- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A179900

UTI (KOSDAQ:179900) delivers shareholders decent 18% CAGR over 3 years, surging 13% in the last week alone

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at UTI Inc. (KOSDAQ:179900), which is up 63%, over three years, soundly beating the market decline of 21% (not including dividends).

The past week has proven to be lucrative for UTI investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for UTI

Because UTI made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

UTI actually saw its revenue drop by 38% per year over three years. Despite the lack of revenue growth, the stock has returned 18%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

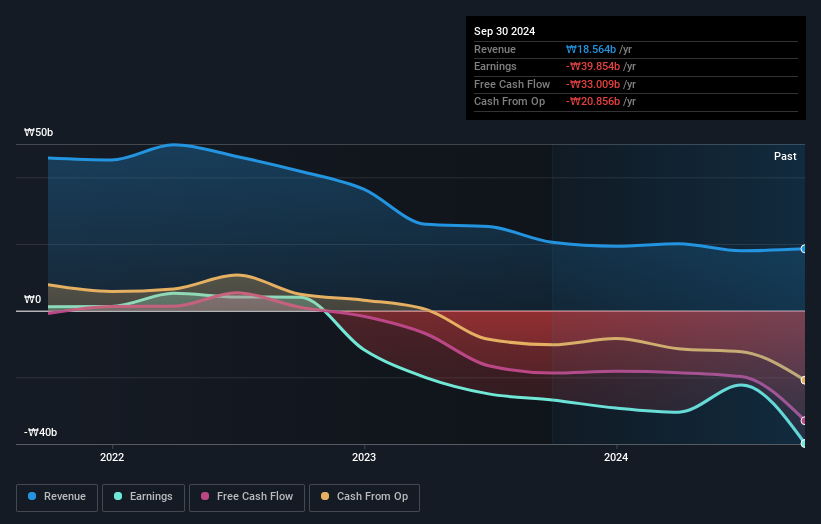

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that UTI shareholders are down 28% for the year. Unfortunately, that's worse than the broader market decline of 10%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand UTI better, we need to consider many other factors. Even so, be aware that UTI is showing 1 warning sign in our investment analysis , you should know about...

But note: UTI may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A179900

UTI

Engages in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses in South Korea and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives