Services and Carriers

- /

- KOSE:A032640

3 Excellent Dividend Stocks Yielding Up To 6.3%

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, marked by AI competition fears and fluctuating interest rates, investors are increasingly seeking stability through reliable income sources. Dividend stocks, known for their potential to provide consistent returns even in uncertain economic times, offer an attractive option for those looking to balance growth with steady income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

LG Uplus (KOSE:A032640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LG Uplus Corp. offers a range of telecommunication services mainly in South Korea, with a market cap of approximately ₩4.28 trillion.

Operations: LG Uplus Corp.'s revenue is primarily derived from its LG U+ Division, contributing ₩13.60 billion, and its LG Hello Vision Division, adding ₩1.21 billion.

Dividend Yield: 6.4%

LG Uplus offers a compelling dividend yield of 6.36%, placing it among the top 25% in the Korean market. Despite this attractive yield, its dividend history is relatively short and has been volatile, with significant annual drops. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 72.5% and 44.8%, respectively. However, LG Uplus carries a high level of debt, which may impact future stability in dividend payments.

- Navigate through the intricacies of LG Uplus with our comprehensive dividend report here.

- Our valuation report here indicates LG Uplus may be undervalued.

Nippon Denko (TSE:5563)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Denko Co., Ltd. operates in Japan through its ferroalloys, functional materials, incineration ash recycling, aqua solutions, and electric power businesses, with a market cap of ¥37.89 billion.

Operations: Nippon Denko Co., Ltd.'s revenue is primarily derived from its Ferroalloy Business at ¥49.47 billion, followed by the Functional Materials Business at ¥13.90 billion, and the Electric Power Business at ¥1.54 billion.

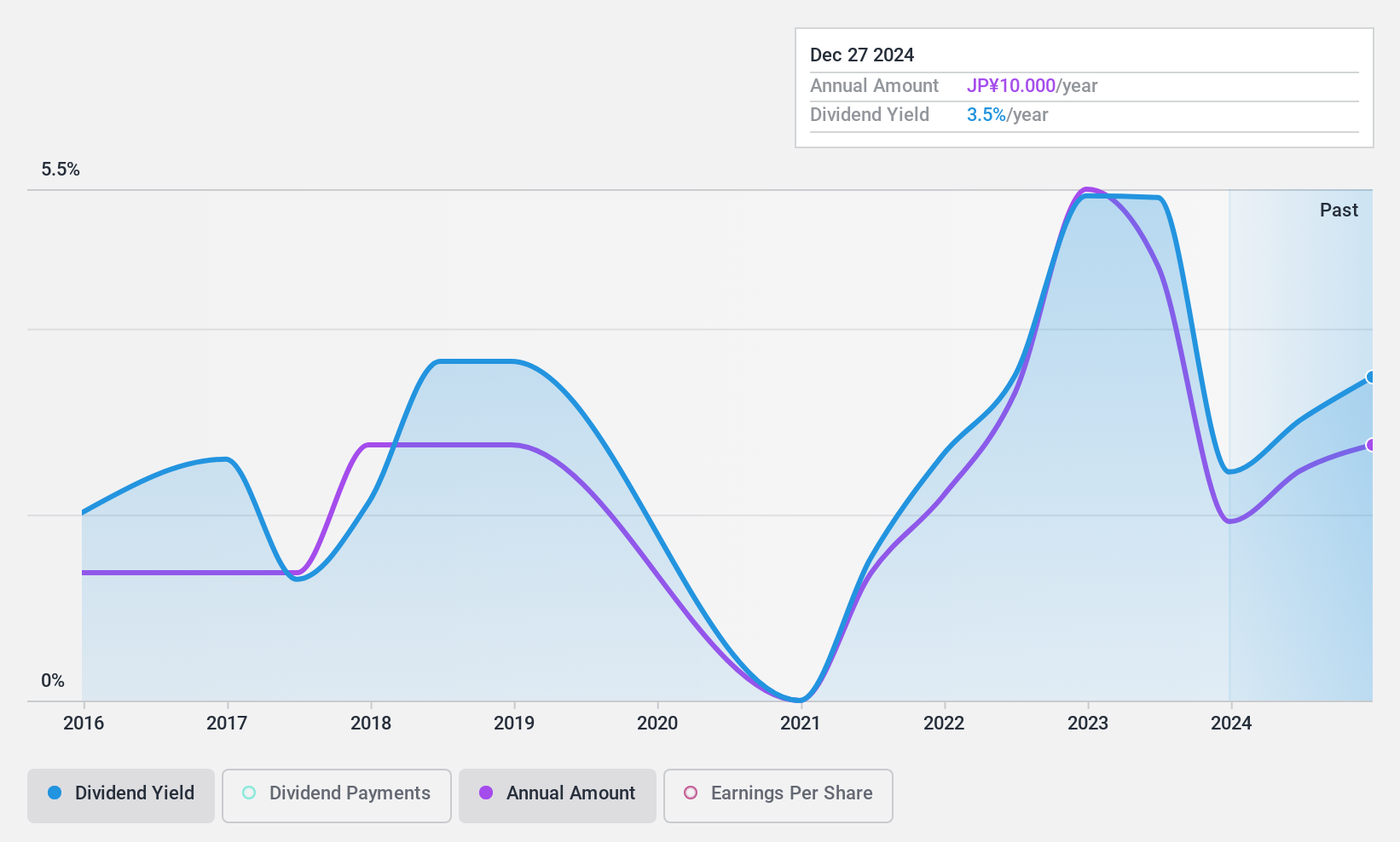

Dividend Yield: 3.5%

Nippon Denko's dividend payments have been volatile over the past decade, with a history of significant drops. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 26.6% and 22.1%, respectively. The company's dividend yield of 3.52% is below the top tier in Japan but has shown growth over ten years. Nippon Denko trades at a substantial discount to its estimated fair value, suggesting potential for capital appreciation alongside dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Nippon Denko.

- Our comprehensive valuation report raises the possibility that Nippon Denko is priced lower than what may be justified by its financials.

Sumitomo Warehouse (TSE:9303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Sumitomo Warehouse Co., Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥210.39 billion.

Operations: Sumitomo Warehouse generates revenue primarily from its Logistics Business, which accounts for ¥175.63 billion, and its Real Estate Business, contributing ¥11.38 billion.

Dividend Yield: 3.6%

Sumitomo Warehouse's dividend payments are covered by earnings and cash flows, with payout ratios of 65.3% and 65.4%, respectively. Despite a volatile dividend history over the past decade, recent increases have been noted. Its yield of 3.64% is slightly below the top tier in Japan (3.8%). A recent share buyback program aims to enhance shareholder returns, repurchasing shares worth ¥1 billion as part of a broader ¥2.5 billion initiative expiring March 2025.

- Click here to discover the nuances of Sumitomo Warehouse with our detailed analytical dividend report.

- Our valuation report unveils the possibility Sumitomo Warehouse's shares may be trading at a premium.

Taking Advantage

- Reveal the 1959 hidden gems among our Top Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A032640

LG Uplus

Provides various telecommunication services primarily in South Korea.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives