- South Korea

- /

- Communications

- /

- KOSDAQ:A189300

High Growth Tech Stocks in Asia Featuring Intellian Technologies

Reviewed by Simply Wall St

Amidst global market volatility and renewed tariff threats, small-cap indexes have faced significant challenges, with the Russell 2000 Index experiencing a notable decline. In this environment, identifying high-growth tech stocks in Asia becomes crucial as these companies often demonstrate resilience through innovation and adaptability in fluctuating economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| RemeGen | 23.19% | 65.54% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Intellian Technologies (KOSDAQ:A189300)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intellian Technologies, Inc. is a company that supplies satellite antennas and terminals both in South Korea and globally, with a market cap of ₩464.52 billion.

Operations: Intellian Technologies focuses on the production and distribution of satellite antennas and terminals, catering to both domestic and international markets. The company generates revenue through the sale of these products, which are essential for maritime, land-based, and government communication systems.

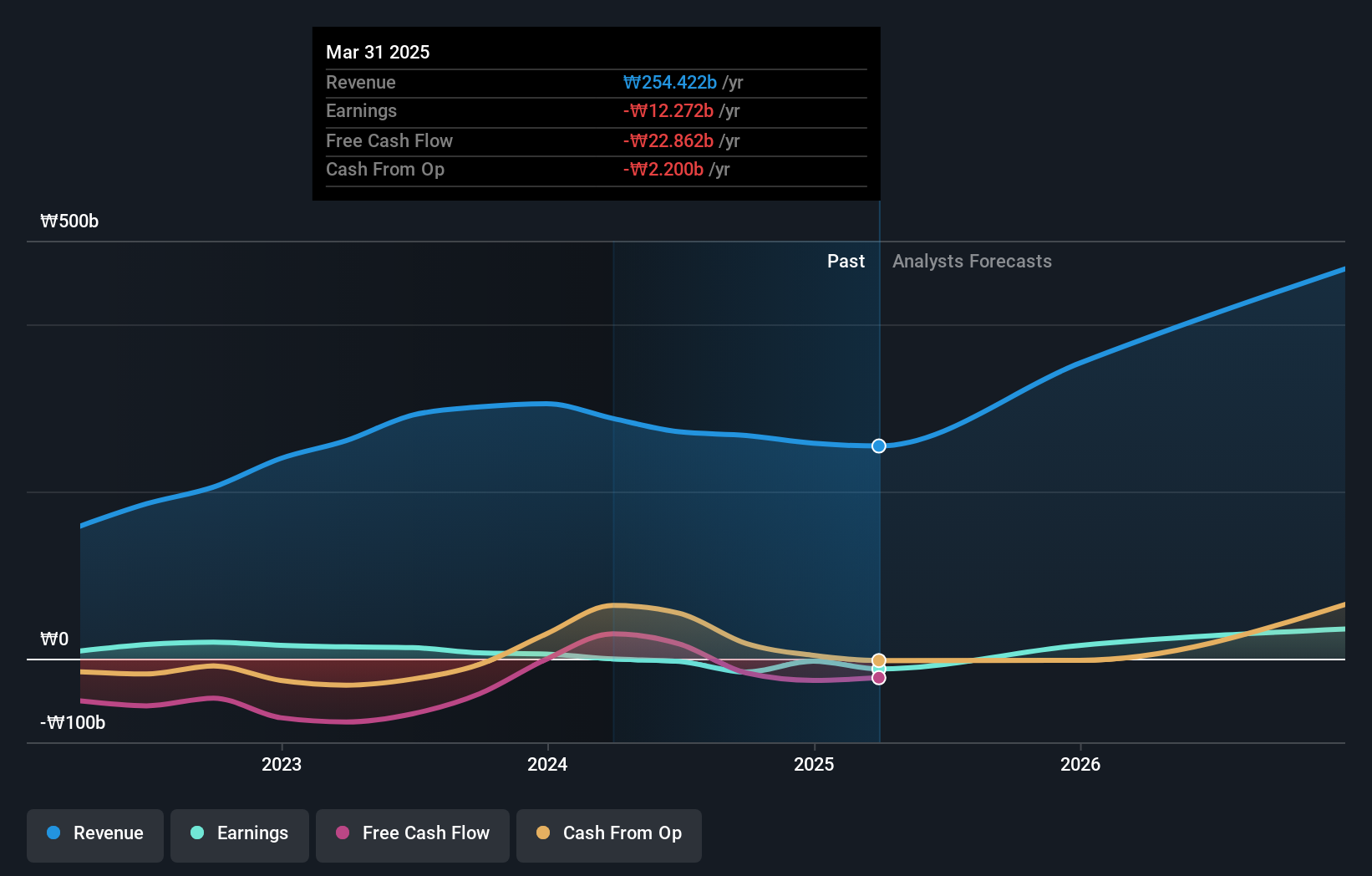

Intellian Technologies, a leader in satellite communication systems, is poised for significant growth with a 33.4% annual revenue increase and an anticipated profit surge of 127.6%. Recently, the company repurchased shares worth KRW 2.04 billion, underscoring its financial confidence amid expanding market demands. Their partnership with Telesat to produce Ka-band flat panel User Terminals for the Lightspeed LEO constellation highlights Intellian's innovative edge in high-tech aerospace solutions. This venture not only enhances their product line but also positions them strategically within the fast-evolving satellite tech industry, promising robust future prospects as they capitalize on advanced manufacturing capabilities and strong client relationships like that with Telesat.

