- South Korea

- /

- Communications

- /

- KOSDAQ:A189300

Top 3 KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The South Korean stock market has shown resilience, ticking higher amidst mixed performances from various sectors, with the KOSPI index nearing the 2,600-point mark despite global uncertainties around interest rate outlooks. In this environment of cautious optimism and strategic positioning, growth companies with high insider ownership can offer unique insights into potential opportunities as insiders often have a deeper understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Park Systems (KOSDAQ:A140860) | 33% | 34.6% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Let's dive into some prime choices out of the screener.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

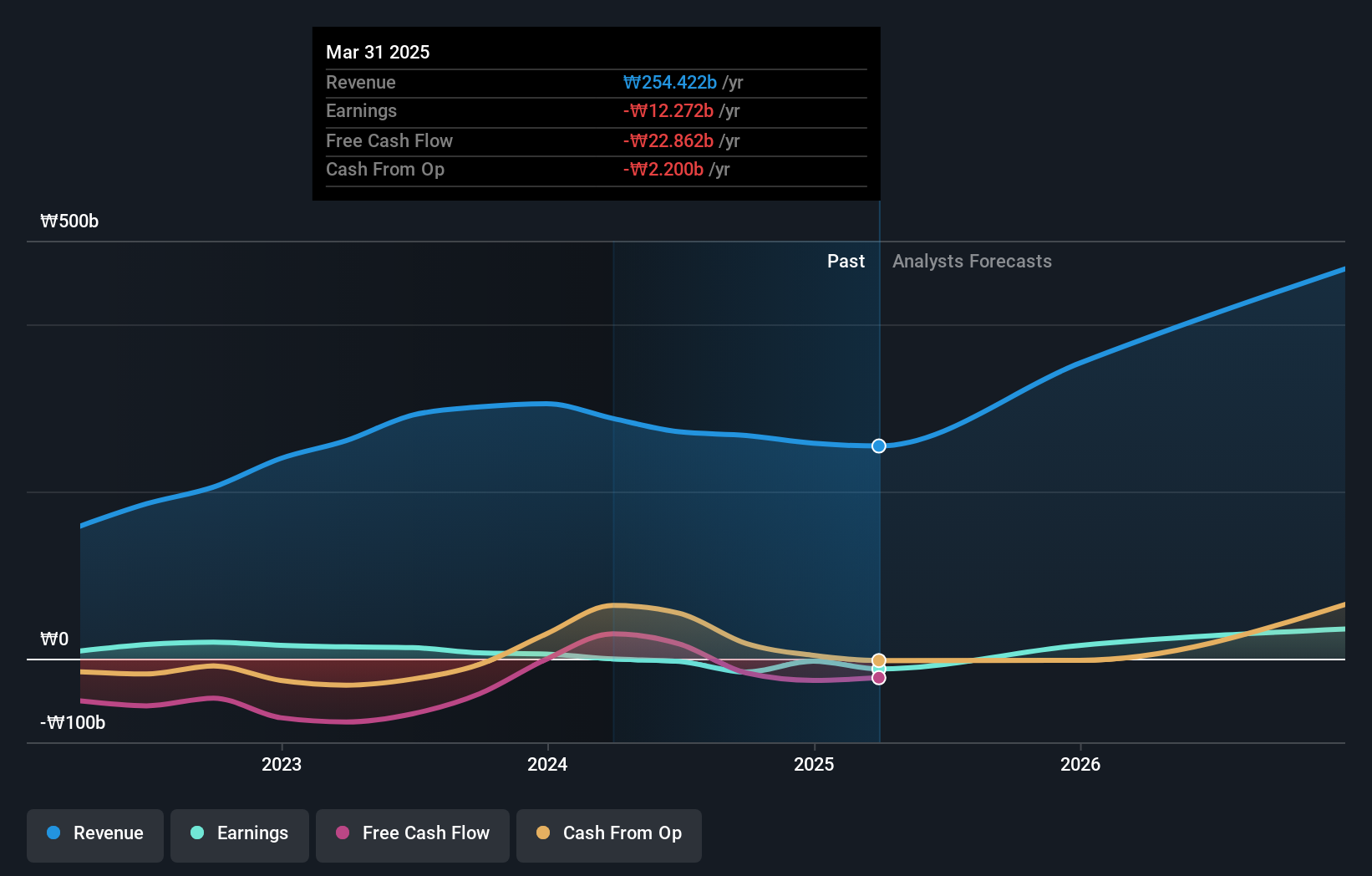

Overview: Intellian Technologies, Inc. is a company that provides satellite antennas and terminals both in South Korea and internationally, with a market cap of ₩569.42 billion.