- Delve into the full analysis health report here for a deeper understanding of Intellian Technologies.

Assess Intellian Technologies' past performance with our detailed historical performance reports.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the global research, development, manufacture, and commercialization of antibody drugs with a market capitalization of HK$75.22 billion.

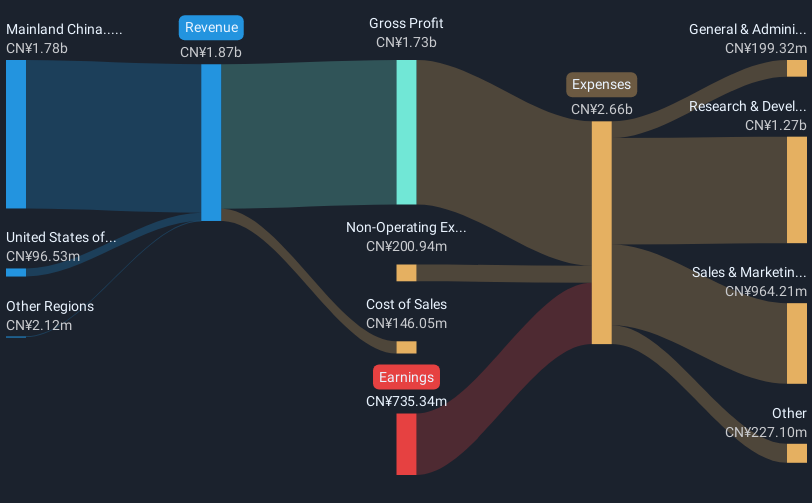

Operations: The company's primary revenue stream is derived from the research, development, production, and sale of biopharmaceutical products, generating CN¥2.12 billion.

Akeso, Inc. has recently made significant strides in the biopharmaceutical sector with its innovative PD-1/VEGF bispecific antibody, ivonescimab, marking a new era in cancer treatment. With the National Medical Products Administration's approval for its use as a first-line treatment for NSCLC, Akeso is at the forefront of addressing critical unmet medical needs. This approval was supported by compelling Phase III data showing ivonescimab's superiority over pembrolizumab in progression-free survival (11.14 months vs 5.82 months) and overall survival rates. These advancements not only underscore Akeso's research prowess but also position it well within Asia’s high-growth tech landscape, promising robust future prospects as they continue to innovate and expand their therapeutic impact globally.

- Navigate through the intricacies of Akeso with our comprehensive health report here.

Gain insights into Akeso's past trends and performance with our Past report.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market cap of ¥239.86 billion.

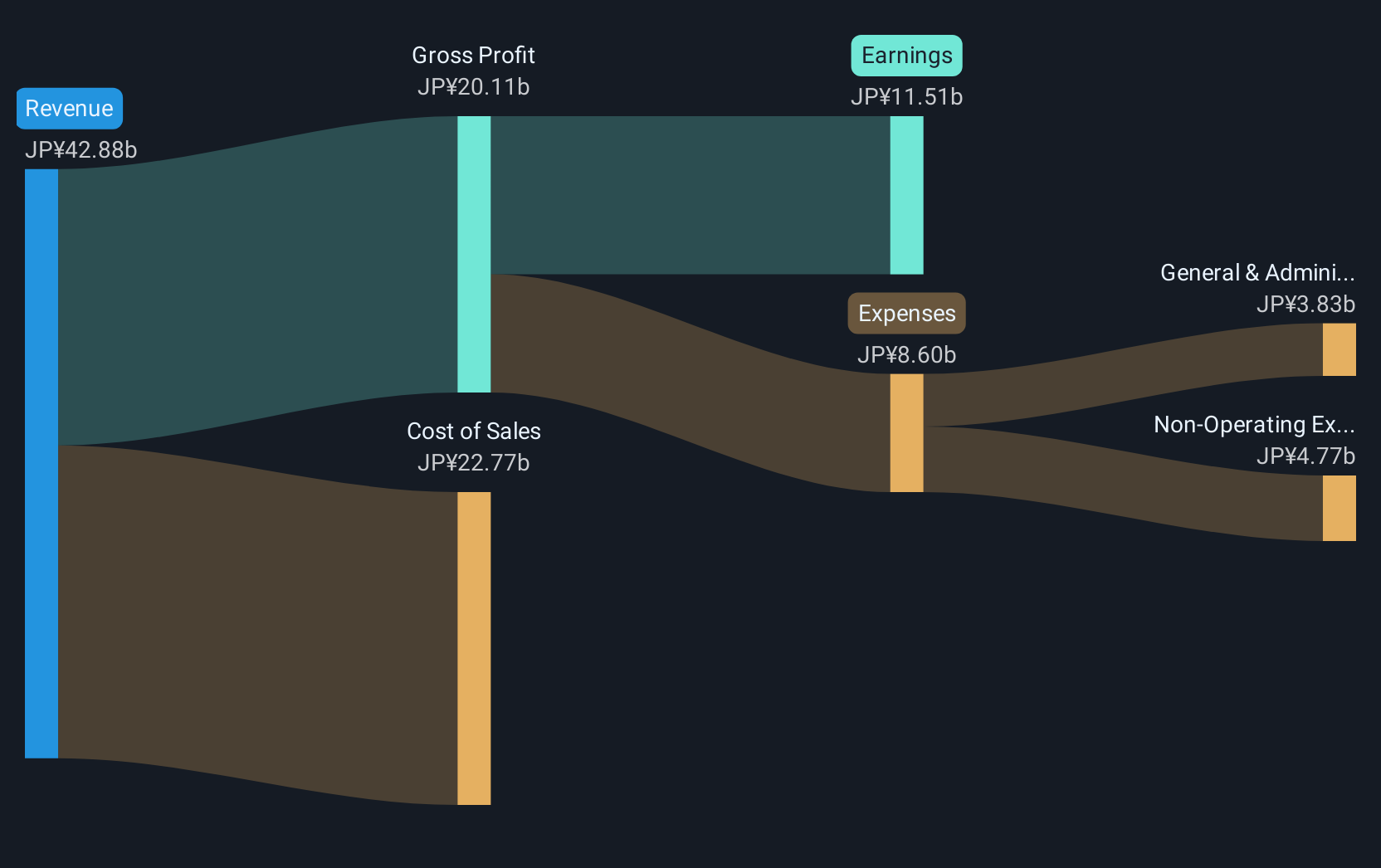

Operations: ANYCOLOR Inc. generates revenue primarily through its entertainment operations in Japan and international markets. The company's offerings include virtual talent management, digital content creation, and related services.

ANYCOLOR Inc. is navigating the dynamic tech landscape with notable agility, underscored by a robust 13.4% annual revenue growth and an even more impressive earnings expansion of 13.5% per year. The company's commitment to innovation is evident from its R&D investments, strategically aligning with industry demands for continuous evolution in entertainment technologies. With recent announcements set for March 12, 2025, regarding Q3 results, stakeholders are keenly watching how these financial trends will potentially bolster ANYCOLOR's market position amidst fierce competition in Asia's tech sector.

- Get an in-depth perspective on ANYCOLOR's performance by reading our health report here.

Explore historical data to track ANYCOLOR's performance over time in our Past section.

Next Steps

- Reveal the 495 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A189300

Intellian Technologies

Provides satellite antennas and terminals in South Korea and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)