Operations: The company generates revenue primarily from telecommunication equipment sales, amounting to ₩271.45 billion.

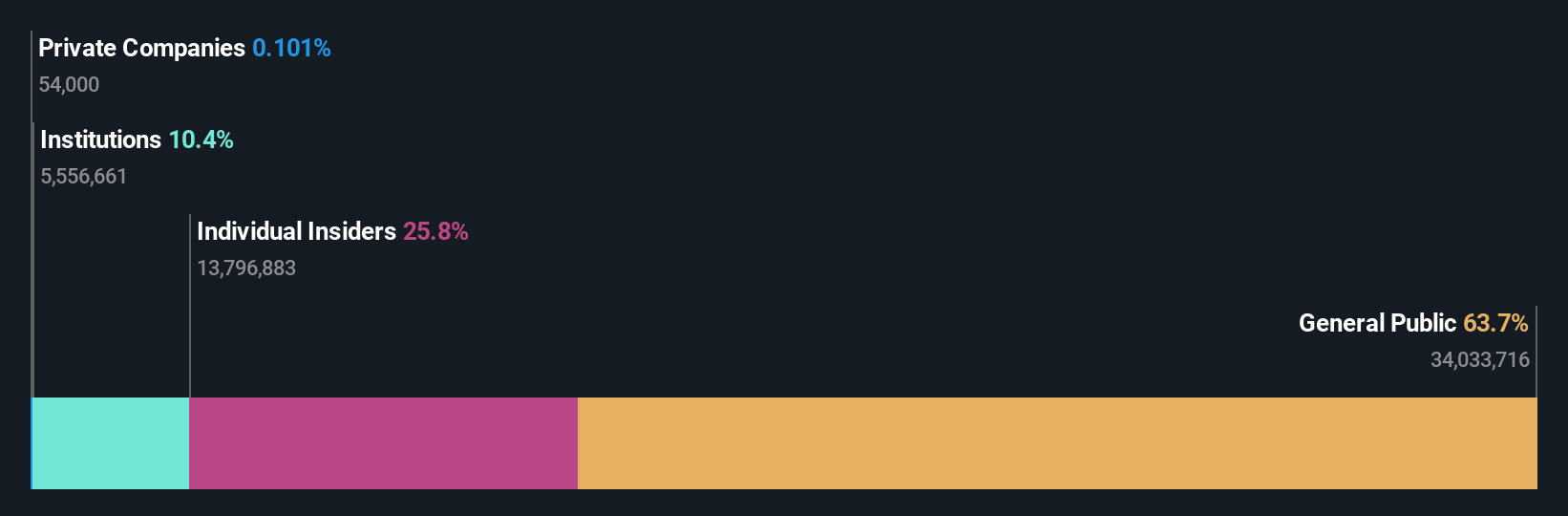

Insider Ownership: 18.8%

Intellian Technologies is trading at 40.2% below its estimated fair value, with analysts predicting a 36.5% price increase. The company is expected to see revenue growth of 33.4% annually, surpassing the South Korean market's average growth rate of 10.4%. Despite no recent insider buying or selling activity, Intellian has completed a share buyback program worth KRW 4,992.97 million, enhancing shareholder value while forecasting profitability within three years with above-market profit growth expectations.

- Click to explore a detailed breakdown of our findings in Intellian Technologies' earnings growth report.

- Our expertly prepared valuation report Intellian Technologies implies its share price may be lower than expected.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

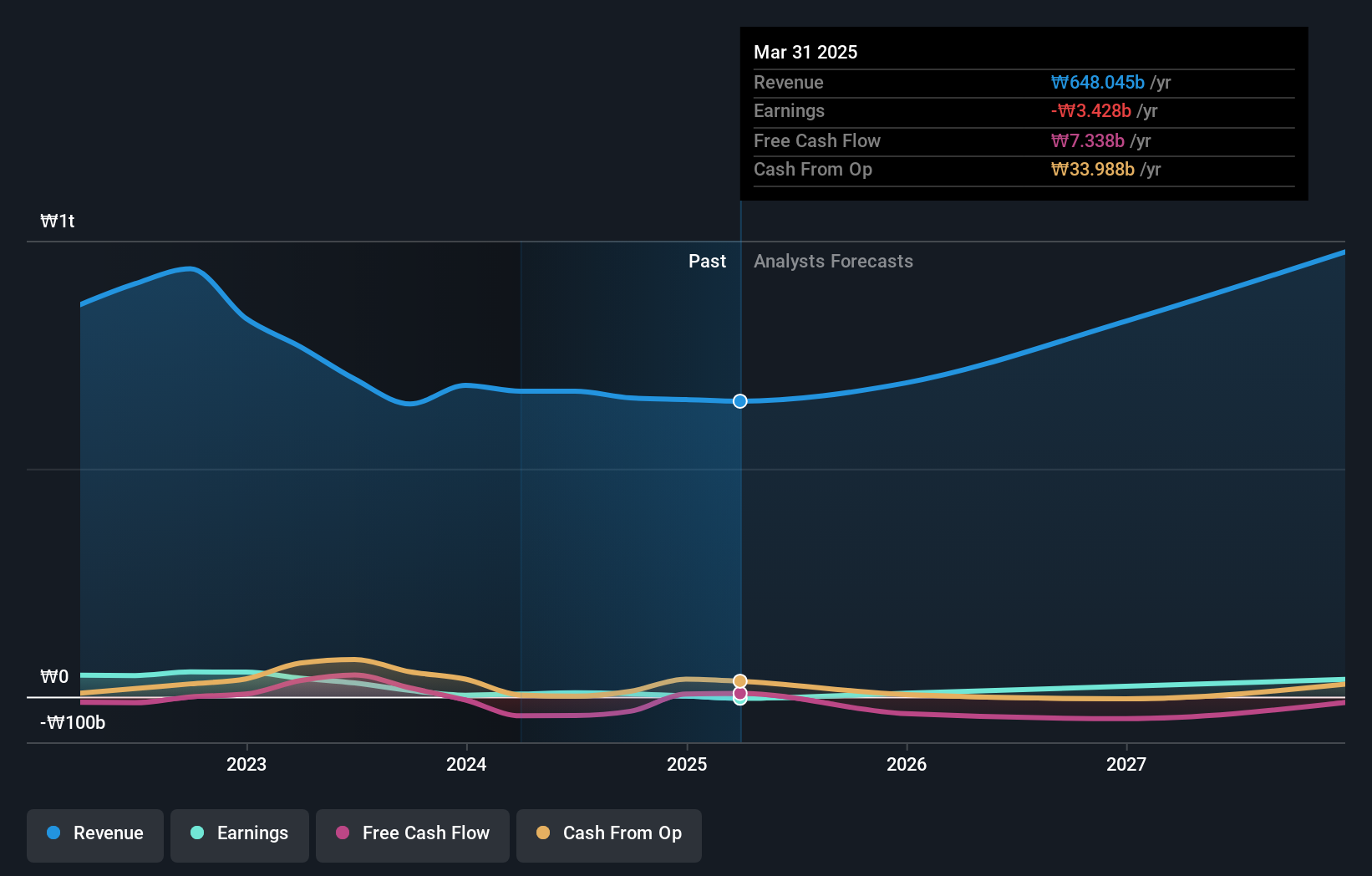

Overview: ALTEOGEN Inc., a biotechnology company, specializes in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.51 trillion.

Operations: The company's revenue primarily comes from its biotechnology segment, amounting to ₩90.79 billion.

Insider Ownership: 26.6%

ALTEOGEN is trading at 70.4% below its estimated fair value, with revenue expected to grow significantly faster than the South Korean market at 64.2% annually. Analysts forecast a high return on equity of 66.3% in three years, alongside substantial earnings growth of 99.46% per year, leading to profitability within the same timeframe. Despite recent shareholder dilution and a volatile share price, no insider trading activity has been reported over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of ALTEOGEN.

- Insights from our recent valuation report point to the potential overvaluation of ALTEOGEN shares in the market.

Di Dong Il (KOSE:A001530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Di Dong Il Corporation operates in the textile and clothing industries both in South Korea and internationally, with a market cap of ₩765.15 billion.

Operations: The company's revenue is primarily derived from its Textile Material segment, which generates ₩354.53 billion, followed by Aluminum at ₩223.28 billion, the Plant and Environment Sector contributing ₩70.78 billion, Furniture Wholesale and Retail at ₩21.83 billion, and Cosmetics bringing in ₩8.08 billion.

Insider Ownership: 12%

Di Dong Il's recent earnings report showed a significant increase in net income, from KRW 2.73 billion to KRW 5.51 billion for the second quarter, highlighting strong profitability growth despite a decline in profit margins. Forecasts suggest substantial earnings growth of 36.44% annually over the next three years, outpacing the South Korean market average of 30.3%. However, revenue growth is expected to be moderate at 10.4% per year, and return on equity remains low at an anticipated 4.8%.

- Take a closer look at Di Dong Il's potential here in our earnings growth report.

- The analysis detailed in our Di Dong Il valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Reveal the 86 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A189300

Intellian Technologies

Provides satellite antennas and terminals in South Korea and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)